CarMax 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

CARMAX

2004

below. The cash reserves and excess receivables are generally 2%

to 4% of managed receivables. The special purpose entities and

the investors have no recourse to the company’s assets. The

company’s risk is limited to the retained interests on the

company’s consolidated balance sheets. The fair value of the

retained interests may fluctuate depending on the performance

of the securitized receivables.

The fair value of retained interests was $146.0 million as of

February 29, 2004, and $135.0 million as of February 28, 2003.

The retained interests had a weighted average life of 1.5 years as

of February 29, 2004, and 1.6 years as of February 28, 2003. As

defined in SFAS No. 140, the weighted average life in periods

(for example, months or years) of pre-payable assets is calculated

by multiplying the principal collections expected in each future

period by the number of periods until that future period,

summing those products, and dividing the sum by the initial

principal balance. The following is a detailed explanation of the

components of retained interests.

Interest-Only Strip Receivables. Interest-only strip

receivables represent the present value of residual cash flows the

company expects to receive over the life of the securitized

receivables. The value of these receivables is determined by

estimating the future cash flows using management’s

assumptions of key factors, such as finance charge income,

default rates, prepayment rates, and discount rates appropriate

for the type of asset and risk. The value of interest-only strip

receivables may be affected by external factors, such as changes

in the behavior patterns of customers, changes in the strength

of the economy, and developments in the interest rate markets;

therefore, actual performance may differ from these

assumptions. Management evaluates the performance of the

receivables relative to these assumptions on a regular basis. Any

financial impact resulting from a change in performance is

recognized in earnings in the period in which it occurs.

Restricted Cash. Restricted cash represents amounts on

deposit in various reserve accounts established for the benefit

of the securitization investors. The amounts on deposit in the

reserve accounts are used to pay various amounts, including

principal and interest to investors, in the event that the cash

generated by the securitized receivables in a given period is

insufficient to pay those amounts. In general, each of the

company’s securitizations requires that an amount equal to a

specified percentage of the initial receivables balance be

deposited in a reserve account on the closing date and that any

excess cash generated by the receivables be used to fund the

reserve account to the extent necessary to maintain the

required amount. If the amount on deposit in the reserve

account exceeds the required amount, an amount equal to that

excess is released through the special purpose entity to the

company. In the public securitizations, the amount required to

be on deposit in the reserve account must equal or exceed a

specified floor amount. The reserve account remains at the

floor amount until the investors are paid in full, at which time

the remaining reserve account balance is released through the

special purpose entity to the company. The amount required

to be maintained in the public securitization reserve accounts

may increase depending upon the performance of the

securitized receivables. The amount on deposit in the restricted

cash accounts was $34.8 million as of February 29, 2004, and

$33.3 million as of February 28, 2003.

Required Excess Receivables. The warehouse facility and

certain public securitizations require that the total value of the

securitized receivables exceed, by a specified amount, the

principal amount owed to the investors. The required excess

receivables balance represents this specified amount. Any cash

flows generated by the required excess receivables are used, if

needed, to make payments to the investors. The unpaid

principal balance related to the required excess receivables was

$28.8 million as of February 29, 2004, and $13.4 million as of

February 28, 2003.

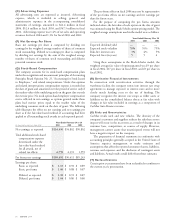

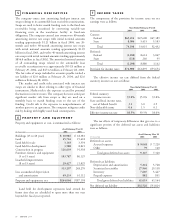

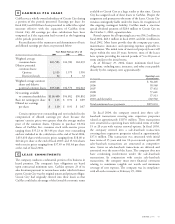

Key Assumptions Used in Measuring Retained

Interests and Sensitivity Analysis

The following table shows the key economic assumptions used

in measuring the fair value of the retained interests at February 29,

2004, and a sensitivity analysis showing the hypothetical effect

on the retained interests if there were unfavorable variations

from the assumptions used. Key economic assumptions at

February 29, 2004, are not materially different from

assumptions used to measure the fair value of retained interests

at the time of securitization. These sensitivities are hypothetical

and should be used with caution. In this table, the effect of a

variation in a particular assumption on the fair value of the

retained interests is calculated without changing any other

assumption; in actual circumstances, changes in one factor may

result in changes in another, which might magnify or counteract

the sensitivities.

Impact on Impact on

Fair Value of Fair Value of

Assumptions 10% Adverse 20% Adverse

(In millions)

Used Change Change

Prepayment rate 1.45%–1.55% $5.4 $10.5

Cumulative default rate 2.00%–2.50% $4.1 $ 8.1

Annual discount rate 12.0% $2.1 $ 4.2

Prepayment Rate. The company uses the Absolute

Prepayment Model or “ABS” to estimate prepayments. This

model assumes a rate of prepayment each month relative to the

original number of receivables in a pool of receivables. ABS

further assumes that all the receivables are the same size and

amortize at the same rate and that each receivable in each

month of its life will either be paid as scheduled or prepaid in

full. For example, in a pool of receivables originally containing

10,000 receivables, a 1% ABS rate means that 100 receivables

prepay each month.

Cumulative Default Rate. Cumulative default rate or

“static pool” net losses are calculated by dividing the total

projected future credit losses of a pool of receivables by the

original pool balance.