Cisco 2002 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cisco Systems, Inc. 2002 Annual Report 21

Recent Accounting Pronouncements

In October 2001, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards No. 144,

“Accounting for the Impairment or Disposal of Long-Lived Assets” (“SFAS 144”). SFAS 144 establishes a single accounting model,

based on the framework established in Statement of Financial Accounting Standards No. 121, “Accounting for the Impairment

of Long-Lived Assets and for Long-Lived Assets to Be Disposed Of” (“SFAS 121”), for long-lived assets to be disposed of by sale,

and resolves implementation issues related to SFAS 121. We are required to adopt SFAS 144 no later than the first quarter of

fiscal 2003. We do not expect the adoption of SFAS 144 to have a material impact on our operating results or financial position.

In July 2002, the FASB issued Statement of Financial Accounting Standards No. 146, “Accounting for Costs Associated with

Exit or Disposal Activities” (“SFAS 146”). SFAS 146 requires that a liability for costs associated with an exit or disposal activity

be recognized and measured initially at fair value only when the liability is incurred. SFAS 146 is effective for exit or disposal

activities that are initiated after December 31, 2002. We do not expect the adoption of SFAS 146 to have a material impact on

our operating results or financial position.

Liquidity and Capital Resources

The following sections discuss the effects of the changes in our balance sheets, cash flows, and commitments on our liquidity and

capital resources.

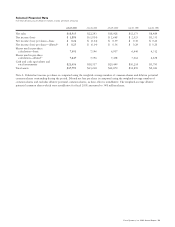

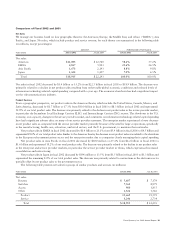

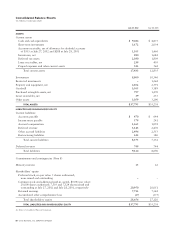

Balance Sheet and Cash Flows

Cash and Cash Equivalents and Total Investments Cash and cash equivalents and total investments were $21.5 billion at July 27, 2002,

an increase of $2.9 billion or 15.9% from $18.5 billion at July 28, 2001. The increase was primarily a result of cash provided

by operating activities of $6.6 billion and cash provided by the issuance of common stock of $655 million. This increase was

partially offset by cash used in capital expenditures of $2.6 billion primarily related to the purchase of land and buildings under

synthetic lease agreements as discussed below, cash used for the repurchase of common stock of $1.9 billion, and a net decrease of

approximately $500 million in the fair value of investments (see Quantitative and Qualitative Disclosures About Market Risk).

We expect that cash provided by operating activities may fluctuate in future periods as a result of a number of factors,

including fluctuations in our operating results, shipment linearity, accounts receivable collections, inventory management, and the

timing of tax and other payments. For additional discussion, see the Risk Factors section in our Form 10-K.

Accounts Receivable, Net Accounts receivable was $1.1 billion at July 27, 2002, a decrease of $361 million or 24.6% from $1.5 billion at

July 28, 2001. Days sales outstanding (“DSO”) in receivables decreased to 21 days at July 27, 2002 from 31 days at July 28, 2001.

The decrease in accounts receivable and DSO was primarily due to shipment linearity and collections performance. Our targeted

range for DSO performance is 40 to 50 days.

Inventories, Net Inventories were $880 million at July 27, 2002, a decrease of $804 million or 47.7% from $1.7 billion at July 28, 2001.

Inventories consist of raw materials, work in process, finished goods, and demonstration systems. Approximately 37.4% of our

finished goods inventory was located at distributor sites. Inventory turns, excluding the additional excess inventory benefits

previously discussed, were 7.1 turns in the fourth quarter of fiscal 2002 and 4.6 turns in the fourth quarter of fiscal 2001. The

improved inventory levels and associated inventory turns reflected our ongoing inventory management efforts. Inventory management

remains an area of focus as we balance the need to maintain strategic inventory levels to ensure competitive lead times against

the risk of inventory obsolescence because of rapidly changing technology and customer requirements.

Property and Equipment, Net Property and equipment were $4.1 billion at July 27, 2002, an increase of $1.5 billion or 58.3% from

$2.6 billion at July 28, 2001. In fiscal 2002, we elected to purchase all of the land and buildings, as well as sites under construction, under

synthetic lease agreements. The total purchase price was approximately $1.9 billion and was primarily funded by the liquidation of

restricted investments and lease deposits. As a result, we no longer have any sites under such synthetic lease agreements.

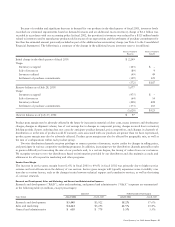

Commitments

Certain Investments in Privately Held Companies We have entered into investment agreements with two privately held companies,

AYR Networks, Inc. (“AYR”) and Andiamo Systems, Inc. (“Andiamo”).

On July 25, 2002, we announced a definitive agreement to acquire the remaining interests of AYR for a purchase price of

approximately $113 million payable in common stock. This acquisition will be accounted for under the purchase method and is

expected to close in the first quarter of fiscal 2003.