CarMax 2004 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2004 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2004

3

provides more than enough resources for our net capital

spending needs, and we have ready availability of attractively

priced debt financing through our inventory facility and real

estate financing relationships. We are now past the vast major-

ity of disruption and costs associated with separating from our

parent company. In fiscal 2005, we expect to incur another

$4 million in incremental stand-alone costs, largely related to

outsourcing our payroll systems, and the following year, we

expect to incur roughly another $3 million to $5 million as

we outsource our computer operations center. We expect this

to be the last major SG&A addition related to our separation.

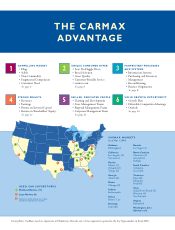

■Growth Program. Our growth plan calls for a ramp up

to a 15%–20% annual growth rate of new stores. Our focus for

the first 4 to 5 years of the program is adding satellite fill-in

stores in established markets and standard stores in new mid-

sized markets. These represent the lowest risk, highest early

return opportunities, which help offset the penalties of a growth

program buildup. At year-end, we had opened 15 new stores

plus one replacement store at our LAX location since resuming

growth. Seven of these stores are satellite fill-in stores while the

other eight are standard stores in new mid-sized markets.

This year was the first we’ve grown at a 20% pace, and we

intend to do so again in fiscal 2005 by opening five standard

superstores and five satellite superstores, including a standard

and a satellite store in the Los Angeles market. We do not

expect the L.A. stores to initially perform as strongly as our

regular openings due to a current lack of enough stores to

support TV advertising in L.A. The L.A. stores are intended

to lay the groundwork for an eventual rollout of the entire

market. A satellite opening in Richmond is a continuation of

our efforts to understand how densely we can store an older,

higher-market-share market. In 4 to 5 years, we hope to better

understand what our ultimate market share potential might

be, and therefore how many stores we may eventually be able

to build nationwide.

■Operational Goals. During fiscal 2005, we have three

major internal goals.

•Quality: First, we want to continue our efforts at contin-

uous quality improvement throughout our operating processes

and particularly our reconditioning process. I believe we have

the best and most consistent inspection, reconditioning, and

certification process in the auto industry — indeed, several

manufacturers have studied our process as the basis for their

own certification programs. But we know there are still errors to

eliminate and efficiencies to be gained. This past year, our sen-

ior operating team studied the quality improvement processes

and cultures of top auto manufacturers like Toyota and Nissan.

Although I believe we’re among the better specialty retailers in

process improvement and significantly ahead of anyone else in

auto retail, our visits to the Toyota and Nissan factories have

helped us understand how much more can be achieved. We are

also taking advantage of data provided by our new electronic

repair order system to improve the quality of our recondition-

ing process while reducing the cost and cycle time involved.

•Associate Development: To open the 10 stores planned

for 2005, we need to generate approximately 140 managers

from our existing base of approximately 700 store-level

managers across the sales, purchasing, service operations,

and business office teams and replace them with internal

promotions and outside hires. It also means identifying,

interviewing, selecting, hiring, and training more than

1,000 additional talented associates in the various operating

departments. To do this smoothly, open the new stores suc-

cessfully, and continue to improve operational execution in

our existing stores is an enormous task. This is, as they say,

Job #1 for CarMax management.

We also believe the broad diversity that we’ve been able

to achieve in both our overall associate teams and our man-

agement teams has given us a significant competitive advan-

tage compared to other auto retailers. We intend to build on

this advantage.

•Company Culture: The entrepreneurial culture of

service and quality that our associates have built as a team

over the last decade has been critical to our success. We’ve

also realized how much fun both we and our customers can

have when you remove all the negatives from the car-buying

process. Yet our own success and growth can become the

enemy if we’re not careful. We want to sustain an enthusiastic,

down-to-earth, non-hierarchical business culture that treats

every associate and every customer with the respect and per-

sonal attention they deserve. A culture where our stores and

store associates come first. They serve our customers, they

create the value in the company, and our job is to support

them and help make their jobs easier in every way we can.

Ultimately, all truly great service and retail companies create a

culture built on similar principles, and they prosper only as

long as they sustain it.

■Board of Directors Additions. This past year we wel-

comed Fully Clingman and Tom Stemberg to our board of

directors. Fully is the retired president of the H.E. Butt

Grocery Company, named one of the top three supermarket

chains in the nation by the Grocery Manufacturers of

America. Tom is the founder and executive chairman of

Staples, Inc. Together they add enormous depth in big-box

retail experience to our board. We are delighted to have their

expertise as we grow.

Austin Ligon

President and Chief Executive Officer

March 30, 2004