Cisco 2002 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cisco Systems, Inc. 2002 Annual Report 41

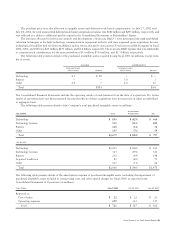

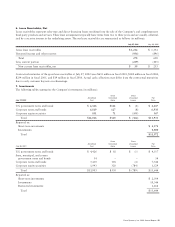

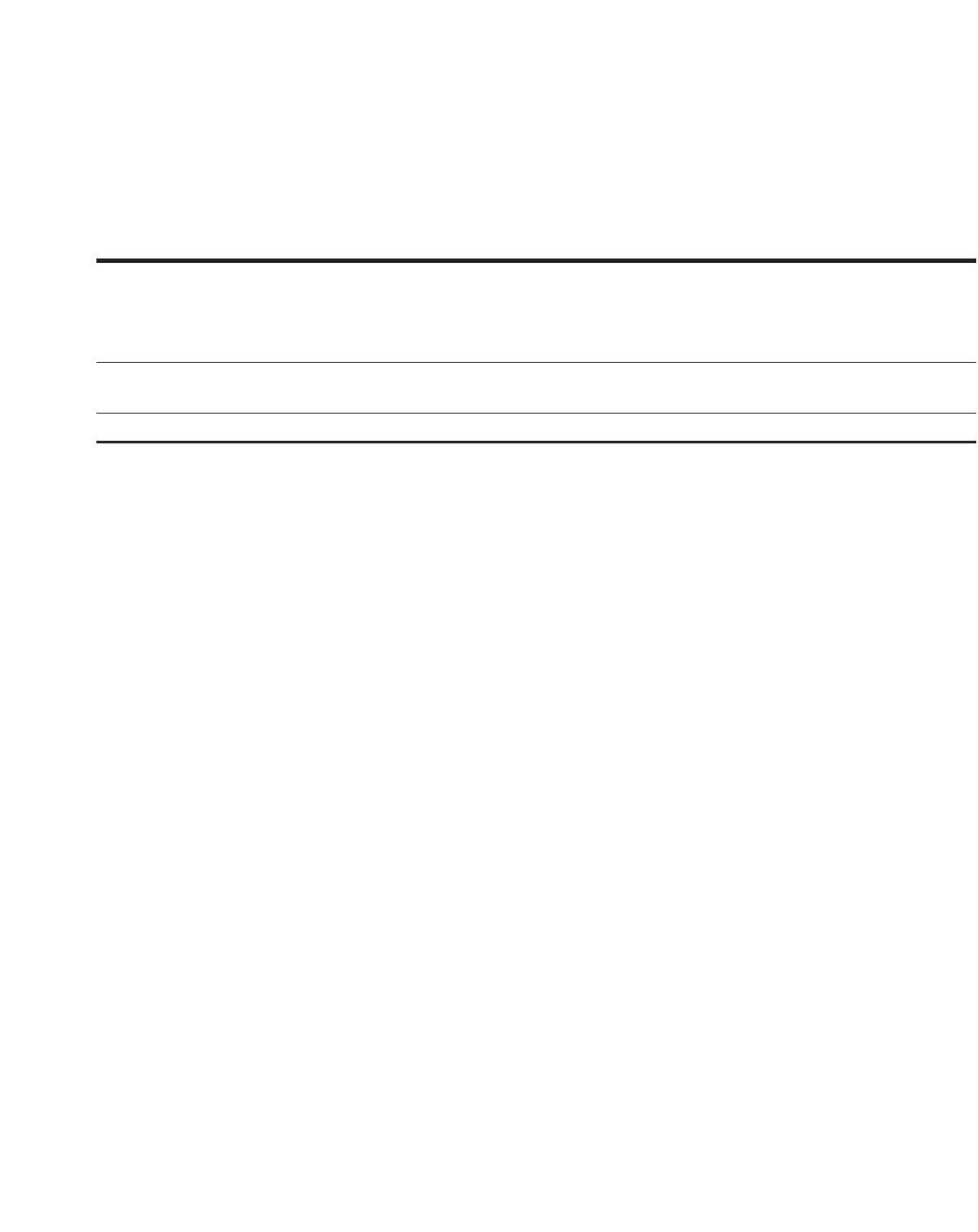

Comprehensive Income (Loss)

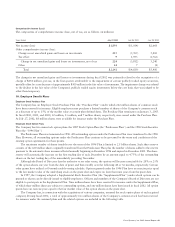

The components of comprehensive income (loss), net of tax, are as follows (in millions):

Years Ended July 27, 2002 July 28, 2001 July 29, 2000

Net income (loss) $ 1,893 $ (1,014) $2,668

Other comprehensive income (loss):

