CarMax 2004 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2004 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CARMAX

2004 25

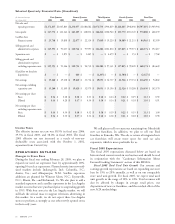

Fiscal 2005 Comparable Store Used Unit Growth. We

expect fiscal 2005 comparable store used unit growth in the

range of 3% to 7%. Fiscal 2005 comparable store growth is

still challenged, we believe, by the exceptionally strong sales

base we established over the past three years, especially

following the high levels of customer traffic stimulated by the

widespread introduction of 0% financing after the events of

September 11, 2001.

Fiscal 2005 Earnings Per Share. We expect fiscal 2005

pretax earnings growth of 12% to 17%. We anticipate that our

effective tax rate will increase from 38.5% to 39.0% as we

expand our store base into states with higher tax rates.

Consequently our earnings per share growth will be slightly

lower at 10% to 15%, in the range of $1.21 to $1.26.

We expect our gross margin to be favorably impacted by the

growing mix of used car sales, as we add used car superstores

and divest new car franchises. In addition, we believe a

refinement of our ACR methodology will provide an

incremental benefit to gross margin.

In fiscal 2005, we expect CAF’s gain as a percent of loans

sold to be slightly below the midpoint of our 3.5% to 4.5%

normalized range. Therefore, we expect CAF income will be

relatively flat with fiscal 2004, despite the anticipated increase

in loan volume. Our fiscal 2005 pretax earnings growth would

be expected in the range of 19% to 24% if our CAF spread

remained at the 4.7% that it was in fiscal 2004.

In fiscal 2005, we will still be experiencing the growth

penalty of opening new stores, which have higher SG&A rates,

while none of our newer stores will have reached mature levels

of revenue. We believe our corporate overhead expenditures as

a percent of sales will remain flat compared with fiscal 2004,

even though we expect to absorb approximately $4 million in

additional expenses related to being a stand-alone company.

Among these expenses are costs related to outsourcing our

payroll systems, which previously had been supplied by Circuit

City. We also expect another $3 million to $5 million of

incremental stand-alone costs in fiscal 2006 when we outsource

our data center, which is now housed at Circuit City. This

should be the last major incremental stand-alone cost increase

we will incur.

Longer-Term Expectations

The longer-term expectations discussed below are based on

historical and current trends in our business and should be read

in conjunction with the “Cautionary Information About

Forward-Looking Statements” section of this MD&A.

We expect used unit comparable store sales increases in the

range of 4% to 8% over the next several years, reflecting the

multi-year ramp in sales of newly opened stores as they mature.

Once CAF income reflects comparative spreads in our

normalized range, we expect the combination of unit growth

and expense leverage to deliver average annual earnings per

share growth of approximately 20%.

RECENT ACCOUNTING

PRONOUNCEMENTS

For a discussion of recent accounting pronouncements

applicable to the company, see Note 14 to the company’s

consolidated financial statements.

FINANCIAL CONDITION

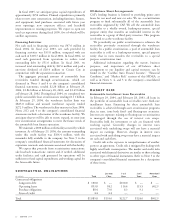

Operating Activities

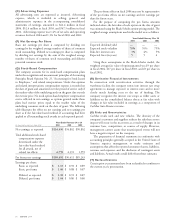

We generated net cash from operating activities of $148.5

million in fiscal 2004, $72.0 million in fiscal 2003, and $42.6

million in fiscal 2002. The fiscal 2004 improvement primarily

resulted from the increase in net earnings and a slight decrease

in inventory, despite adding nine used car superstores during

the year. The decrease in inventory in fiscal 2004 reflects the

combined effects of a higher-than-normal inventory balance at

the end of fiscal 2003 resulting from weather-impeded sales in

February 2003 and the disposal of four new car franchises

during the current fiscal year. The fiscal 2003 improvement

primarily resulted from an increase in net earnings and an

increase in accounts payable and accrued expenses associated

with the separation from Circuit City. Prior to fiscal 2003,

certain liabilities such as the workers’ compensation liability

were recorded through the debt from our former parent and

therefore reflected as financing activities.

Investing Activities

Net cash used in investing activities was $73.8 million in fiscal

2004 and $80.4 million in fiscal 2003. Net cash provided by

investing activities was $57.5 million in fiscal 2002. Capital

expenditures were $181.3 million in fiscal 2004, $122.0

million in fiscal 2003, and $41.4 million in fiscal 2002. The

increase in capital expenditures reflects the increase in our store

base associated with the resumption of our growth plan.

Additionally, some of the fiscal 2004 increase is associated with

the initial expenditures associated with our future corporate

office site in Richmond, Va.

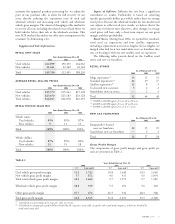

Capital expenditures are funded through sale-leaseback

transactions, short- and long-term debt, and internally

generated funds. Net proceeds from sales of property and

equipment totaled $107.5 million in fiscal 2004, $41.6 million

in fiscal 2003, and $99.0 million in fiscal 2002. The majority

of the sale proceeds relate to sale-leaseback transactions. In

fiscal 2004, the company entered into sale-leaseback

transactions involving nine properties valued at approximately

$107.0 million. In fiscal 2003, we entered into a sale leaseback

transaction involving three superstore properties valued at

approximately $37.6 million and in fiscal 2002 we entered into

a sale leaseback transaction involving nine superstore properties

valued at approximately $102.4 million. These transactions

were structured as operating leases with initial terms of either

15 or 20 years with various renewal options. At February 29,

2004, we owned a total of four CarMax superstores.