Cisco 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

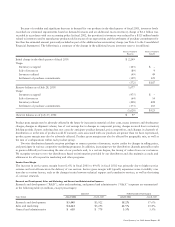

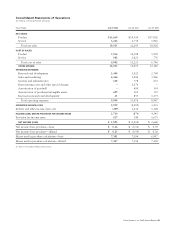

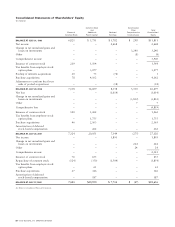

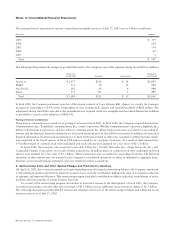

Consolidated Statements of Cash Flows

(In millions)

Years Ended July 27, 2002 July 28, 2001 July 29, 2000

Cash flows from operating activities:

Net income (loss) $ 1,893 $ (1,014) $ 2,668

Adjustments to reconcile net income (loss) to

net cash provided by operating activities:

Depreciation and amortization 1,957 2,236 863

Provision for doubtful accounts 91 268 40

Provision for inventory 149 2,775 339

Deferred income taxes (573) (924) (782)

Tax benefits from employee stock option plans 61 1,397 2,495

Adjustment to conform fiscal year ends of pooled acquisitions –– (18)

In-process research and development 53 739 1,279

Net (gains) losses on investments and provision for losses 1,127 43 (92)

Restructuring costs and other special charges –501 –

Change in operating assets and liabilities:

Accounts receivable 270 569 (1,043)

Inventories 673 (1,644) (887)

Prepaid expenses and other current assets (28) (25) (249)

Accounts payable (174) (105) 286

Income taxes payable 389 (434) (365)

Accrued compensation 307 (256) 576

Deferred revenue 678 1,629 662

Other accrued liabilities (222) 251 369

Restructuring liabilities (64) 386 –

Net cash provided by operating activities 6,587 6,392 6,141

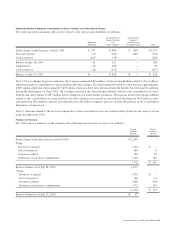

Cash flows from investing activities:

Purchases of short-term investments (5,473) (4,594) (2,473)

Proceeds from sales and maturities of short-term investments 5,868 4,370 2,481

Purchases of investments (15,760) (18,306) (14,778)

Proceeds from sales and maturities of investments 15,317 15,579 13,240

Purchases of restricted investments (291) (941) (458)

Proceeds from sales and maturities of restricted investments 1,471 1,082 206

Acquisition of property and equipment (2,641) (2,271) (1,086)

Purchases of technology licenses –(4) (444)

Acquisition of businesses, net of cash and cash equivalents 16 (13) 24

Change in lease receivables, net 380 457 (535)

Purchases of investments in privately held companies (58) (1,161) (130)

Lease deposits 320 (320) –

Purchase of minority interest of Cisco Systems, K.K. (Japan) (115) (365) –

Other 159 (516) (424)

Net cash used in investing activities (807) (7,003) (4,377)

Cash flows from financing activities:

Issuance of common stock 655 1,262 1,564

Repurchase of common stock (1,854) ––

Other 30 (12) (7)

Net cash (used in) provided by financing activities (1,169) 1,250 1,557

Net increase in cash and cash equivalents 4,611 639 3,321

Cash and cash equivalents, beginning of fiscal year 4,873 4,234 913

Cash and cash equivalents, end of fiscal year $ 9,484 $ 4,873 $ 4,234

See Notes to Consolidated Financial Statements.

Cisco Systems, Inc. 2002 Annual Report 27