CarMax 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX

2004 39

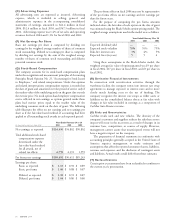

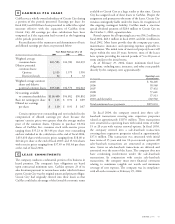

Based on the company’s historical and current pretax

earnings, management believes the amount of gross deferred tax

assets will more likely than not be realized through future

taxable income and future reversals of existing temporary

differences; therefore, no valuation allowance is necessary.

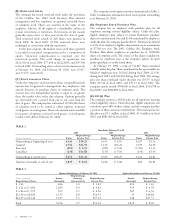

RETIREMENT PLANS

The company has a noncontributory defined benefit pension

plan covering the majority of full-time employees who are at

least 21 years old and have completed one year of service. The

cost of the program is being funded currently. Plan benefits

generally are based on years of service and average

compensation. The company also has an unfunded nonqualified

plan (“restoration plan”) that restores retirement benefits for

certain senior executives who are affected by Internal Revenue

Code limitations on benefits provided under the pension plan.

The liabilities for these plans are included in accrued expenses

and other current liabilities in the consolidated balance sheets.

Funding Policy. For the defined benefit pension plan, the

company contributes amounts sufficient to meet minimum

funding requirements as set forth in the employee benefit and

tax laws plus any additional amounts as the company may

determine to be appropriate. The company expects to

8

contribute approximately $0.2 million to the pension plan in

fiscal 2005.

Projected Benefit Obligations. The projected benefit

obligations are the present value of future benefits to

employees, including assumed salary increases. Changes in

the company’s projected benefit obligations are presented in

Table 1.

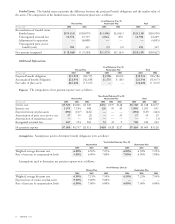

Assets. Assets used in calculating the funded status are

measured at current market values. The restoration plan is

excluded since it is unfunded. Changes in the market value of

the company’s pension plan assets were as follows:

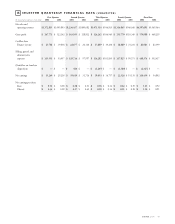

Years Ended February 29 or 28

Pension Plan

(In thousands)

2004 2003

Change in plan assets:

Fair value of plan assets at

beginning of year $5,676 $ 5,008

Actual return on plan assets 2,564 (1,095)

Adjustment for separation 606 (478)

Employer contributions 7,785 2,343

Benefits paid (227) (102)

Fair value of plan assets at end of year $16,404 $ 5,676

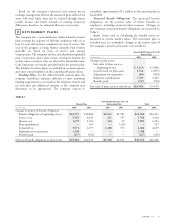

TABLE 1

Years Ended February 29 or 28

Pension Plan Restoration Plan Total

(In thousands)

2004 2003 2004 2003 2004 2003

Change in projected benefit obligation:

Benefit obligation at beginning of year $24,555 $14,868 $2,031 $1,583 $26,586 $16,451

Service cost 5,529 4,021 231 197 5,760 4,218

Interest cost 1,679 1,104 126 99 1,805 1,203

Plan amendments —367 —(220) —147

Actuarial loss 3,074 4,297 1,208 372 4,282 4,669

Adjustment for separation 1,308 ———1,308 —

Benefits paid (227) (102) ——(227) (102)

Projected benefit obligation at end of year $35,918 $24,555 $3,596 $2,031 $39,514 $26,586