Cisco 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

People, Productivity,

and the Network.

Cisco Systems, Inc. Empowering the Internet Generation®

2002 Annual Report

Table of contents

-

Page 1

2002 Annual Report People, Productivity, and the Network. Cisco Systems, Inc. Empowering the Internet Generation® -

Page 2

... acquired businesses and technologies; increasing customer credit risk; rate of growth of the Internet and Internet-based systems; factors arising from international operations, including currency fluctuations; timing and amount of employer payroll tax to be paid on employees' gains on stock options... -

Page 3

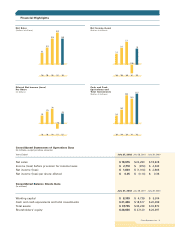

...Consolidated Statements of Operations Data (In millions, except per-share amounts) Years Ended July 27, 2002 July 28, 2001 July 29, 2000 Net sales Income (loss) before provision for income taxes Net income (loss) Net income (loss) per share-diluted $ 18,915 $ 2,710 $ 1,893 $ 0.25 $ 22,293 $ (874... -

Page 4

To Our Shareholders Fiscal 2002 was a very challenging year for the entire industry, and the most difficult environment Cisco Systems has ever faced. In a tough market, we focused on the four elements that we could influence and control-profit contribution, cash flow from operations, available ... -

Page 5

... almost half of their expected productivity increases would come through Internet business solutions. In short, it's the productivity gains-including increasing operational efficiencies and cutting costs-that are allowing companies to drive profits in this challenging economy. Cisco Systems, Inc. 3 -

Page 6

..., we are concentrating on core routing and switching, and new growth markets. In conceptual terms, we are creating an end-to-end shared, common architecture for both hardware and software. This is unique to Cisco. People and Giving Back As always, our employees continue to be our strongest asset... -

Page 7

... Relations magazines awarded Cisco "Best Investor Relations Officer" and "Best Investor Relations by a CEO," in what was a very challenging year. We want to thank shareholders for your confidence, and we will continue to do everything possible to reward that confidence. In many ways, fiscal 2002... -

Page 8

... with the corporate governance listing requirements proposed by the New York Stock Exchange and Nasdaq, including: • A majority of our Board members are independent of the Company and its management • All members of the key Board committees-the Audit, Compensation and Nomination Committees-are... -

Page 9

... new services, and enhance customer satisfaction. The network makes possible communications that are secure, collaborative, and ultimately, more human. In the following pages, chief information officers, technologists, business executives, educators, visionaries, students, and a Nobel Laureate share... -

Page 10

Our Cisco IP phones and unified messaging system ensure that our customers can more effectively reach us. The integrated voice and data network gives our midsized company the capabilities of a large electronic enterprise. Phil Go Chief Information Officer Barton Malow Company In our work together ... -

Page 11

... the Internet to transform the way we interact with customers and new markets. Dave Kepler Chief Information Officer Dow Chemical Company As we Web-enable our internal business processes, we have found ways to streamline our business and reallocate those resources to better serve our internal and... -

Page 12

...me new opportunities as a civilian, following a successful 22-year career in the military. Clarence Mitchell Cisco Networking Academy Graduate Communications Workers of America Academy Maryland I'm using the Internet to communicate with people all over the world. It's amazing. It's a heady business... -

Page 13

... the absolute best in network performance and scalability. We have a world-class network in place-and with Cisco we have the right partner to make sure it stays that way. Bill Godfrey Chief Technology Officer Dow Jones & Company With more than 3.5 billion viewers watching the 2002 Olympics, the... -

Page 14

...economy in recent years can be traced quite directly to increased business use of information technologies, including the Internet. Economists in every major institution have revised upward their projections of future trend productivity growth as a result, and living standards will be commensurately... -

Page 15

... using the weighted-average number of common shares and excludes dilutive potential common shares, as their effect is antidilutive. The weighted-average dilutive potential common shares which were antidilutive for fiscal 2001 amounted to 348 million shares. Cisco Systems, Inc. 2002 Annual Report 13 -

