Cisco 2002 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cisco Systems, Inc. 2002 Annual Report 17

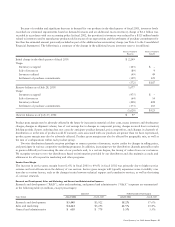

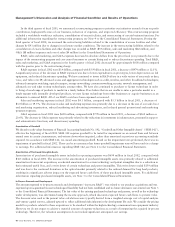

Because of a sudden and significant decrease in demand for our products in the third quarter of fiscal 2001, inventory levels

exceeded our estimated requirements based on demand forecasts and an additional excess inventory charge of $2.2 billion was

recorded in accordance with our accounting policy. In fiscal 2002, the provision for inventory was reduced by a $525 million benefit

related to inventory used to manufacture products sold in excess of our expectations and the settlement of purchase commitments for

less than the estimated amount previously included as part of the additional excess inventory charge (see Note 4 to the Consolidated

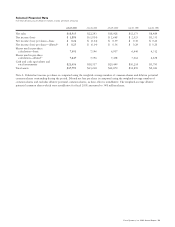

Financial Statements). The following is a summary of the change in the additional excess inventory reserve (in millions):

Excess Inventory Excess Inventory

Reserve Benefit

Initial charge in the third quarter of fiscal 2001 $ 2,249

Usage:

Inventory scrapped (105) $ –

Sale of inventory (89) 9

Inventory utilized (49) 49

Settlement of purchase commitments (329) 129

(572) $ 187

Reserve balance as of July 28, 2001 1,677

Usage:

Inventory scrapped (975) $ –

Sale of inventory (64) 14

Inventory utilized (408) 408

Settlement of purchase commitments (173) 103

(1,620) $ 525

Reserve balance as of July 27, 2002 $57

Product gross margin may be adversely affected in the future by increases in material or labor costs, excess inventory and obsolescence

charges, changes in shipment volume, loss of cost savings due to changes in component pricing, charges incurred due to inventory

holding periods if parts ordering does not correctly anticipate product demand, price competition, and changes in channels of

distribution or in the mix of products sold. If warranty costs associated with our products are greater than we have experienced,

product gross margin may also be adversely affected. Product gross margin may also be affected by geographic mix, as well as

the mix of configurations within each product group.

Two-tier distribution channels are given privileges to return a portion of inventory, receive credits for changes in selling prices,

and participate in various cooperative marketing programs. In addition, increasing two-tier distribution channels generally results

in greater difficulty in forecasting the mix of our products and, to a certain degree, the timing of orders from our customers.

We recognize revenue to two-tier distributors based on information provided by our distributors and also maintain accruals and

allowances for all cooperative marketing and other programs.

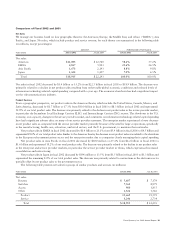

Service Gross Margin

The increase in service gross margin from 62.6% in fiscal 2001 to 69.6% in fiscal 2002 was primarily due to higher service

revenue and cost efficiencies in the delivery of our services. Service gross margin will typically experience some variability over

time due to various factors, such as the changes in mix between technical support and consultative services, as well as the timing

of contract renewals.

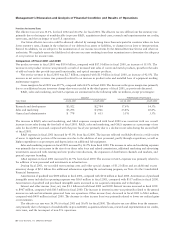

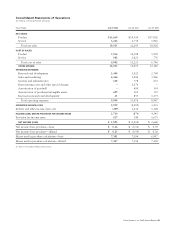

Research and Development, Sales and Marketing, and General and Administrative Expenses

Research and development (“R&D”), sales and marketing, and general and administrative (“G&A”) expenses are summarized

in the following table (in millions, except percentages):

AMOUNT PERCENTAGE OF NET SALES

Years Ended July 27, 2002 July 28, 2001 July 27, 2002 July 28, 2001

Research and development $ 3,448 $3,922 18.2% 17.6%

Sales and marketing $ 4,264 $5,296 22.5% 23.8%

General and administrative $ 618 $ 778 3.3% 3.5%