Cisco 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

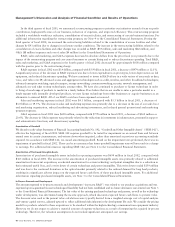

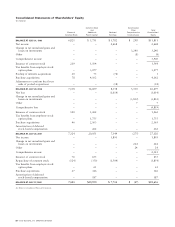

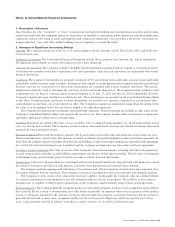

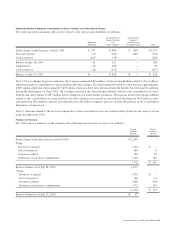

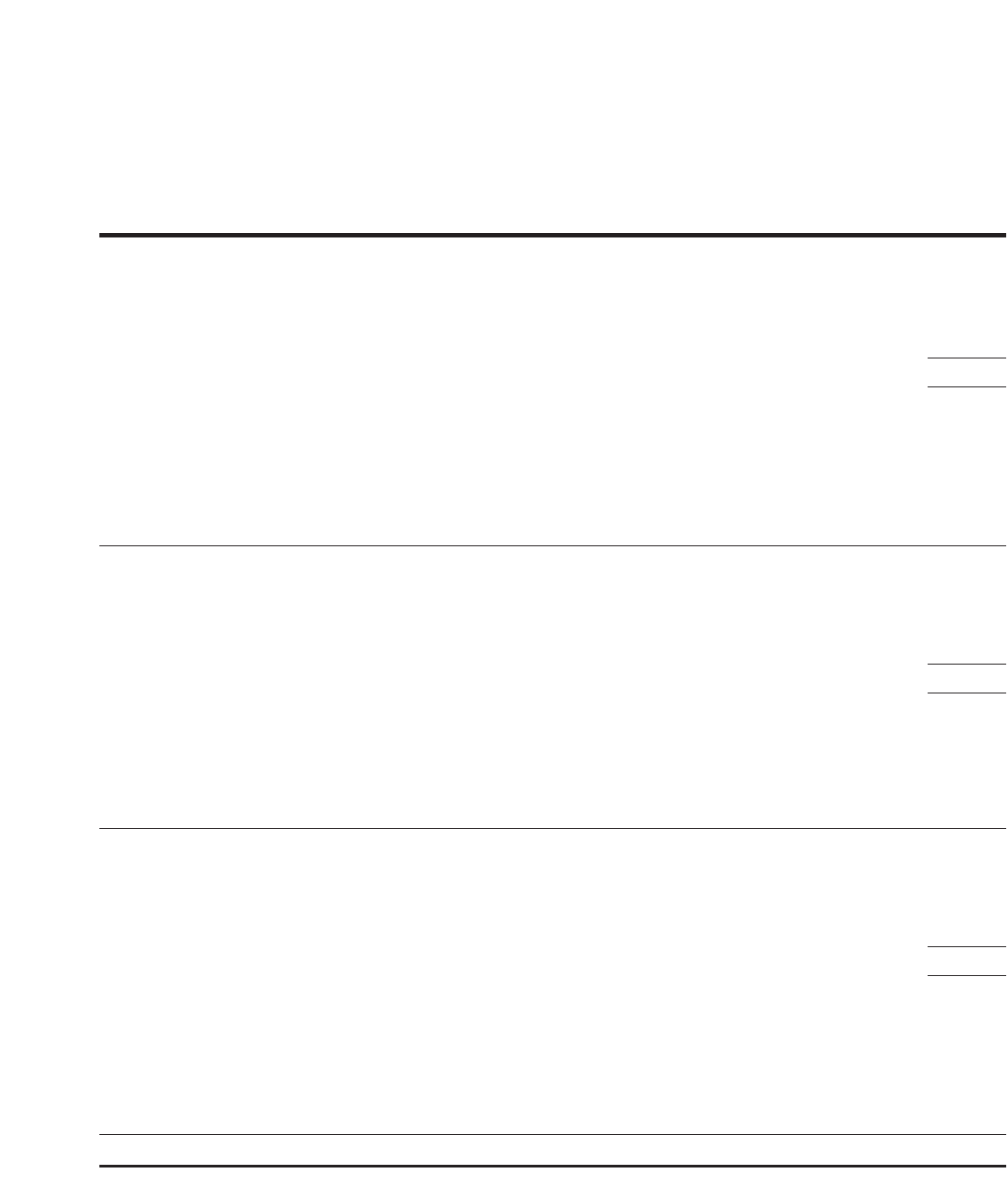

Consolidated Statements of Shareholders’ Equity

(In millions)

28 Cisco Systems, Inc. 2002 Annual Report

Common Stock Accumulated

and Other Total

Shares of Additional Retained Comprehensive Shareholders’

Common Stock Paid-In Capital Earnings Income (Loss) Equity

BALANCE AT JULY 31, 1999 6,821 $ 5,731 $ 5,782 $ 298 $11,811

Net income – – 2,668 – 2,668

Change in net unrealized gains and

losses on investments – – – 3,240 3,240

Other – – – (8) (8)

Comprehensive income – – – – 5,900

Issuance of common stock 219 1,564 – – 1,564

Tax benefits from employee stock

option plans – 3,077 – – 3,077

Pooling of interests acquisitions 20 75 (74) – 1

Purchase acquisitions 78 4,162 – – 4,162

Adjustment to conform fiscal year

ends of pooled acquisitions – – (18) – (18)

BALANCE AT JULY 29, 2000 7,138 14,609 8,358 3,530 26,497

Net loss – – (1,014) – (1,014)

Change in net unrealized gains and

losses on investments – – – (3,812) (3,812)

Other – – – 7 7

Comprehensive loss – – – – (4,819)

Issuance of common stock 140 1,262 – – 1,262

Tax benefits from employee stock

option plans – 1,755 – – 1,755

Purchase acquisitions 46 2,163 – – 2,163

Amortization of deferred

stock-based compensation – 262 – – 262

BALANCE AT JULY 28, 2001 7,324 20,051 7,344 (275) 27,120

Net income – – 1,893 – 1,893

Change in net unrealized gains and

losses on investments – – – 224 224

Other – – – 24 24

Comprehensive income – – – – 2,141

Issuance of common stock 76 655 – – 655

Repurchase of common stock (124) (350) (1,504) – (1,854)

Tax benefits from employee stock

option plans – 61 – – 61

Purchase acquisitions 27 346 – – 346

Amortization of deferred

stock-based compensation – 187 – – 187

BALANCE AT JULY 27, 2002 7,303 $20,950 $ 7,733 $ (27) $28,656

See Notes to Consolidated Financial Statements.