Page 16

... probable that an asset has been impaired or a liability has been incurred and the amount of loss can be reasonably estimated. We regularly evaluate current information available to us to determine whether such accruals should be adjusted. 14 Cisco Systems, Inc. 2002 Annual Report -

Page 17

... for groups of similar products and services (in millions): Years Ended July 27, 2002 July 28, 2001 Net sales: Routers Switches Access Other Product Service Total $ 5,607 7,560 980 1,522 15,669 3,246 $ 18,915 $ 7,179 8,979 1,855 1,546 19,559 2,734 $ 22,293 Cisco Systems, Inc. 2002 Annual Report... -

Page 18

... margin (in millions, except percentages): AMOUNT Years Ended July 27, 2002 July 28, 2001 STANDARD MARGIN July 27, 2002 July 28, 2001 Gross margin: Americas EMEA Asia Pacific Japan Standard margin Production overhead Manufacturing variances and other related costs Total $ 8,422 3,856 1,368 1,060... -

Page 19

...): AMOUNT Years Ended July 27, 2002 July 28, 2001 PERCENTAGE OF NET SALES July 27, 2002 July 28, 2001 Research and development Sales and marketing General and administrative $ 3,448 $ 4,264 $ 618 $3,922 $5,296 $ 778 18.2% 22.5% 3.3% 17.6% 23.8% 3.5% Cisco Systems, Inc. 2002 Annual Report 17 -

Page 20

... equipment industry. However, we do not expect to achieve a material amount of expense reductions as a result of integrating the acquired in-process technology. Therefore, the valuation assumptions do not include significant anticipated cost savings. 18 Cisco Systems, Inc. 2002 Annual Report -

Page 21

... impairment of certain publicly traded equity securities in our investment portfolio. This impairment charge was due to the decline in the fair value of our publicly traded equity investments below the cost basis that was judged to be other-than-temporary. Cisco Systems, Inc. 2002 Annual Report 19 -

Page 22

...for fiscal 2000. The effective tax rate differs from the statutory rate primarily due to the impact of nondeductible in-process R&D, acquisition-related costs, research and experimentation tax credits, state taxes, and the tax impact of non-U.S. operations. 20 Cisco Systems, Inc. 2002 Annual Report -

Page 23

...of AYR for a purchase price of approximately $113 million payable in common stock. This acquisition will be accounted for under the purchase method and is expected to close in the first quarter of fiscal 2003. Certain Investments in Privately Held Companies Cisco Systems, Inc. 2002 Annual Report 21 -

Page 24

... investment commitment. We provide structured financing to certain qualified customers to be used for the purchase of equipment and other needs through our wholly-owned subsidiary, Cisco Systems Capital Corporation. At July 27, 2002, the outstanding loan commitments were approximately $948 million... -

Page 25

... selected hypothetical changes in each stock's price. Stock price fluctuations of plus or minus 25%, 50%, and 75% were selected based on the probability of their occurrence and are representative of the historical movements in the Nasdaq Composite Index. Cisco Systems, Inc. 2002 Annual Report 23 -

Page 26

... exchange forward and option contracts for trading purposes. We do not expect gains or losses on these derivative instruments to have a material impact on our financial results or financial condition (see Note 8 to the Consolidated Financial Statements). 24 Cisco Systems, Inc. 2002 Annual Report -

Page 27

... TAXES Provision for income taxes NET INCOME (LOSS) Net income (loss) per share-basic Net income (loss) per share-diluted Shares used in per-share calculation-basic Shares used in per-share calculation-diluted See Notes to Consolidated Financial Statements. Cisco Systems, Inc. 2002 Annual Report... -

Page 28

... at July 27, 2002 and $288 at July 28, 2001 Inventories, net Deferred tax assets Lease receivables, net Prepaid expenses and other current assets Total current assets Investments Restricted investments Property and equipment, net Goodwill Purchased intangible assets, net Lease receivables, net Other... -

