Cisco 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cisco Systems, Inc. 2002 Annual Report 39

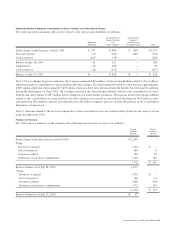

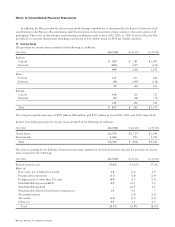

The Company periodically hedges foreign currency forecasted transactions related to certain operating expenses with currency

options. These transactions are designated as cash flow hedges. These currency option contracts generally have maturities of less than

one year. The Company does not purchase currency options for trading purposes. Foreign exchange forward and option contracts

as of July 27, 2002 are summarized as follows (in millions):

Notional Amount Fair Value

Forward contracts:

Purchased $561 $ 2

Sold $712 $ (4)

Option contracts:

Purchased $752 $ 24

Sold $675 $ (3)

The Company’s foreign exchange forward and option contracts expose the Company to credit risk to the extent that the counterparties

may be unable to meet the terms of the agreement. The Company minimizes such risk by limiting its counterparties to major financial

institutions. In addition, the potential risk of loss with any one party resulting from this type of credit risk is monitored. Management

does not expect any material losses as a result of default by counterparties.

Legal Proceedings

The Company is subject to legal proceedings, claims, and litigation arising in the ordinary course of business. While the outcome of

these matters is currently not determinable, management does not expect that the ultimate costs to resolve these matters will have a

material adverse effect on the Company’s consolidated financial position, results of operations, or cash flows.

Beginning on April 20, 2001, a number of purported shareholder class action lawsuits were filed in the United States District

Court for the Northern District of California against Cisco and certain of its officers and directors. The lawsuits have been consolidated,

and the consolidated action is purportedly brought on behalf of those who purchased the Company’s publicly traded securities

between August 10, 1999 and February 6, 2001. Plaintiffs allege that defendants have made false and misleading statements, purport

to assert claims for violations of the federal securities laws, and seek unspecified compensatory damages and other relief. Cisco

believes the claims are without merit and intends to defend the actions vigorously.

In addition, beginning on April 23, 2001, a number of purported shareholder derivative lawsuits were filed in the Superior

Court of California, County of Santa Clara and in the Superior Court of California, County of San Mateo. There is a procedure

in place for the coordination of such actions. Two purported derivative suits have also been filed in the United States District Court

for the Northern District of California, and those federal court actions have been consolidated. The complaints in the various

derivative actions include claims for breach of fiduciary duty, waste of corporate assets, mismanagement, unjust enrichment,

and violations of the California Corporations Code; seek compensatory and other damages, disgorgement, and other relief; and

are based on essentially the same allegations as the class actions.

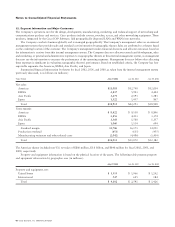

Certain Investments in Privately Held Companies

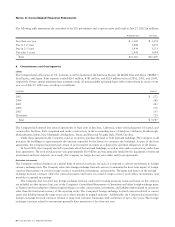

Cisco has entered into investment agreements with two privately held companies, AYR Networks, Inc. (“AYR”) and Andiamo

Systems, Inc. (“Andiamo”).

On July 25, 2002, Cisco announced a definitive agreement to acquire the remaining interests of AYR for a purchase price

of approximately $113 million payable in common stock. This acquisition will be accounted for under the purchase method and

is expected to close in the first quarter of fiscal 2003.

In the case of Andiamo, as of July 27, 2002, Cisco had an option to acquire the remaining interests not owned by Cisco for

consideration consisting of shares of its common stock. In addition, Andiamo had a put option enabling them to require Cisco

to acquire the remaining interests not owned by Cisco, subject to the fulfillment of various conditions, including the achieve-

ment of specified technology and other milestones. As of July 27, 2002, Cisco funded $63 million of its $84 million investment

commitment to Andiamo. Upon full funding of the commitment and based on certain terms and conditions, Cisco will hold a

promissory note that is convertible into approximately 44% of the equity of Andiamo. Cisco is also committed to provide

additional funding to Andiamo through the closing of the acquisition of approximately $100 million. Since making its initial

investment in the third quarter of fiscal 2001, Cisco has expensed the entire amount funded as research and development costs,

as if such expenses constituted the development costs of the Company.

On August 19, 2002, the Company entered into a definitive agreement to acquire Andiamo, which represents the Company’s

exercise of its rights (see Note 14 to the Consolidated Financial Statements).