Cisco 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

34 Cisco Systems, Inc. 2002 Annual Report

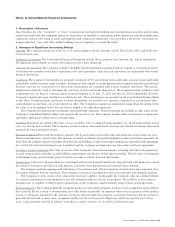

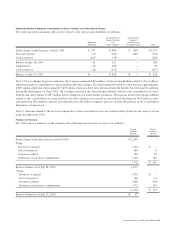

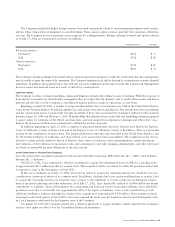

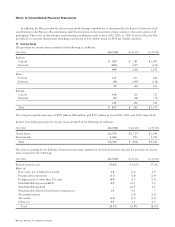

The estimated future amortization expense of purchased intangible assets as of July 27, 2002 was as follows (in millions):

Fiscal Year Amount

2003 $ 359

2004 234

2005 154

2006 49

2007 1

Total $ 797

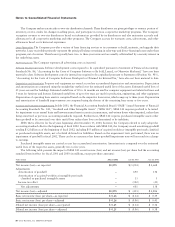

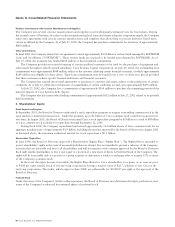

The following table presents the changes in goodwill allocated to the Company’s reportable segments during fiscal 2002 (in millions):

Balance at Balance at

July 28, 2001 Acquired Adjustments July 27, 2002

Americas $ 2,177 $120 $ 38 $ 2,335

EMEA 531 50 12 593

Asia Pacific 110 26 4 140

Japan 371 125 1 497

Total $ 3,189 $321 $ 55 $ 3,565

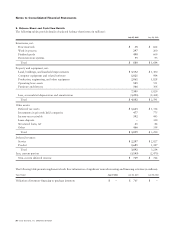

In fiscal 2002, the Company purchased a portion of the minority interest of Cisco Systems, K.K. (Japan). As a result, the Company

increased its ownership to 92.4% of the voting rights of Cisco Systems, K.K. (Japan) and recorded goodwill of $108 million. The

adjustments during fiscal 2002 were due to the reclassification of acquired workforce intangible and the related deferred tax liabilities

to goodwill as a result of the adoption of SFAS 142.

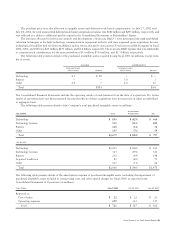

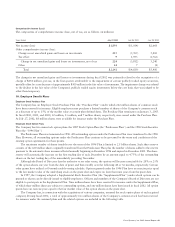

Pooling of Interests Combinations

There were no transactions accounted for as pooling of interests in fiscal 2001. In fiscal 2000, the Company acquired StratumOne

Communications, Inc.; TransMedia Communications, Inc.; Cerent Corporation; WebLine Communications Corporation; SightPath, Inc.;

InfoGear Technology Corporation; and ArrowPoint Communications, Inc. These transactions were accounted for as pooling of

interests and the historical financial information for all periods presented prior to fiscal 2000 was restated. In addition, the historical

financial information for all periods presented prior to fiscal 2000 was restated to reflect the acquisition of Fibex Systems, which

was completed in the fourth quarter of fiscal 1999 and accounted for as a pooling of interests. As a result of these transactions,

354 million shares of common stock were exchanged and stock options were assumed for a fair value of $15.2 billion.

In fiscal 2000, the Company also acquired Cocom A/S; V-Bits, Inc.; Growth Networks, Inc.; Altiga Networks, Inc.; and

Compatible Systems Corporation. As a result of these transactions, 20 million shares of common stock were exchanged and stock

options were assumed for a fair value of $1.1 billion. These transactions were accounted for as pooling of interests. The historical

operations of these entities were not material to the Company’s consolidated operations on either an individual or aggregate basis;

therefore, prior period financial statements were not restated for these acquisitions.

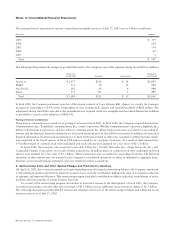

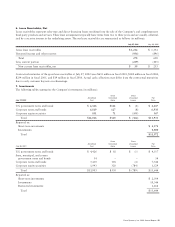

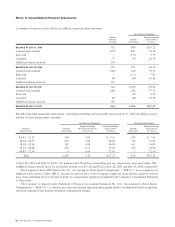

4. Restructuring Costs and Other Special Charges and Provision for Inventory

On April 16, 2001, due to macroeconomic and capital spending issues affecting the networking industry, the Company announced

a restructuring program to prioritize its initiatives around a focus on profit contribution, high-growth areas of its business, reduction

of expenses, and improved efficiency. This restructuring program included a worldwide workforce reduction, consolidation of excess

facilities, and restructuring of certain business functions.

As a result of the restructuring program and decline in forecasted revenue in the third quarter of fiscal 2001, the Company

recorded restructuring costs and other special charges of $1.2 billion and an additional excess inventory charge of $2.2 billion.

The following discussion provides detailed information relating to the status of the restructuring liabilities and additional excess

inventory reserve as of July 27, 2002.