Cisco 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cisco Systems, Inc. 2002 Annual Report 33

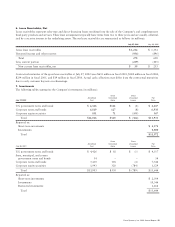

The purchase price was also allocated to tangible assets and deferred stock-based compensation. At July 27, 2002 and

July 28, 2001, the total unamortized deferred stock-based compensation balance was $182 million and $293 million, respectively, and

was reflected as a debit to additional paid-in capital in the Consolidated Statements of Shareholders’ Equity.

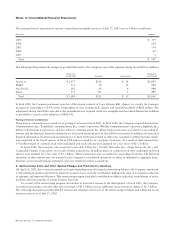

The amounts allocated to in-process research and development (“in-process R&D”) were determined through established

valuation techniques in the high-technology communications equipment industry and were expensed upon acquisition because

technological feasibility had not been established and no future alternative uses existed. Total in-process R&D expense in fiscal

2002, 2001, and 2000 was $65 million, $855 million, and $1.4 billion, respectively. The in-process R&D expense that was attributable

to common stock consideration for the same periods was $53 million, $739 million, and $1.3 billion, respectively.

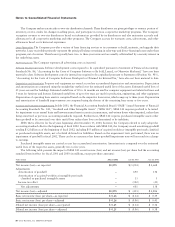

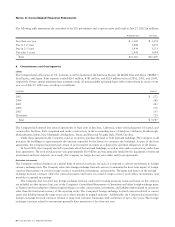

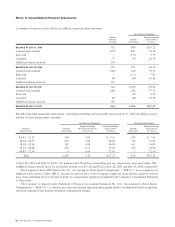

The following table presents details of the purchased intangible assets acquired during fiscal 2002 (in millions, except num-

ber of years):

ALLEGRO AURORANETICS

Estimated Useful Estimated Useful

Life (in Years) Amount Life (in Years) Amount

Technology 4.1 $ 98 –$–

Patents – – 5.0 3

Other 2.0 7 2.0 11

Total $105 $ 14

The Consolidated Financial Statements include the operating results of each business from the date of acquisition. Pro forma

results of operations have not been presented because the effects of these acquisitions were not material on either an individual

or aggregate basis.

