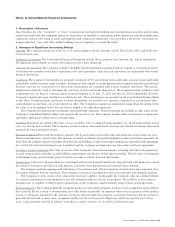

Cisco 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Quantitative and Qualitative Disclosures about Market Risk

24 Cisco Systems, Inc. 2002 Annual Report

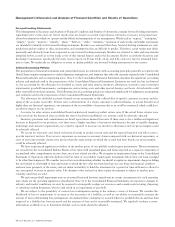

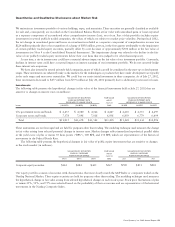

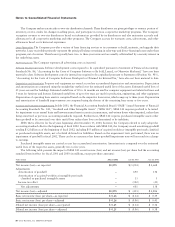

Derivative Instruments

We enter into foreign exchange forward contracts to minimize the short-term impact of foreign currency fluctuations on certain

foreign currency receivables, investments, and payables primarily denominated in Australian, Canadian, Japanese, Korean, and

several European currencies, including the euro and British pound. We also periodically hedge foreign currency forecasted

transactions related to certain operating expenses with currency options. Foreign exchange forward and option contracts as

of July 27, 2002 are summarized as follows (in millions):

Notional Amount Fair Value

Forward contracts:

Purchased $561 $ 2

Sold $712 $ (4)

Option contracts:

Purchased $752 $24

Sold $675 $ (3)

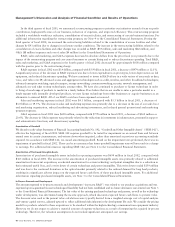

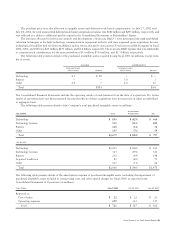

Our foreign exchange forward contracts related to current assets and liabilities generally range from one to three months in original

maturity. Additionally, we have entered into foreign exchange forward contracts related to long-term customer financings with

maturities of up to two years. The foreign exchange contracts related to investments generally have maturities of less than one

year. Currency option contracts generally have maturities of less than one year. We do not enter into foreign exchange forward and

option contracts for trading purposes. We do not expect gains or losses on these derivative instruments to have a material impact

on our financial results or financial condition (see Note 8 to the Consolidated Financial Statements).