CarMax 2004 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2004 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX

2004 21

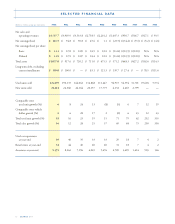

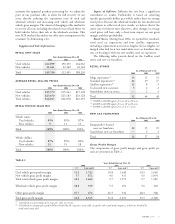

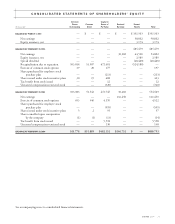

TABLE 2

Years Ended February 29 or 28

2004 2003 2002

%

(1)

$ per unit

(2)

%

(1)

$ per unit

(2)

%

(1)

$ per unit

(2)

Used vehicle gross profit margin 11.3 1,742 10.8 1,648 10.9 1,660

New vehicle gross profit margin 3.7 872 4.0 931 4.5 1,054

Total retail vehicle gross profit margin 10.3 1,666 9.7 1,572 9.7 1,583

Wholesale vehicle gross profit margin 10.4 359 5.5 192 5.6 202

Other gross profit margin 67.7 472 66.5 534 68.3 548

Total gross profit margin 12.4 2,323 11.8 2,201 11.9 2,228

(1) Calculated as a percentage of its respective sales or revenue.

(2) Calculated as category gross profit dollars divided by the respective units sold, except the other and total categories, which are divided by

total retail units sold.

customer the appraisal purchase processing fee, we adjust the

price of our purchase offer to allow for full recovery of our

costs, thereby reducing the acquisition costs of used and

wholesale vehicles and increasing used vehicle and wholesale

vehicle gross margins. The intent of changing to this method is

to recover all costs, including the related costs of land where we

hold vehicles before their sale at the wholesale auctions. This

new ACR method also makes our offer more transparent to the

consumer by eliminating a fee.

Supplemental Sales Information.

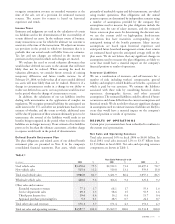

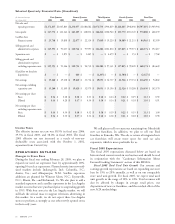

RETAIL UNIT SALES

Years Ended February 29 or 28

2004 2003 2002

Used vehicles 224,099 190,135 164,062

New vehicles 21,641 22,360 24,164

Total 245,740 212,495 188,226

AVERAGE RETAIL SELLING PRICES

Years Ended February 29 or 28

2004 2003 2002

Used vehicles $15,379 $15,243 $15,128

New vehicles $23,650 $23,183 $23,128

Total vehicles $16,107 $16,078 $16,155

RETAIL VEHICLE SALES MIX

Years Ended February 29 or 28

2004 2003 2002

Vehicle units:

Used vehicles 91% 89% 87%

New vehicles 911 13

Total 100% 100% 100%

Vehicle dollars:

Used vehicles 87% 85% 82%

New vehicles 13 15 18

Total 100% 100% 100%

Impact of Inflation. Inflation has not been a significant

contributor to results. Profitability is based on achieving

specific gross profit dollars per vehicle rather than on average

retail prices. Because the wholesale market for late-model used

cars adjusts to reflect retail price trends, we believe that if the

stores meet inventory turn objectives, then changes in average

retail prices will have only a short-term impact on our gross

margin and thus profitability.

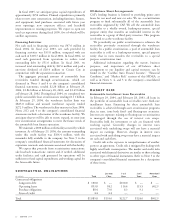

Retail Stores. During fiscal 2004, we opened five standard-

sized used car superstores and four satellite superstores,

including a replacement store in Los Angeles. In Los Angeles, we

merged what had been two stand-alone new car franchises into

one, co-locating it with our new satellite used car superstore.

The following tables provide detail on the CarMax retail

stores and new car franchises:

RETAIL STORES

As of February 29 or 28

2004 2003 2002

Mega superstores(1) 13 13 13

Standard superstores(2) 24 19 17

Satellite superstores(3) 12 85

Co-located new car stores 322

Stand-alone new car stores —23

Total 52 44 40

(1) 70,000 to 95,000 square feet on 20 to 35 acres.

(2) 40,000 to 60,000 square feet on 10 to 25 acres.

(3) 10,000 to 20,000 square feet on 4 to 7 acres.

NEW CAR FRANCHISES

As of February 29 or 28

2004 2003 2002

Integrated/co-located

new car franchises 12 15 15

Stand-alone new car franchises —23

Total 12 17 18

Gross Profit Margin

The components of gross profit margin and gross profit per

unit are presented in Table 2.