CarMax 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

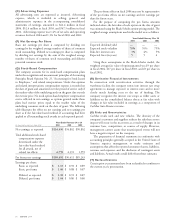

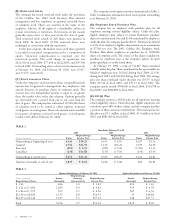

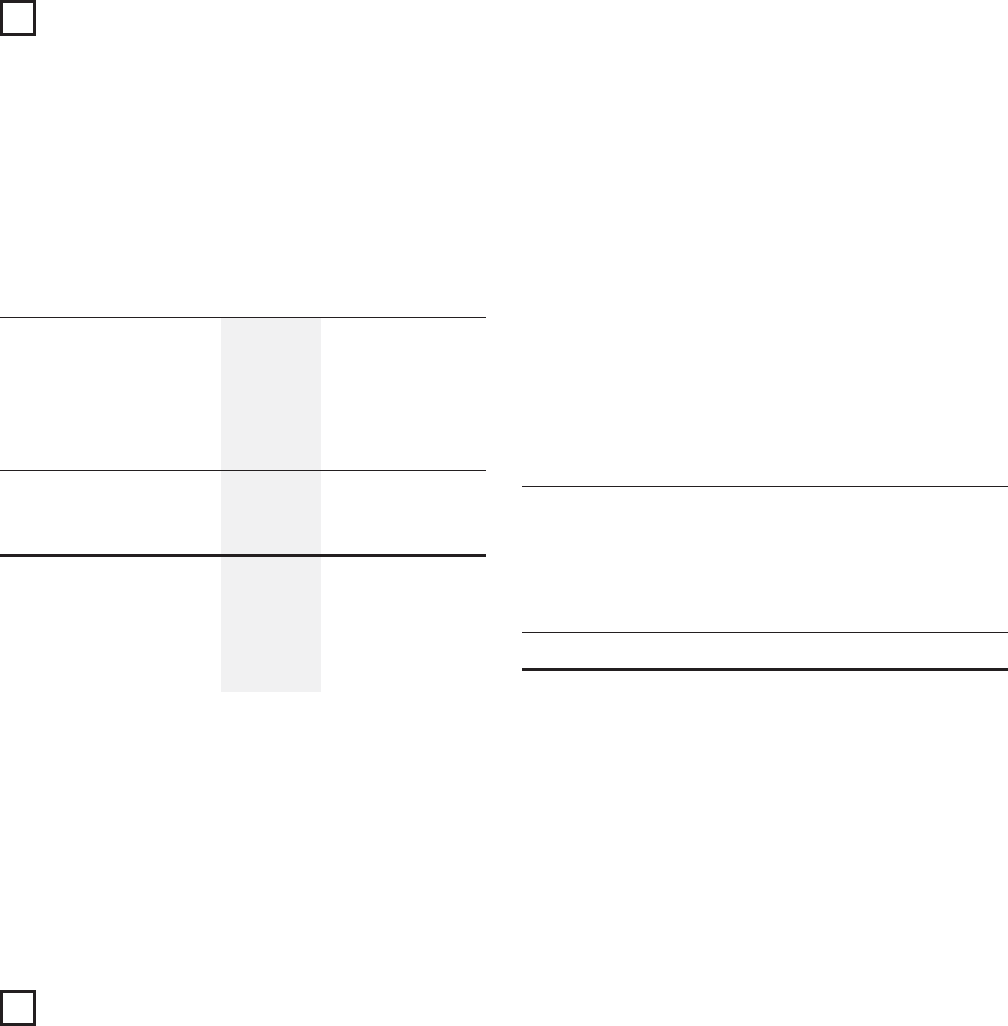

EARNINGS PER SHARE

CarMax was a wholly owned subsidiary of Circuit City during

a portion of the periods presented. Earnings per share for

fiscal 2003 and 2002 have been presented to reflect the capital

structure effective with the separation of CarMax from

Circuit City. All earnings per share calculations have been

computed as if the separation had occurred at the beginning

of the periods presented.

