CarMax 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

CARMAX 2004

TO OUR SHAREHOLDERS

WHERE WE’VE BEEN

During the past year, we’ve celebrated some important mile-

stones that reflect just how far we’ve come since we began.

Last July, we sold our 1 millionth car. In late September, we

celebrated our 10th anniversary since opening, and on

October 1, our first anniversary as an independent public

company. As we finished the fiscal year, we hit a few other

impressive milestones:

■Over 11 million customers greeted with a smile.

■Over 4.5 million free appraisals and cash offers

to customers.

■Over 1 million used cars sold.

■Over $20 billion in cumulative sales.

■Our 3rd consecutive PricewaterhouseCoopers/

Automotive News award for top 3-year shareholder

return among auto retailers.

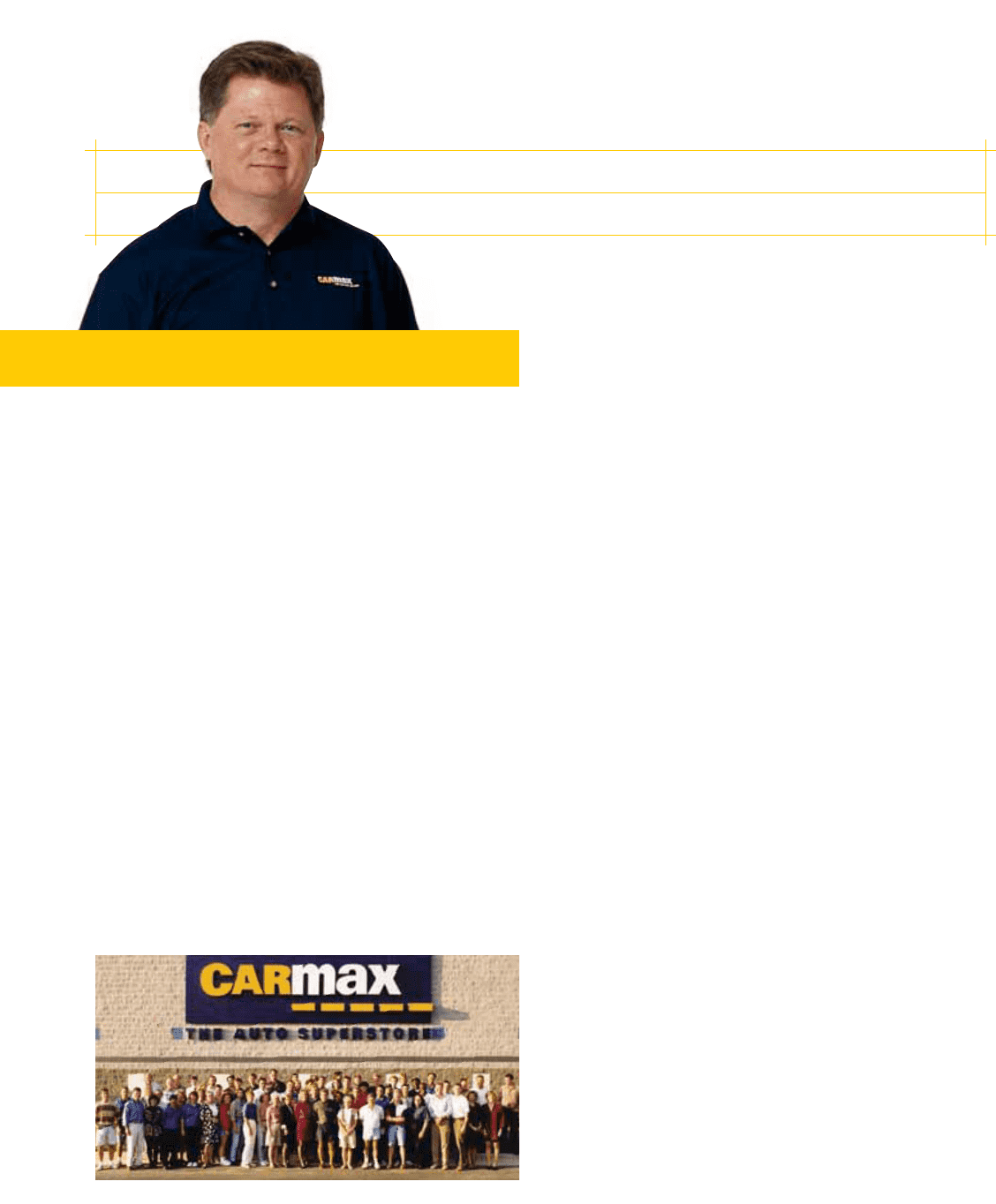

All in all, a pretty good first decade for an organic growth

start-up in the retail industry — all thanks to the extraordinary

efforts of the 9,500-plus CarMax associates who’ve joined us

along the way and made it all happen. Twenty-six of the

original 100 associates that were with CarMax the day we

opened the Richmond store on September 29, 1993, are still

a part of our team today. They now play a wide variety of

roles throughout our organization, and their stories are the

story of CarMax’s growth and development.

WHERE WE ARE

In fiscal 2004 we delivered strong earnings growth, up 14%

excluding the non-deductible separation costs we paid for in

fiscal 2003, and up 23% on a net earnings basis. Our earnings

growth resulted from an 18% increase in used vehicle unit

sales, driven both by our new store openings and 6% compa-

rable store used unit sales growth. With our unique consumer

offer and strong store execution, we continued to take market

share. We hit our gross margin dollars per used unit target for

the year despite a particularly challenging model year

changeover period in the third quarter. Our proprietary buy-

ing and inventory processes and systems continue to help us

“buy right” and “price right.”

This earnings growth was achieved while we absorbed

both the penalty that comes with ramping up our store

growth and the expected decline in CarMax Auto Finance

spreads. As planned, we opened nine used car superstores,

compared with five the previous year. Consequently, SG&A

expense reflected appreciably higher preopening expense, as

well as the significantly higher SG&A ratio of new stores

compared with stores at mature sales levels. We also absorbed

approximately $13.5 million in incremental costs related to

being a stand-alone company compared with fiscal 2003.

Also as expected, CAF income grew a modest 3% for the

year. For more than two years — through the first half of fiscal

2004 — we benefited from much higher than normal spreads

at CAF because market rates for consumer auto loans did not

fall as fast as our cost of funds. During the second half, spreads

returned to more normal ranges. We expect CAF income com-

parisons in fiscal 2005 to be challenging for the first two quar-

ters, and then they should be on a more comparable basis.

WHERE WE’RE GOING

We are pleased that CarMax has built a strong foundation

for consistent and profitable growth. We have adjusted our

longer-term used unit comp store growth expectation to a

range of 4% to 8%. We continue to expect to deliver average

annual earnings growth of approximately 20%, once our CAF

income comparisons have cycled around to reflect spreads in

the normal range for each period. Our operating cash flow

Founding Associates, September 1993

Austin Ligon

President and Chief Executive Officer