CarMax 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

CARMAX

2004

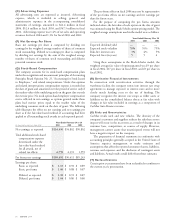

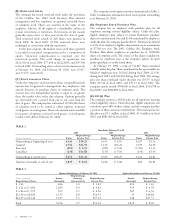

FINANCIAL DERIVATIVES

The company enters into amortizing fixed-pay interest rate

swaps relating to its automobile loan receivable securitizations.

Swaps are used to better match funding costs to the fixed-rate

receivables being securitized by converting variable-rate

financing costs in the warehouse facility to fixed-rate

obligations. The company entered into twenty-two 40-month

amortizing interest rate swaps with initial notional amounts

totaling approximately $1.21 billion in fiscal 2004, one 20-

month and twelve 40-month amortizing interest rate swaps

with initial notional amounts totaling approximately $1.05

billion in fiscal 2003, and twelve 40-month amortizing interest

rate swaps with initial notional amounts totaling approximately

$854.0 million in fiscal 2002. The amortized notional amount

of all outstanding swaps related to the automobile loan

receivable securitizations was approximately $551.8 million at

February 29, 2004, and $473.2 million at February 28, 2003.

The fair value of swaps included in accounts payable totaled a

net liability of $2.0 million at February 29, 2004, and $2.6

million at February 28, 2003.

The market and credit risks associated with interest rate

swaps are similar to those relating to other types of financial

instruments. Market risk is the exposure created by potential

fluctuations in interest rates. The company does not anticipate

significant market risk from swaps as they are used on a

monthly basis to match funding costs to the use of the

funding. Credit risk is the exposure to nonperformance of

another party to an agreement. The company mitigates credit

risk by dealing with highly rated bank counterparties.

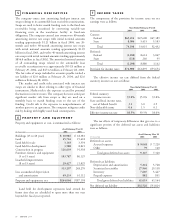

PROPERTY AND EQUIPMENT

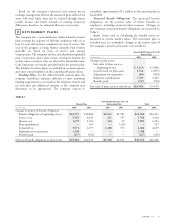

Property and equipment, at cost, is summarized as follows:

As of February 29 or 28

(In thousands)

2004 2003

Buildings (25 to 40 years) $30,985 $ 18,381

Land 25,716 19,418

Land held for sale 3,163 3,354

Land held for development 3,580 8,021

Construction in progress 116,639 91,938

Furniture, fixtures, and equipment

(5 to 15 years) 103,787 86,129

Leasehold improvements

(8 to 15 years) 29,427 21,029

313,297 248,270

Less accumulated depreciation

and amortization 69,233 61,112

Property and equipment, net $244,064 $187,158

Land held for development represents land owned for

future sites that are scheduled to open more than one year

beyond the fiscal year reported.

6

5

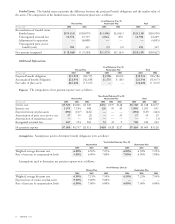

INCOME TAXES

The components of the provision for income taxes on net

earnings were as follows:

Years Ended February 29 or 28

(In thousands)

2004 2003 2002

Current:

Federal $65,212 $47,600 $47,389

State 8,986 5,415 5,103

Total 74,198 53,015 52,492

Deferred:

Federal (1,180) 8,614 3,067

State (118) 266 95

Total (1,298) 8,880 3,162

Provision for income taxes $72,900 $61,895 $55,654

The effective income tax rate differed from the federal

statutory income tax rate as follows:

Years Ended February 29 or 28

2004 2003 2002

Federal statutory

income tax rate 35.0% 35.0% 35.0%

State and local income taxes,

net of federal benefit 3.1 3.0 2.9

Non-deductible items 0.4 1.5 0.1

Effective income tax rate 38.5% 39.5% 38.0%

The tax effects of temporary differences that give rise to a

significant portion of the deferred tax assets and liabilities

were as follows:

As of February 29 or 28

(In thousands)

2004 2003

Deferred tax assets:

Accrued expenses $9,048 $ 7,220

Other 79 120

Total gross deferred tax assets 9,127 7,340

Deferred tax liabilities:

Depreciation and amortization 5,224 5,748

Securitized receivables 27,940 29,138

Inventory 7,607 5,447

Prepaid expenses 882 831

Total gross deferred tax liabilities 41,653 41,164

Net deferred tax liability $32,526 $33,824

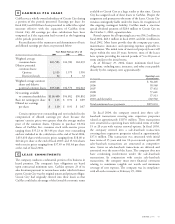

7