CarMax 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

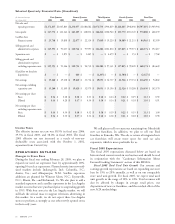

In fiscal 2005, we anticipate gross capital expenditures of

approximately $250 million. Planned expenditures primarily

relate to new store construction, including furniture, fixtures,

and equipment; land purchases associated with future year

store openings; new corporate offices; and leasehold

improvements to existing properties. We expect to open ten

used car superstores during fiscal 2005, five of which will be

satellite superstores.

Financing Activities

Net cash used in financing activities was $47.6 million in

fiscal 2004. In fiscal year 2003, net cash provided by

financing activities was $39.8 million, compared with net

cash used of $105.7 million in fiscal 2002. In fiscal 2004, we

used cash generated from operations to reduce total

outstanding debt by $51.6 million. In fiscal 2003, we

increased total outstanding debt by $67.6 million and paid a

one-time dividend of $28.4 million to Circuit City in

conjunction with the separation transaction.

The aggregate principal amount of automobile loan

receivables funded through securitizations, which are

discussed in Notes 3 and 4 to the company’s consolidated

financial statements, totaled $2.20 billion at February 29,

2004, $1.86 billion at February 28, 2003, and $1.49 billion

at February 28, 2002. During fiscal 2004, we completed two

public automobile loan securitizations totaling $1.11 billion.

At February 29, 2004, the warehouse facility limit was

$825.0 million and unused warehouse capacity totaled

$272.5 million. The warehouse facility matures in June 2004.

Notes 2(C) and 4 to the company’s consolidated financial

statements include a discussion of the warehouse facility. We

anticipate that we will be able to renew, expand, or enter into

new securitization arrangements to meet the future needs of

the automobile loan finance operation.

We maintain a $300 million credit facility secured by vehicle

inventory. As of February 29, 2004, the amount outstanding

under this credit facility was $104.4 million, with the

remainder fully available to the company. See Note 9 to the

company’s consolidated financial statements for discussion of

expiration, renewals, and covenants associated with this facility.

We expect that proceeds from securitization transactions;

sale-leaseback transactions; current and, if needed, additional

credit facilities; and cash generated by operations will be

sufficient to fund capital expenditures and working capital for

the foreseeable future.

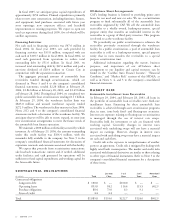

Off-Balance Sheet Arrangements

CAF’s lending business is limited to providing prime auto

loans for our used and new car sales. We use a securitization

program to fund substantially all of the automobile loan

receivables originated by CAF. We sell the automobile loan

receivables to a wholly owned, bankruptcy-remote, special

purpose entity that transfers an undivided interest in the

receivables to a group of third-party investors. This program

is referred to as the warehouse facility.

We periodically use public securitizations to refinance the

receivables previously securitized through the warehouse

facility. In a public securitization, a pool of automobile loan

receivables is sold to a bankruptcy-remote, special purpose

entity that in turn transfers the receivables to a special

purpose securitization trust.

Additional information regarding the nature, business

purposes, and importance of our off-balance sheet

arrangement to our liquidity and capital resources can be

found in the “CarMax Auto Finance Income,” “Financial

Condition,” and “Market Risk” sections of this MD&A, as

well as in Notes 3, 4, and 5 to the company’s consolidated

financial statements.

MARKET RISK

Automobile Installment Loan Receivables

At February 29, 2004, and February 28, 2003, all loans in

the portfolio of automobile loan receivables were fixed-rate

installment loans. Financing for these automobile loan

receivables is achieved through asset securitization programs

that, in turn, issue both fixed- and floating-rate securities.

Interest rate exposure relating to floating-rate securitizations

is managed through the use of interest rate swaps.

Receivables held for investment or sale are financed with

working capital. Generally, changes in interest rates

associated with underlying swaps will not have a material

impact on earnings. However, changes in interest rates

associated with underlying swaps may have a material impact

on cash and cash flows.

Credit risk is the exposure to nonperformance of another

party to an agreement. Credit risk is mitigated by dealing with

highly rated bank counterparties. The market and credit risks

associated with financial derivatives are similar to those relating

to other types of financial instruments. Refer to Note 5 to the

company’s consolidated financial statements for a description

of these items.

26

CARMAX

2004

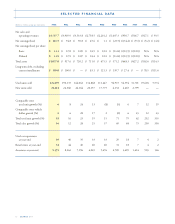

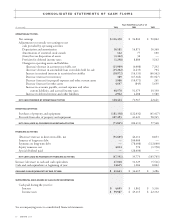

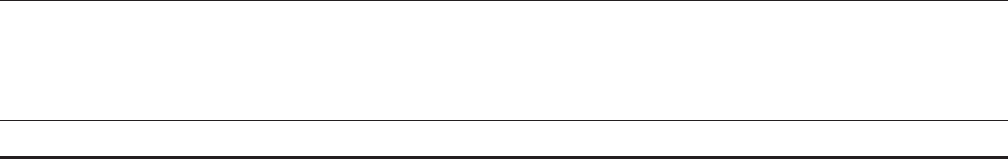

CONTRACTUAL OBLIGATIONS

Less than 1 to 3 3 to 5 More than 5

(In millions)

Total 1 Year Years Years Years

Contractual obligations:

Long-term debt $ 100.0 $ — $100.0 $ — $ —

Operating leases 893.0 58.2 116.4 115.5 602.9

Purchase obligations 88.4 73.0 6.3 9.1 —

Lines of credit 4.4 4.4 — — —

Total $1,085.8 $135.6 $222.7 $124.6 $602.9