Page 29

... Acquisition of property and equipment Purchases of technology licenses Acquisition of businesses, net of cash and cash equivalents Change in lease receivables, net Purchases of investments in privately held companies Lease deposits Purchase of minority interest of Cisco Systems, K.K. (Japan) Other... -

Page 30

... Issuance of common stock Repurchase of common stock Tax benefits from employee stock option plans Purchase acquisitions Amortization of deferred stock-based compensation BALANCE AT JULY 27, 2002 See Notes to Consolidated Financial Statements. $ (27) 28 Cisco Systems, Inc. 2002 Annual Report -

Page 31

... enterprises. Cisco provides a broad line of products for transporting data, voice, and video within buildings, across campuses, or around the world. 2. Summary of Significant Accounting Policies The Company's fiscal year is the 52 or 53 weeks ending on the last Saturday in July. Fiscal 2002, 2001... -

Page 32

... balance remaining in sales-type and direct-financing leases under these programs, net of reserves. These leases typically have two- to three-year terms and are usually collateralized by a security interest in the underlying assets. Advertising Costs The Company expenses all advertising costs as... -

Page 33

... preferred stockholders' proportionate share of the equity of Cisco Systems, K.K. (Japan). At July 27, 2002, the Company owned all issued and outstanding common stock amounting to 92.4% of the voting rights. Each share of preferred stock is convertible into one share of common stock at any time at... -

Page 34

... Certain reclassifications have been made to prior year balances in order to conform to the current year presentation. 3. Business Combinations Purchase Combinations During the year ended July 27, 2002, the Company completed a number of purchase acquisitions which are summarized as follows (in... -

Page 35

...charges for fiscal 2001) as reported in the Consolidated Statements of Operations (in millions): Years Ended July 27, 2002 July 28, 2001 July 29, 2000 Reported as: Cost of sales Operating expenses Total $ 22 699 $ 22 365 $ 25 137 $ 721 $ 387 $ 162 Cisco Systems, Inc. 2002 Annual Report 33 -

Page 36

... charges of $1.2 billion and an additional excess inventory charge of $2.2 billion. The following discussion provides detailed information relating to the status of the restructuring liabilities and additional excess inventory reserve as of July 27, 2002. 34 Cisco Systems, Inc. 2002 Annual Report -

Page 37

... - 9 49 129 $ 187 Reserve balance as of July 28, 2001 Usage: Inventory scrapped Sale of inventory Inventory utilized Settlement of purchase commitments 1,677 (975) (64) (408) (173) (1,620) $ - 14 408 103 $ 525 Reserve balance as of July 27, 2002 $ 57 Cisco Systems, Inc. 2002 Annual Report 35 -

Page 38

... table presents supplemental cash flow information of significant noncash investing and financing activities (in millions): Years Ended July 27, 2002 July 28, 2001 July 29, 2000 Utilization of inventory financing to purchase inventory $ - $ 765 $ - 36 Cisco Systems, Inc. 2002 Annual Report -

Page 39

... Corporate equity securities Total Reported as: Short-term investments Investments Restricted investments Total $ 4,426 54 7,430 1,993 $13,903 $ 92 - 118 320 $530 $ (1) - (4) (784) $ 4,517 54 7,544 1,529 $ 13,644 $ 2,034 10,346 1,264 $ 13,644 $ (789) Cisco Systems, Inc. 2002 Annual Report... -

Page 40

... under construction, in the surrounding areas of San Jose, California; Boxborough, Massachusetts; Salem, New Hampshire; Richardson, Texas; and Research Triangle Park, North Carolina. Under these agreements, the Company could, at its option, purchase the land or both land and buildings. The Company... -

Page 41

...April 23, 2001, a number of purported shareholder derivative lawsuits were filed in the Superior Court of California, County of Santa Clara and in the Superior Court of California, County of San Mateo. There is a procedure in place for the coordination of such actions. Two purported derivative suits... -