Change in net unrealized gains and losses on investments 215 (5,765) 5,002

Tax effect 91,953 (1,762)

Change in net unrealized gains and losses on investments, net of tax 224 (3,812) 3,240

Other 24 7 (8)

Total $ 2,141 $ (4,819) $ 5,900

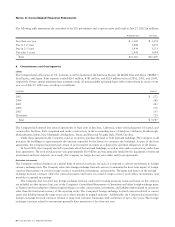

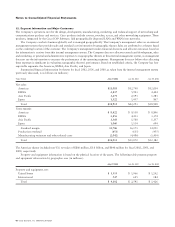

The change in net unrealized gains and losses on investments during fiscal 2002 was primarily related to the recognition of a

charge of $858 million, pre-tax, in the first quarter attributable to the impairment of certain publicly traded equity securities,

partially offset by a net decrease of approximately $500 million in the fair value of investments. The impairment charge was related

to the decline in the fair value of the Company’s publicly traded equity investments below the cost basis that was judged to be

other-than-temporary.

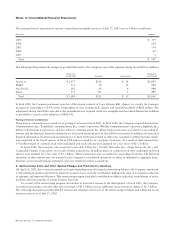

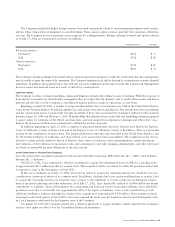

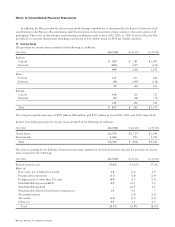

10. Employee Benefit Plans

Employee Stock Purchase Plan

The Company has an Employee Stock Purchase Plan (the “Purchase Plan”) under which 222 million shares of common stock

have been reserved for issuance. Eligible employees may purchase a limited number of shares of the Company’s common stock

at a discount of up to 15% of the market value at certain plan-defined dates. The Purchase Plan terminates on January 3, 2005.

In fiscal 2002, 2001, and 2000, 22 million, 13 million, and 7 million shares, respectively, were issued under the Purchase Plan.

At July 27, 2002, 88 million shares were available for issuance under the Purchase Plan.

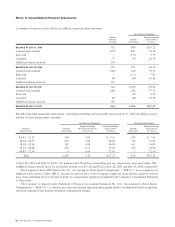

Employee Stock Option Plans

The Company has two main stock option plans: the 1987 Stock Option Plan (the “Predecessor Plan”) and the 1996 Stock Incentive

Plan (the “1996 Plan”).

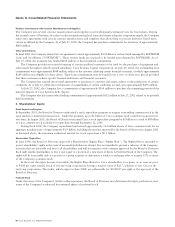

The Predecessor Plan was terminated in 1996. All outstanding options under the Predecessor Plan were transferred to the 1996

Plan. However, all outstanding options under the Predecessor Plan continue to be governed by the terms and conditions of the

existing option agreements for those grants.

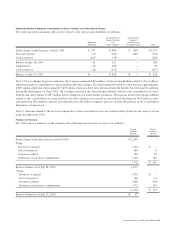

The maximum number of shares issuable over the term of the 1996 Plan is limited to 2.5 billion shares. Such share reserve

consists of the 620 million shares originally transferred from the Predecessor Plan plus the number of shares added to the reserve

pursuant to the automatic share increases effected annually beginning in December 1996 and expired in December 2001. The share

reserve will automatically increase on the first trading day of each December by an amount equal to 4.75% of the outstanding

shares on the last trading day of the immediately preceding November.

Although the Board of Directors has the authority to set other terms, the options will become exercisable for 20% or 25%

of the option shares one year from the date of grant and then ratably over the following 48 or 36 months, respectively. Certain

other grants have utilized a 60-month ratable vesting schedule. Options granted under the 1996 Plan have an exercise price equal

to the fair market value of the underlying stock on the grant date and expire no later than nine years from the grant date.

In 1997, the Company adopted a Supplemental Stock Incentive Plan (the “Supplemental Plan”) under which options can be

granted or shares can be directly issued to eligible employees. Officers and members of the Company’s Board of Directors are not

eligible to participate in the Supplemental Plan. Nine million shares have been reserved for issuance under the Supplemental Plan,

of which three million shares are subject to outstanding options, and one million shares have been issued in fiscal 2002. All option

grants have an exercise price equal to the fair market value of the option shares on the grant date.

The Company has, in connection with the acquisitions of various companies, assumed the stock option plans of each acquired

company. During fiscal 2002, a total of approximately two million shares of the Company’s common stock has been reserved

for issuance under the assumed plans and the related options are included in the following table.