CarMax 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

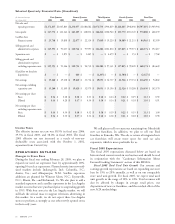

32

CARMAX

2004

BACKGROUND AND BASIS OF

PRESENTATION

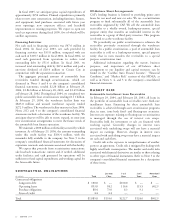

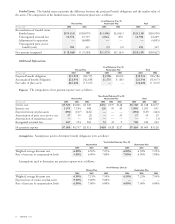

CarMax, Inc. (“CarMax” and “the company”), including its

wholly owned subsidiaries, is the leading specialty retailer of

used cars and light trucks in the United States. CarMax was

the first used vehicle retailer to offer a large selection of

quality used vehicles at low, “no-haggle” prices using a

customer-friendly sales process in an attractive, modern sales

facility. CarMax also sells new vehicles under various franchise

agreements. CarMax provides its customers with a full range

of related services, including the financing of vehicle

purchases through its own finance operation, CarMax Auto

Finance (“CAF”), and third-party lenders; the sale of

extended warranties; and vehicle repair service.

CarMax was formerly a subsidiary of Circuit City Stores,

Inc. (“Circuit City”). Prior to October 1, 2002, Circuit City

had two common stock series, the Circuit City Stores, Inc.—

Circuit City Group (“Circuit City Group”) common stock

and the Circuit City Stores, Inc.—CarMax Group (“CarMax

Group”) common stock, which was intended to track

separately the performance of the CarMax business. On

October 1, 2002, the CarMax business was separated from

Circuit City through a tax-free transaction in which each

share of CarMax Group common stock was exchanged for one

share of CarMax, Inc. common stock. In addition, each

holder of Circuit City Group common stock received a

distribution of a 0.313879 share of CarMax, Inc. common

stock for each Circuit City Group share. As a result of the

separation, all of the businesses, assets, and liabilities of the

CarMax Group are held in CarMax, Inc., an independent,

separately traded public company.

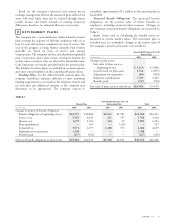

In conjunction with the separation, all outstanding

CarMax Group stock options and restricted stock were

replaced with CarMax, Inc. stock options and restricted

stock with the same terms and conditions, exercise prices,

and restrictions as the CarMax Group stock options and

restricted stock they replaced.

At the separation date, Circuit City and CarMax executed

a transition services agreement and a tax allocation agreement.

In the transition services agreement, Circuit City agreed to

provide to CarMax services including human resources,

payroll, benefits administration, tax services, computer center

support, and telecommunications. The agreement specified

initial service periods ranging from six to twenty-four

months, with varying renewal options. For fiscal 2005,

Circuit City will provide computer center support and

telecommunication services for CarMax pursuant to this

agreement. The tax allocation agreement provided that the

pre-separation taxes attributable to the business of each party

would be borne solely by that party.

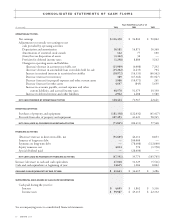

1

SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

(A) Principles of Consolidation

The consolidated financial statements include the accounts of

CarMax and its wholly owned subsidiaries. All significant

intercompany balances and transactions have been eliminated

in consolidation.

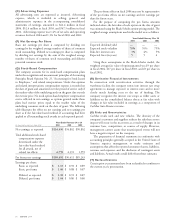

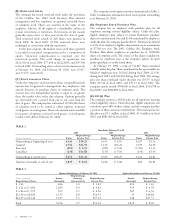

(B) Cash and Cash Equivalents

Cash equivalents of $48.9 million and $29.6 million at

February 29, 2004, and February 28, 2003, respectively,

consisted of highly liquid debt securities with original

maturities of three months or less. Included in cash equivalents

at February 29, 2004, and February 28, 2003, were restricted

cash deposits of $13.0 million and $11.5 million, respectively,

which were associated with certain insurance deductibles.

Additional restricted cash related to securitized auto loan

receivables at February 29, 2004, and February 28, 2003, were

$6.4 million and $2.4 million, respectively.

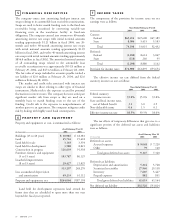

(C) Securitizations

The company uses a securitization program to fund

substantially all of the automobile loan receivables originated

by CAF. The company sells the automobile loan receivables to

a wholly owned, bankruptcy-remote, special purpose entity

that transfers an undivided interest in the receivables to a group

of third-party investors. This program is referred to as the

warehouse facility.

The company periodically uses public securitizations to

refinance the receivables previously securitized through the

warehouse facility. In a public securitization, a pool of

automobile loan receivables is sold to a bankruptcy-remote,

special purpose entity that in turn transfers the receivables to a

special purpose securitization trust.

The transfers of receivables are accounted for as sales in

accordance with Statement of Financial Accounting Standards

(“SFAS”) No. 140, “Accounting for Transfers and Servicing of

Financial Assets and Extinguishments of Liabilities.” The

company retains various interests in the automobile loan

receivables that it securitizes. The retained interests presented

on the company’s consolidated balance sheets include the

present value of the expected residual cash flows generated by

the securitized receivables, the restricted cash on deposit in

various reserve accounts, and an undivided ownership interest

in the receivables securitized through the warehouse facility and

certain public securitizations. Retained interests are carried at

fair value and changes in fair value are included in earnings. See

Notes 3 and 4 for additional discussion on securitizations.

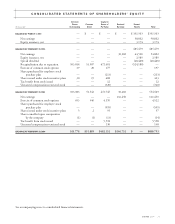

2

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS