Cisco 2002 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

42 Cisco Systems, Inc. 2002 Annual Report

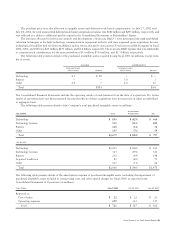

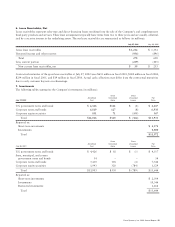

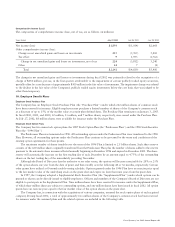

A summary of option activity follows (in millions, except per-share amounts):

OPTIONS OUTSTANDING

Options Weighted-Average

Available Number Exercise Price

for Grant Outstanding per Share

BALANCE AT JULY 31, 1999 312 889 $11.22

Granted and assumed (295) 295 52.10

Exercised – (176) 5.75

Canceled 37 (37) 22.70

Additional shares reserved 339 – –

BALANCE AT JULY 29, 2000 393 971 24.19

Granted and assumed (320) 320 39.93

Exercised – (133) 7.43

Canceled 98 (98) 41.82

Additional shares reserved 351 – –

BALANCE AT JULY 28, 2001 522 1,060 29.41

Granted and assumed (282) 282 17.72

Exercised – (54) 6.99

Canceled 82 (82) 36.94

Additional shares reserved 342 – –

BALANCE AT JULY 27, 2002 664 1,206 $27.17

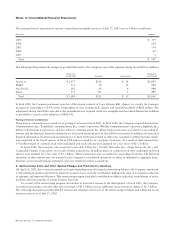

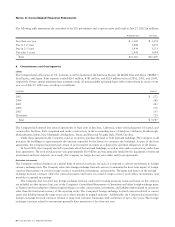

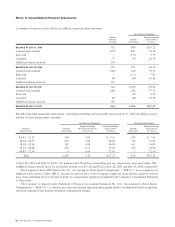

The following table summarizes information concerning outstanding and exercisable options at July 27, 2002 (in millions, except

number of years and per-share amounts):

OPTIONS OUTSTANDING OPTIONS EXERCISABLE

Weighted-Average Weighted-Average Weighted-Average

Range of Number Remaining Contractual Exercise Price Number Exercise Price

Exercise Prices Outstanding Life (in Years) per Share Exercisable per Share

$ 0.01 – 12.27 308 3.90 $ 7.32 299 $ 7.43

12.28 – 18.57 297 7.82 16.49 66 15.91

18.58 – 50.38 382 6.91 34.09 163 34.09

50.39 – 68.98 213 6.57 57.07 103 56.90

68.99 – 72.56 6 6.66 72.56 3 72.56

Total 1,206 6.30 $ 27.17 634 $ 23.51

At July 28, 2001 and July 29, 2000, 505 million and 418 million outstanding options, respectively, were exercisable. The

weighted-average exercise prices for exercisable options were $17.62 and $9.22 at July 28, 2001 and July 29, 2000, respectively.

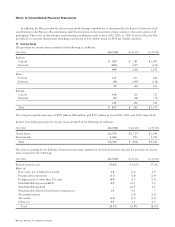

The Company follows APB Opinion No. 25, “Accounting for Stock Issued to Employees” (“APB 25”), in accounting for its

employee stock options. Under APB 25, because the exercise price of the Company’s employee stock options equals the market

price of the underlying stock on the date of grant, no compensation expense is recognized in the Company’s Consolidated Statements

of Operations.

The Company is required under Statement of Financial Accounting Standards No. 123, “Accounting for Stock-Based

Compensation” (“SFAS 123”), to disclose pro forma information regarding option grants made to its employees based on specified

valuation techniques that produce estimated compensation charges.