Cisco 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cisco Systems, Inc. 2002 Annual Report 37

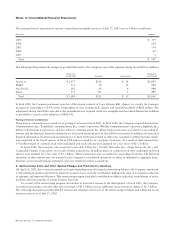

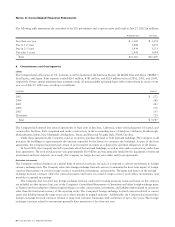

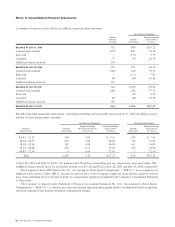

6. Lease Receivables, Net

Lease receivables represent sales-type and direct-financing leases resulting from the sale of the Company’s and complementary

third-party products and services. These lease arrangements typically have terms from two to three years and are usually collateral-

ized by a security interest in the underlying assets. The net lease receivables are summarized as follows (in millions):

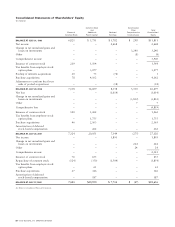

July 27, 2002 July 28, 2001

Gross lease receivables $ 1,214 $ 1,554

Unearned income and other reserves (936) (896)

Total 278 658

Less, current portion (239) (405)

Non-current lease receivables, net $39 $ 253

Contractual maturities of the gross lease receivables at July 27, 2002 were $613 million in fiscal 2003, $348 million in fiscal 2004,

$234 million in fiscal 2005, and $19 million in fiscal 2006. Actual cash collections may differ from the contractual maturities

due to early customer buyouts or refinancings.

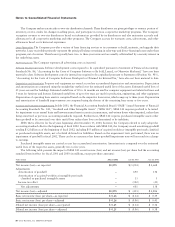

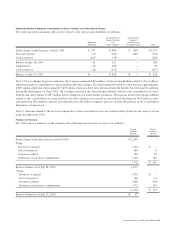

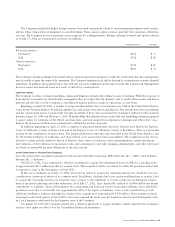

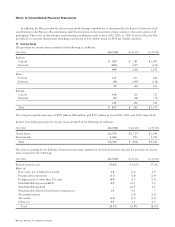

7. Investments

The following tables summarize the Company’s investments (in millions):

Gross Gross

Amortized Unrealized Unrealized Fair

July 27, 2002 Cost Gains Losses Value

U.S. government notes and bonds $ 4,346 $122 $ (1) $ 4,467

Corporate notes and bonds 6,819 127 (8) 6,938

Corporate equity securities 851 71 (355) 567

Total $12,016 $320 $ (364) $11,972

Reported as:

Short-term investments $ 3,172

Investments 8,800

Total $ 11,972

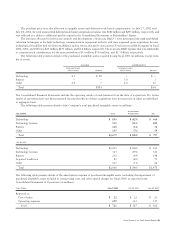

Gross Gross

Amortized Unrealized Unrealized Fair

July 28, 2001 Cost Gains Losses Value

U.S. government notes and bonds $ 4,426 $ 92 $ (1) $ 4,517

State, municipal, and county

government notes and bonds 54 – – 54

Corporate notes and bonds 7,430 118 (4) 7,544

Corporate equity securities 1,993 320 (784) 1,529

Total $13,903 $530 $ (789) $ 13,644

Reported as:

Short-term investments $ 2,034

Investments 10,346

Restricted investments 1,264

Total $ 13,644