CarMax 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX

2004 37

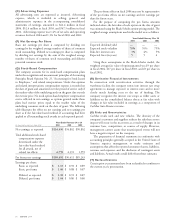

Continuing Involvement with Securitized Receivables

The company continues to manage the automobile loan

receivables that it securitizes. The company receives servicing

fees of approximately 1% of the outstanding principal balance

of the securitized receivables. The servicing fees specified in the

securitization agreements adequately compensate the company

for servicing the securitized receivables. Accordingly, no

servicing asset or liability has been recorded. The company is at

risk for the retained interests in the securitized receivables. If the

securitized receivables do not perform as originally projected,

the value of the retained interests would be impacted. The

assumptions used to value the retained interests, as well as a

sensitivity analysis, are detailed in the “Key Assumptions Used

in Measuring Retained Interests and Sensitivity Analysis” section

of this footnote. Supplemental information about the managed

receivables is shown in the following tables:

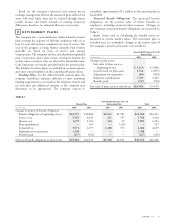

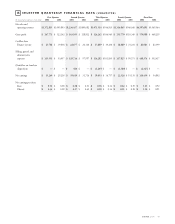

As of February 29 or 28

(In millions)

2004 2003 2002

Loans securitized $2,200.4 $1,859.1 $1,489.4

Loans held for sale

or investment 48.2 19.6 13.9

Ending managed receivables $2,248.6 $1,878.7 $1,503.3

Accounts 31+ days past due $31.4 $ 27.6 $ 22.3

Past due accounts as a

percentage of ending

managed receivables 1.40% 1.47% 1.48%

Years Ended February 29 or 28

(In millions)

2004 2003 2002

Average managed

receivables $2,099.4 $1,701.0 $1,393.7

Credit losses on managed

receivables $21.1 $ 17.5 $ 12.9

Credit losses as a

percentage of average

managed receivables 1.01% 1.03% 0.93%

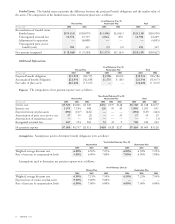

Selected Cash Flows from Securitized Receivables

The table below summarizes certain cash flows received from

and paid to the automobile loan securitizations:

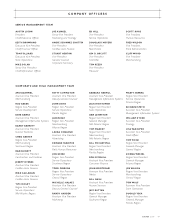

Years Ended February 29 or 28

(In millions)

2004 2003 2002

•Proceeds from new

securitizations $1,185.5 $1,018.7 $755.7

•Proceeds from collections

reinvested in revolving

period securitizations $514.9 $ 468.9 $452.3

•Servicing fees received $21.5 $ 17.0 $ 13.8

•Other cash flows received

from retained interests:

Interest-only strip receivables $74.1 $ 65.4 $ 48.2

Cash reserve releases, net $16.6 $ 25.3 $ 15.8

Proceeds from New Securitizations. Proceeds from new

securitizations represent receivables newly securitized through

the warehouse facility during the period. Receivables initially

securitized through the warehouse facility that are periodically

refinanced in public securitizations are not considered new

securitizations for this table.

Proceeds from Collections. Proceeds from collections

reinvested in revolving period securitizations represent

principal amounts collected on receivables securitized through

the warehouse facility, which are used to fund new originations.

Servicing Fees. Servicing fees received represent cash fees

paid to the company to service the securitized receivables.

Other Cash Flows Received from Retained Interests. Other

cash flows received from retained interests represent cash

received by the company from securitized receivables other

than servicing fees. It includes cash collected on interest-only

strip receivables and amounts released to the company from

restricted cash accounts.

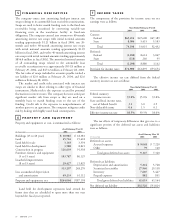

Financial Covenants and Performance Triggers

Certain securitization agreements include various financial

covenants and performance triggers, while other securitization

agreements, such as public securitizations with a senior-

subordinated structure, do not include financial covenants or

performance triggers. For those agreements with financial

covenants and performance triggers, the company must meet

financial covenants relating to minimum tangible net worth,

maximum total liabilities to tangible net worth ratio, minimum

tangible net worth to managed assets ratio, minimum current

ratio, minimum cash balance or borrowing capacity, and

minimum fixed charge coverage ratio. Certain securitized

receivables must meet performance tests relating to portfolio

yield, default rates, and delinquency rates. If these financial

covenants and/or performance tests are not met, in addition to

other consequences, the company may be unable to continue to

securitize receivables through the warehouse facility or it may be

terminated as servicer under the securitizations. At February 29,

2004, the company was in compliance with these financial

covenants, and the securitized receivables were in compliance

with these performance triggers.