CarMax 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX

2004 41

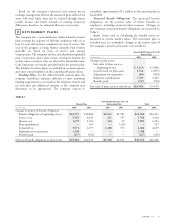

To determine the expected long-term rate of return on

pension plan assets, the company considers the current and

expected asset allocations, as well as historical and expected

returns on various categories of plan assets. The company

applies the expected rate of return to a market-related value of

assets, which reduces the underlying variability in assets to

which the expected return is applied.

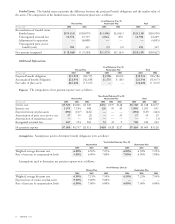

Asset Allocation Strategy. The company’s pension plan

assets are held in trust. The asset allocation was as follows:

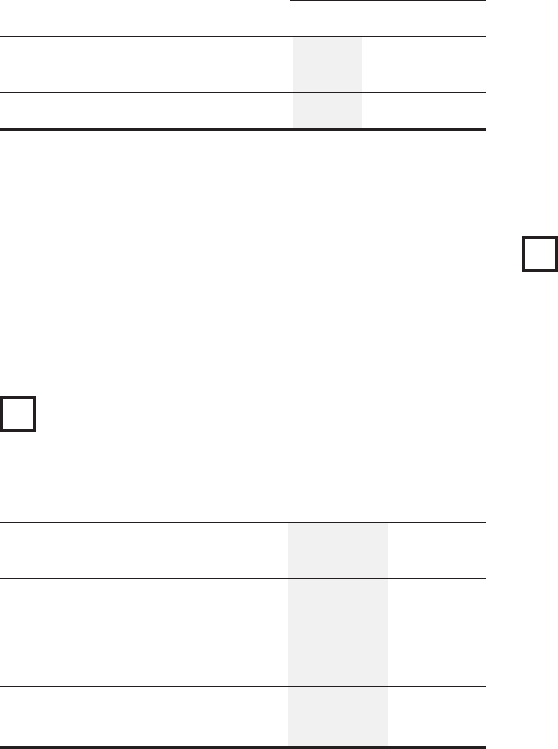

As of February 29 or 28

2004 2003

Ta rget Actual Actual

Allocation Allocation Allocation

Equity securities 80% 80% 79%

Fixed income securities 20 20 21

Total 100% 100% 100%

Plan fiduciaries set investment policies and strategies for the

pension plan. Long-term strategic investment objectives

include preserving the funded status of the trust and balancing

risk and return. The plan fiduciaries oversee the investment

allocation process, which includes selecting investment

managers, setting long-term strategic targets, and monitoring

asset allocations. Target allocation ranges are guidelines, not

limitations, and occasionally plan fiduciaries will approve

allocations above or below a target range.

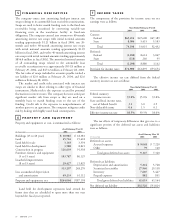

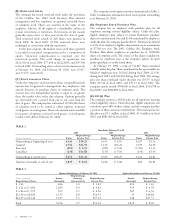

DEBT

Total debt is summarized as follows:

As of February 29 or 28

(In thousands)

2004 2003

Term loan $100,000 $100,000

Revolving loan 4,446 56,051

Total debt 104,446 156,051

Less current installments of

long-term debt ——

Less short-term debt 4,446 56,051

Total long-term debt, excluding

current installments $100,000 $100,000

In May 2002, the company entered into a $200 million

credit agreement secured by vehicle inventory. During the

fourth quarter of fiscal 2003, the credit agreement was

increased from $200 million to $300 million. The credit

agreement includes a $200 million revolving loan commitment

9

and a $100 million term loan. Principal is due in full at

maturity with interest payable monthly at a LIBOR-based rate.

The credit agreement is scheduled to terminate on May 17,

2005. The termination date of the agreement will be

automatically extended one year each May 17 unless either

CarMax or either lender elects, prior to the extension date, not

to extend the agreement. As of February 29, 2004, the amount

outstanding under this credit agreement was $104.4 million.

Under this agreement, the company must meet financial

covenants relating to minimum current ratio, maximum total

liabilities to tangible net worth ratio, and minimum fixed

charge coverage ratio. The company was in compliance with all

such covenants at February 29, 2004.

The weighted average interest rate on the outstanding short-

term debt was 3.5% during fiscal 2004, 3.2% during fiscal

2003, and 4.4% during fiscal 2002.

The company capitalizes interest in connection with the

construction of certain facilities. Capitalized interest totaled

$2.5 million in fiscal 2004, $1.0 million in fiscal 2003, and

$0.5 million in fiscal 2002.

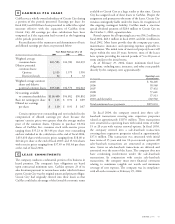

COMMON STOCK AND STOCK-BASED

INCENTIVE PLANS

(A) Shareholder Rights Plan

In conjunction with the company’s shareholder rights plan,

shareholders received preferred stock purchase rights as a

dividend at the rate of one right for each share of CarMax, Inc.

common stock owned. The rights are exercisable only upon the

attainment of, or the commencement of a tender offer to attain,

a 15% ownership interest in the company by a person or group.

When exercisable, each right would entitle the holder to buy

one one-thousandth of a share of Cumulative Participating

Preferred Stock, Series A, $20 par value, at an exercise price of

$140 per share, subject to adjustment. A total of 120,000

shares of such preferred stock, which have preferential dividend

and liquidation rights, have been authorized and designated.

No such shares are outstanding. In the event that an acquiring

person or group acquires the specified ownership percentage of

CarMax, Inc. common stock (except pursuant to a cash tender

offer for all outstanding shares determined to be fair by the

board of directors) or engages in certain transactions with the

company after the rights become exercisable, each right will be

converted into a right to purchase, for half the current market

price at that time, shares of CarMax, Inc. common stock valued

at two times the exercise price. The company also has an

additional 19,880,000 shares of undesignated preferred stock

authorized of which no shares are outstanding.

10