Cisco 2002 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

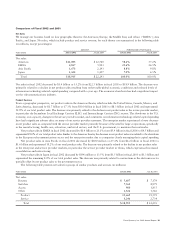

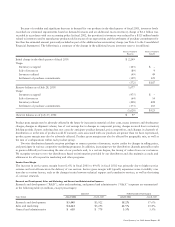

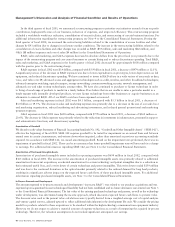

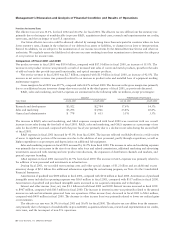

Management’s Discussion and Analysis of Financial Condition and Results of Operations

14 Cisco Systems, Inc. 2002 Annual Report

Forward-Looking Statements

This Management’s Discussion and Analysis of Financial Condition and Results of Operations contains forward-looking statements

regarding future events and our future results that are based on current expectations, estimates, forecasts, and projections

about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,”

“targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words, and similar expressions

are intended to identify such forward-looking statements. Readers are cautioned that these forward-looking statements are only

predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual results may differ

materially and adversely from those expressed in any forward-looking statements. Readers are referred to risks and uncertainties

identified below, as well as on the inside cover of this Annual Report and in the documents filed by us with the Securities and

Exchange Commission, specifically the most recent reports on Forms 10-K, 10-Q, and 8-K, each as it may be amended from

time to time. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

Critical Accounting Policies

The preparation of financial statements and related disclosures in conformity with accounting principles generally accepted in the

United States requires management to make judgments, assumptions, and estimates that affect the amounts reported in the Consolidated

Financial Statements and accompanying notes. Note 2 to the Consolidated Financial Statements describes the significant accounting

policies and methods used in the preparation of the Consolidated Financial Statements. Estimates are used for, but not limited

to, the accounting for the allowance for doubtful accounts and sales returns, inventory allowances, warranty costs, investment

impairments, goodwill impairments, contingencies, restructuring costs and other special charges, and taxes. Actual results could

differ materially from these estimates. The following critical accounting policies are impacted significantly by judgments, assumptions,

and estimates used in the preparation of the Consolidated Financial Statements.

The allowance for doubtful accounts is based on our assessment of the collectibility of specific customer accounts and the

aging of the accounts receivable. If there were a deterioration of a major customer’s creditworthiness, or actual defaults were

higher than our historical experience, our estimates of the recoverability of amounts due to us could be overstated, which could have

an adverse impact on our revenue.

A reserve for sales returns is established based on historical trends in product return rates. If the actual future returns were

to deviate from the historical data on which the reserve had been established, our revenue could be adversely affected.

Inventory purchases and commitments are based upon future demand forecasts. If there were to be a sudden and significant

decrease in demand for our products, or if there were a higher incidence of inventory obsolescence because of rapidly changing

technology and customer requirements, we could be required to increase our inventory allowances and our gross margins could

be adversely affected.

We accrue for warranty costs based on historical trends in product return rates and the expected material and labor costs to

provide warranty services. If we were to experience an increase in warranty claims compared with our historical experience, or

costs of servicing warranty claims were greater than the expectations on which the accrual had been based, our gross margins

could be adversely affected.

We have experienced significant volatility in the market prices of our publicly traded equity investments. These investments

are recorded on the Consolidated Balance Sheets at fair value with unrealized gains and losses reported as a separate component of

accumulated other comprehensive income (loss), net of any related tax effect. We recognize an impairment charge in the Consolidated

Statements of Operations when the decline in the fair value of our publicly traded equity investments below their cost basis is judged

to be other-than-temporary. We consider various factors in determining whether we should recognize an impairment charge including,

but not limited to, the length of time and extent to which the fair value has been less than our cost basis, the financial condition

and near-term prospects of the issuer, and our intent and ability to hold the investment for a period of time sufficient to allow for

any anticipated recovery in market value. The ultimate value realized on these equity investments is subject to market price

volatility until they are sold.

We perform goodwill impairment tests on an annual basis and between annual tests in certain circumstances for each reporting

unit, which are the operating segments as described in Note 12 to the Consolidated Financial Statements. In response to changes in

industry and market conditions, we may be required to strategically realign our resources and consider restructuring, disposing,

or otherwise exiting businesses, which could result in an impairment of goodwill.

We are subject to the possibility of various loss contingencies arising in the ordinary course of business. We consider the

likelihood of loss or impairment of an asset or the incurrence of a liability, as well as our ability to reasonably estimate the

amount of loss in determining loss contingencies. An estimated loss contingency is accrued when it is probable that an asset has been

impaired or a liability has been incurred and the amount of loss can be reasonably estimated. We regularly evaluate current

information available to us to determine whether such accruals should be adjusted.