CarMax 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The following Management’s Discussion and Analysis

(“MD&A”) is intended to help the reader understand

CarMax, Inc. MD&A is presented in nine sections: Business

Overview; Critical Accounting Policies; Results of Operations;

Operations Outlook; Recent Accounting Pronouncements;

Financial Condition; Contractual Obligations; Market Risk;

and Cautionary Information About Forward-Looking

Statements. MD&A is provided as a supplement to, and

should be read in conjunction with, our consolidated financial

statements and the accompanying notes contained elsewhere

in this annual report.

In MD&A, “we,” “our,” “us,” “CarMax,” and “the

company” refer to CarMax, Inc. and its wholly owned

subsidiaries, unless the context requires otherwise. Amounts

and percents in tables may not total due to rounding.

BUSINESS OVERVIEW

General

CarMax was formerly a subsidiary of Circuit City Stores, Inc.

(“Circuit City”). On October 1, 2002, the CarMax business was

separated from Circuit City through a tax-free transaction and

became an independent, separately traded public company. We

pioneered the used car superstore concept, opening our first store

in 1993. Over the next six years, we opened an additional 32

used car superstores before suspending new store development to

focus on improving profitability. After a period of concept

refinement and execution improvement, we resumed used car

superstore growth in fiscal 2002, adding two stores late in the

fiscal year, five stores in fiscal 2003, and nine stores in fiscal 2004.

At the end of fiscal 2004, we had 49 used car superstores in 23

markets, including 8 large markets and 15 mid-sized markets.

CarMax is the nation’s leading specialty retailer of used

vehicles. The CarMax consumer offer is unique in the auto

retailing marketplace. It gives consumers a way to shop for cars

the same way they shop for items at other “big-box” retailers.

Our consumer offer is structured around four core equities,

including low, no-haggle prices; a broad selection; high

quality; and customer-friendly service. We generate revenues,

income, and cash flows by retailing used and new vehicles and

associated items including vehicle financing, extended

warranties, and vehicle repair service. In addition, vehicles

purchased through our appraisal process that do not meet our

retail standards are wholesaled at on-site auctions.

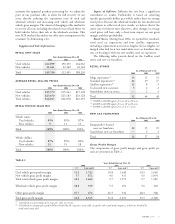

Sales of new vehicles represented a decreasing percentage of

our total revenues over the last three years as we divested new

car franchises and added used car superstores. While further

franchise disposals are planned, we expect to keep a small

number of core new car franchises in order to maintain long-

term strategic relationships with automotive manufacturers.

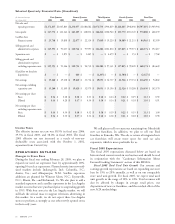

We provide prime financing for customers through CarMax

Auto Finance (“CAF”) and Bank of America. We also provide

financing for non-prime customers through three third-party

lenders. We continue to test additional non-prime lenders, as

well as lenders for sub-prime financing. Having our own

finance operation allows us to limit the risk of reliance on

third-party finance sources, while also allowing us to capture

additional profit and cash flows. The majority of CAF’s profit

contribution is generated from the spread between the interest

rate charged the customer and our cost of funds. We collect

fixed, pre-negotiated fees from most of the third-party lenders

for each CarMax customer loan they finance.

We sell extended warranties on behalf of unrelated third

parties who are the primary obligors. Under these third-party

warranty programs, we have no contractual liability to the

customer. Extended warranty revenue represents commissions

from the unrelated third parties.

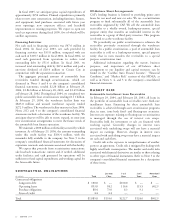

We are still at an early stage in the national rollout of our

retail concept. The primary drivers for future earnings growth

will be vehicle unit growth from geographic expansion and

comparable store sales increases, and the related expense

leverage. We target a roughly similar fixed dollar amount of

gross profit per used unit, regardless of price, making unit

growth our primary focus. During the next two-to-three years,

we plan to focus our store growth primarily on adding standard

superstores to new mid-sized markets, which we define as those

with television viewing audiences between 1 million and 2.5

million people, and satellite fill-in superstores in established

markets. In addition, in fiscal 2005 we plan to open two stores

in Los Angeles on sites that were purchased prior to suspending

growth in 1999. Following these openings, we will have four

stores in Los Angeles, which will provide a foundation for

future expansion in this market. In fiscal 2006 or 2007, we

expect to once again begin entering additional larger, multi-

store markets. Over the three-year period, we plan to open used

car superstores at a rate of 15% to 20% of our store base each

year. We also expect used unit comparable store sales increases

in the range of 4% to 8%, reflecting the multi-year ramp in

sales of newly opened stores as they mature and continued

market share gains at stores that have reached mature sales

levels. On a combined basis, we expect that new store openings

and comparable store used unit increases will drive total used

unit growth of approximately 20% annually.

The principal challenges we face in expanding our store

base and meeting our total unit growth targets include:

■Our ability to procure suitable real estate at reasonable

costs. Real estate acquisition will be an increasing challenge

as we enter large, multi-store markets.

■Our ability to build our management bench strength to

support the store growth.

We staff each newly opened store with an experienced

management team, including the location general manager,

operations manager, purchasing manager, and business office

manager, as well as a number of experienced sales managers

and buyers. We must therefore be continually recruiting,

training, and developing managers and associates to fill the

pipeline necessary to support future store openings. If at any

time we believe that the rate of store growth is causing our

performance to falter, we will slow the growth rate.

CARMAX

2004 17

MANAGEMENT’S DISCUSSION AND ANALYSIS