CarMax 2004 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2004 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

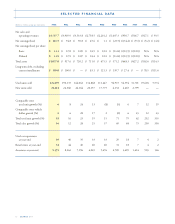

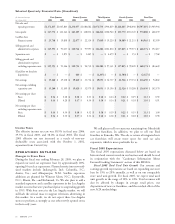

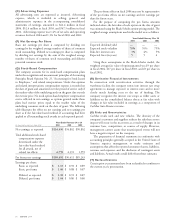

Selected Quarterly Financial Data (Unaudited)

(In thousands except

First Quarter Second Quarter Third Quarter Fourth Quarter Fiscal Year

per share data)

2004 2003 2004 2003 2004 2003 2004 2003 2004 2003

Net sales and

operating revenues $1,172,835 $1,005,803 $1,236,457 $1,080,682 $1,071,534 $936,819 $1,116,865 $946,640 $4,597,691 $3,969,944

Gross profit $147,771 $122,142 $163,105 $128,812 $126,242 $106,940 $133,770 $110,345 $570,888 $468,239

CarMax Auto

Finance income $25,748 $19,838 $22,677 $22,110 $17,649 $19,220 $18,889 $21,231 $84,963 $82,399

Selling, general, and

administrative expenses $115,553 $93,037 $120,714 $97,997 $114,282 $101,810 $117,825 $99,573 $468,374 $392,417

Separation costs $ — $1,871 $—$1,265 $—$4,479 $—$153 $—$7,768

Selling, general, and

administrative expenses

excluding separation costs $115,553 $91,166 $120,714 $96,732 $114,282 $97,331 $117,825 $99,420 $468,374 $384,649

(Gain)/loss on franchise

dispositions $—$—$460 $—$(1,207) $—$(1,580) $—$(2,327) $—

Net earnings $35,260 $29,238 $39,610 $31,714 $19,053 $14,717 $22,526 $19,133 $116,450 $94,802

Net earnings excluding

separation costs $35,260 $31,109 $39,610 $32,979 $19,053 $19,196 $22,526 $19,286 $116,450 $102,570

Net earnings per share:

Basic $0.34 $0.28 $0.38 $0.31 $0.18 $0.14 $0.22 $0.19 $1.13 $0.92

Diluted $0.34 $0.28 $0.37 $0.30 $0.18 $0.14 $0.21 $0.18 $1.10 $0.91

Net earnings per share

excluding separation costs:

Basic $0.34 $0.30 $0.38 $0.32 $0.18 $0.19 $0.22 $0.19 $1.13 $1.00

Diluted $0.34 $0.30 $0.37 $0.32 $0.18 $0.18 $0.21 $0.18 $1.10 $0.98

24

CARMAX

2004

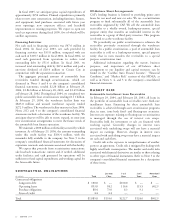

Income Taxes

The effective income tax rate was 38.5% in fiscal year 2004,

39.5% in fiscal 2003, and 38.0% in fiscal 2002. The fiscal

2003 effective tax rate increased as a result of non-tax-

deductible costs associated with the October 1, 2002,

separation from Circuit City.

OPERATIONS OUTLOOK

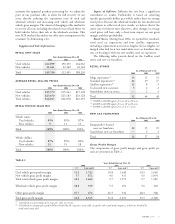

Changes in Store Base

During the fiscal year ending February 28, 2005, we plan to

expand our used car superstore base by approximately 20%,

opening 10 used car superstores. Planned entries into new mid-

sized markets include Indianapolis, Ind.; Columbia, S.C.;

Austin, Tex.; and Albuquerque, N.M. Satellite superstore

additions are planned for Winston Salem, N.C.; Fayetteville,

N.C.; Miami, Fla.; and Richmond, Va. We also plan to add a

standard superstore and a satellite superstore in the Los Angeles

market on sites that were purchased prior to suspending growth

in 1999. With four stores in the Los Angeles market, we will

still lack the critical mass to support television advertising in

this market. As a result, we do not expect these Los Angeles

stores to perform as strongly as our other newly opened stores

in their early years.

We still plan to sell or return our remaining four Mitsubishi

new car franchises. In addition, we plan to sell our Ford

franchise in Kenosha, Wis. The sale or return of integrated new

car franchises will create more space for used car sales

expansion, which is more profitable for us.

Fiscal 2005 Expectations

The fiscal 2005 expectations discussed below are based on

historical and current trends in our business and should be read

in conjunction with the “Cautionary Information About

Forward-Looking Statements” section of this MD&A.

Fiscal 2005 Total Used Unit Growth. Our revenue and

earnings growth expectations are based on expanding our store

base by 15% to 20% annually, as well as on our comparable

store used unit growth. For fiscal 2005, we expect total used

unit growth in the range of 18% to 22%. Total revenues will

also be affected by changes in average retail prices, our

dispositions of new car franchises, and the residual effect of the

new ACR methodology.