Page 42

... investment commitment. The Company provides structured financing to certain qualified customers to be used for the purchase of equipment and other needs through its wholly-owned subsidiary, Cisco Systems Capital Corporation. At July 27, 2002, the outstanding loan commitments were approximately $948... -

Page 43

... the stock option plans of each acquired company. During fiscal 2002, a total of approximately two million shares of the Company's common stock has been reserved for issuance under the assumed plans and the related options are included in the following table. Cisco Systems, Inc. 2002 Annual Report... -

Page 44

... Accounting Standards No. 123, "Accounting for Stock-Based Compensation" ("SFAS 123"), to disclose pro forma information regarding option grants made to its employees based on specified valuation techniques that produce estimated compensation charges. 42 Cisco Systems, Inc. 2002 Annual Report -

Page 45

... average share price of $16.68. The Cisco share price at the end of fiscal 2002 was $11.82; the dilutive impact of in-the-money stock options would be 80 million shares or approximately 1% of the average shares outstanding in fiscal 2002. Employee 401(k) Plans The Company sponsors the Cisco Systems... -

Page 46

... deferred stock-based compensation Tax-exempt interest Tax credits Other, net Total 35.0% 1.8 (1.5) (4.9) 0.9 - 1.9 - (3.4) 0.3 30.1% (35.0)% (2.4) (1.8) (1.7) 30.3 20.9 8.0 (1.0) (2.5) 1.2 16.0% 35.0% 1.9 (1.9) (1.6) 7.6 0.5 - (1.8) (1.6) 0.5 38.6% 44 Cisco Systems, Inc. 2002 Annual Report -

Page 47

... ended July 31, 1999 and July 25, 1998 are under examination and the Internal Revenue Service has proposed certain adjustments. Management believes that adequate amounts have been reserved for any adjustments that may ultimately result from these examinations. Cisco Systems, Inc. 2002 Annual Report... -

Page 48

..., the Company has four reportable segments: the Americas; EMEA; Asia Pacific; and Japan. Summarized financial information by theater for fiscal 2002, 2001, and 2000, as taken from the internal management system previously discussed, is as follows (in millions): Years Ended July 27, 2002 July 28... -

Page 49

... of the Company's net sales. 13. Net Income (Loss) per Share The following table presents the calculation of basic and diluted net income (loss) per share (in millions, except per-share amounts): Years Ended July 27, 2002 July 28, 2001 July 29, 2000 Net income (loss) Weighted-average shares-basic... -

Page 50

... Company changed its method of accounting for goodwill in accordance with Statement of Financial Accounting Standards No. 142, "Goodwill and Other Intangible Assets." San Jose, California August 6, 2002, except for Note 14, as to which the date is August 19, 2002 48 Cisco Systems, Inc. 2002 Annual... -

Page 51

....24 $16.42 $13.91 $11.61 $ 68.62 $ 56.75 $ 38.25 $ 23.48 $ 49.81 $ 33.31 $ 13.62 $ 16.20 The Company has never paid cash dividends on its common stock and has no present plans to do so. There were 81,058 registered shareholders as of July 27, 2002. Cisco Systems, Inc. 2002 Annual Report 49 -

Page 52

...other financial information, contact: Investor Relations Cisco Systems, Inc. 170 West Tasman Drive San Jose, CA 95134-1706 (408) 227-CSCO (2726) You may also contact us by sending an e-mail to [email protected] or by visiting the Investor Relations section on the Company's Web site at www... -

Page 53

... Amsterdam, The Netherlands Americas Headquarters San Jose, California, USA Asia Pacific Headquarters Singapore Cisco Systems has offices in the following countries. Addresses, phone numbers, and fax numbers are listed at www.cisco.com/go/offices. Argentina • Australia • Austria • Belgium... -

Page 54

Corporate Headquarters Cisco Systems, Inc. 170 West Tasman Drive San Jose, CA 95134-1706 USA Tel: (408) 526-4000 (800) 553-NETS (6387) www.cisco.com Printed on recycled paper. SKU# 1028-AR-02 Lit# 956488