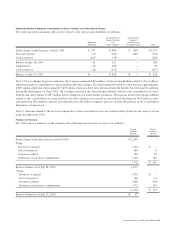

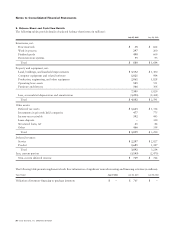

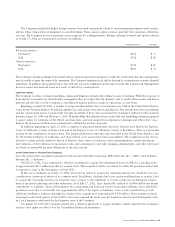

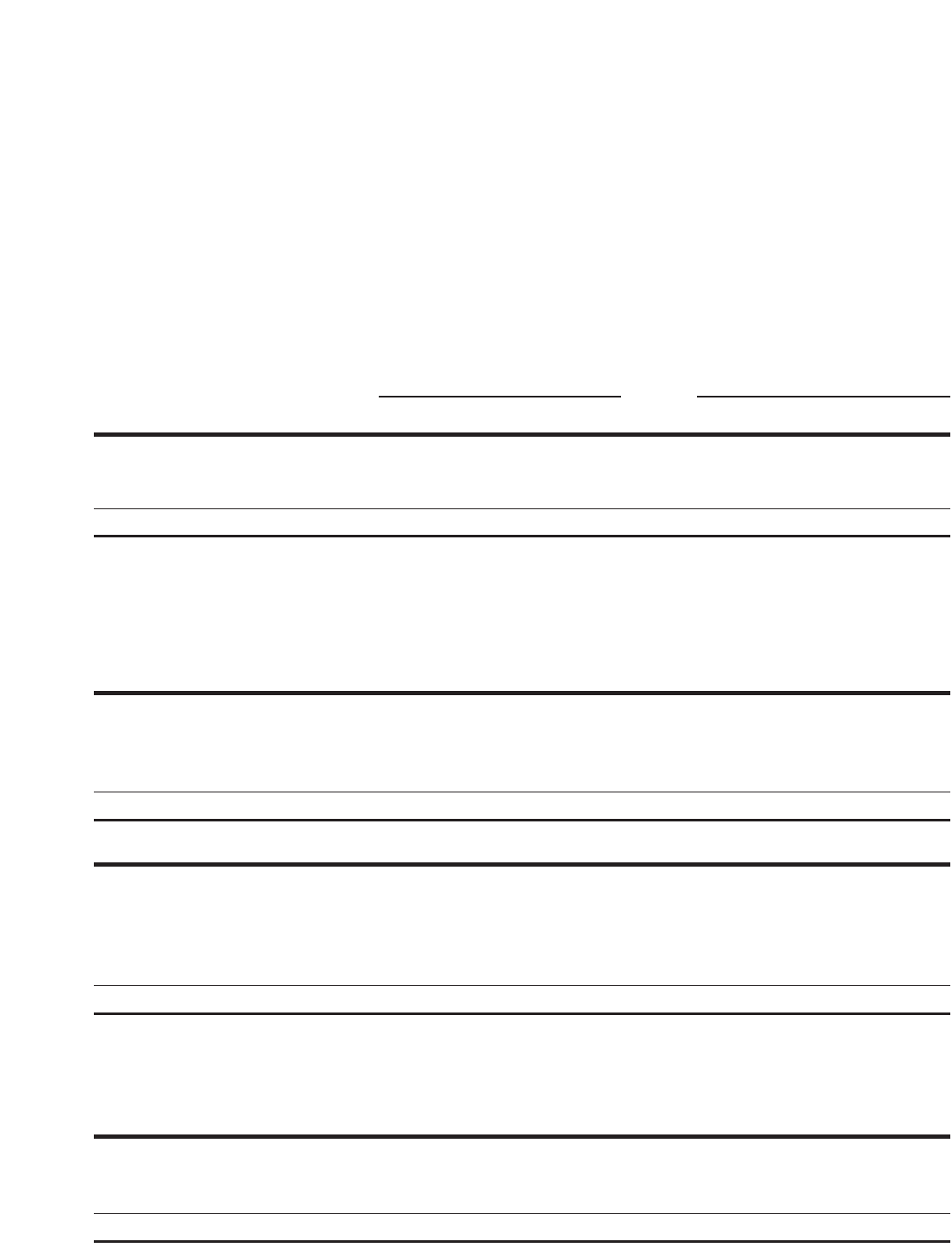

The following tables present details of the Company’s total purchased intangible assets (in millions):

Accumulated

July 27, 2002 Gross Amortization Net

Technology $ 893 $ (429) $ 464

Technology licenses 523 (323) 200

Patents 128 (54) 74

Other 135 (76) 59

Total $1,679 $ (882) $ 797

July 28, 2001

Technology $1,053 $ (240) $ 813

Technology licenses 523 (191) 332

Patents 232 (44) 188

Acquired workforce 91 (20) 71

Other 117 (51) 66

Total $2,016 $ (546) $1,470

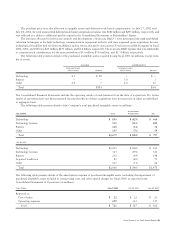

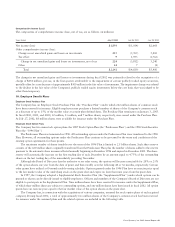

The following table presents details of the amortization expense of purchased intangible assets (excluding the impairment of

purchased intangible assets included in restructuring costs and other special charges for fiscal 2001) as reported in the

Consolidated Statements of Operations (in millions):

Years Ended July 27, 2002 July 28, 2001 July 29, 2000

Reported as:

Cost of sales $22 $22 $ 25

Operating expenses 699 365 137

Total $ 721 $ 387 $ 162