Reconciliations of the numerator and denominator of basic

and diluted earnings per share are presented below:

Years Ended February 29 or 28

(In thousands except per share data)

2004 2003 2002

Weighted average

common shares 103,503 102,983 102,039

Dilutive potential

common shares:

Options 2,113 1,579 1,950

Restricted stock 12 833

Weighted average common

shares and dilutive

potential common shares 105,628 104,570 104,022

Net earnings available

to common shareholders $116,450 $94,802 $90,802

Basic net earnings per share $1.13 $ 0.92 $ 0.89

Diluted net earnings

per share $1.10 $ 0.91 $ 0.87

Certain options were outstanding and not included in the

computation of diluted earnings per share because the

options’ exercise prices were greater than the average market

price of the common shares. Options to purchase 18,364

shares of CarMax, Inc. common stock with exercise prices

ranging from $35.23 to $43.44 per share were outstanding

and not included in the calculation at the end of fiscal 2004;

1,053,610 shares with exercise prices ranging from $18.60 to

$43.44 per share at the end of fiscal 2003; and 15,364 shares

with exercise prices ranging from $37.49 to $43.44 per share

at the end of fiscal 2002.

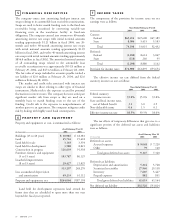

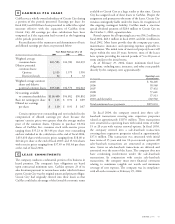

LEASE COMMITMENTS

The company conducts a substantial portion of its business in

leased premises. The company’s lease obligations are based

upon contractual minimum rates. CarMax operates 23 of its

sales locations pursuant to various leases under which its former

parent Circuit City was the original tenant and primary obligor.

Circuit City had originally entered into these leases so that

CarMax could take advantage of the favorable economic terms

12

11

available to Circuit City as a large retailer at that time. Circuit

City has assigned each of these leases to CarMax. Despite the

assignment and pursuant to the terms of the leases, Circuit City

remains contingently liable under the leases. In recognition of

this ongoing contingent liability, CarMax made a one-time

special dividend payment of $28.4 million to Circuit City on

the October 1, 2002, separation date.

Rental expense for all operating leases was $54.2 million in

fiscal 2004, $48.1 million in fiscal 2003, and $41.4 million in

fiscal 2002. Most leases provide that the company pay taxes,

maintenance, insurance, and operating expenses applicable to

the premises. The initial term of most real property leases will

expire within the next 20 years; however, most of the leases

have options providing for renewal periods of 5 to 20 years at

terms similar to the initial terms.

As of February 29, 2004, future minimum fixed lease

obligations, excluding taxes, insurance, and other costs payable

directly by the company, were approximately:

Operating Lease

(In thousands)

Commitments

2005 $ 58,205

2006 58,940

2007 57,432

2008 57,641

2009 57,913

2010 and thereafter 602,902

Total minimum lease payments $893,033

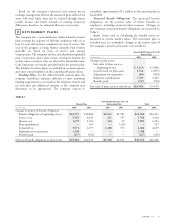

In fiscal 2004, the company entered into three sale-

leaseback transactions covering nine superstore properties

valued at approximately $107.0 million. These transactions

were structured as operating leases with initial terms of either

15 or 20 years with various renewal options. In fiscal 2003,

the company entered into a sale-leaseback transaction

covering three superstore properties valued at approximately

$37.6 million. This transaction was structured with initial

lease terms of 15 years and two 10-year renewal options. All

sales-leaseback transactions are structured at competitive

rates. Gains on sale-leaseback transactions are deferred and

amortized over the term of the leases. The company does not

have continuing involvement under the sale-leaseback

transactions. In conjunction with certain sale-leaseback

transactions, the company must meet financial covenants

relating to minimum tangible net worth and minimum

coverage of rent expense. The company was in compliance

with all such covenants at February 29, 2004.

CARMAX

2004 43