CarMax 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2003 C4n1

CARMAX, INC. ANNUAL REPORT

FISCAL YEAR 2004

Table of contents

-

Page 1

C A R M A X , I N C . A N N U A L R E P O RT FISCAL YEAR 2004 CARMAX 2003 C4n1 -

Page 2

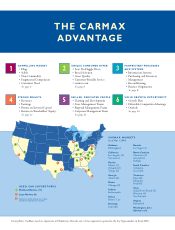

... 1 1 1 CARMAX MARKETS (as of May 1, 2004) Alabama Nevada Birmingham California Las Vegas (2) North Carolina 1 1 Los Angeles (2) Sacramento Florida Charlotte (2) Greensboro Raleigh South Carolina 1 2 Miami (3) Orlando (2) Tampa (2) Georgia Columbia Greenville Tennessee Atlanta (4) Illinois... -

Page 3

... Net sales and operating revenues Net earnings Separation costs Net earnings excluding separation costs Per Share Data Diluted earnings Separation costs Diluted earnings excluding separation costs Other Information Cash provided by (used in) operating activities Used car superstores at end of year... -

Page 4

... 4.5 million free appraisals and cash offers to customers. â- Over 1 million used cars sold. â- Over $20 billion in cumulative sales. â- Our 3rd consecutive PricewaterhouseCoopers/ Automotive News award for top 3-year shareholder return among auto retailers. All in all, a pretty good first decade... -

Page 5

..., and training more than 1,000 additional talented associates in the various operating departments. To do this smoothly, open the new stores successfully, and continue to improve operational execution in our existing stores is an enormous task. This is, as they say, Job #1 for CarMax management. We... -

Page 6

... Cars School and Office Products Home Improvement 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 % Change Used Vehicle Unit Sales % Change New Vehicle Unit Sales Source: Manheim Auctions Source: Manheim Auctions; CarMax estimates; the School, Home and Office Products Association... -

Page 7

... our stores. Every retail vehicle undergoes a rigorous reconditioning process to ensure it meets our high quality standards. We back our quality promise with a 5-day, 250-mile, noquestions-asked, money-back guarantee and a free 30-day, industry-leading limited warranty. We also sell extended service... -

Page 8

... behind our quality standards with our 5-day, 250-mile, money-back guarantee and our industryleading, 30-day limited warranty. We also offer extended service plans on every vehicle we sell that provide up to 6 years of coverage. • The price of the "trade-in" is a written cash offer, based solely... -

Page 9

... right car for their needs at a price they can afford. Our computerized inventory system makes it easy to search our vehicle inventory. There is no hand-off of customers to a finance manager or sales manager. The sales consultant helps the customer through the entire sales process. â- Carmax.com... -

Page 10

...information systems would be critical to success in the complex used car retailing business. Our systems capture data on every aspect of our business. • Every vehicle purchased is electronically tracked Purchasing/ Inventory Management through its CarMax life from purchase through reconditioning... -

Page 11

PURCHASING AND INVENTORY MANAGEMENT â- RECONDITIONING â- More than half the cars we retail are purchased directly from consumers, an excellent source of quality, highdemand vehicles. Customer vehicle purchases that do not meet our retail standards are sold at our own in-store auctions, which are... -

Page 12

... gives customers up to three business days to replace the loan with cash or an alternative lending source, free of penalty or interest. • The sales consultant receives no commission on the finance process. Having our own finance operation also reduces the sales risk associated with changes in... -

Page 13

...' EQUITY (5.3)% 3.5% 8.5% 20.7% $1.1 $45.6 FY95 FY96 FY97 FY98 FY99 FY97 FY01 FY02 FY03 FY04 (5%) FY98 FY99 $(4.1) $(5.2) $(9.3) FY00 $(23.5) 0.3% 12.4% FY00 (6.7%) FY01 FY02 FY03 18.2% FY04 $(34.2) ROE calculations not meaningful for periods prior to fiscal 1997. CARMAX... -

Page 14

... areas - sales, service, buying, and business office. The programs include classroom and online training as well as formal mentoring assignments. Standardized training and processes also facilitate transfers between stores and regions. We recruit the majority of our superstore managers from the... -

Page 15

R E G I O N A L M A N AG E M E N T T E A M S C O R P O R AT E M A N A G E M E N T T E A M TEAMS CARMAX 2004 13 -

Page 16

..., and nine superstores in fiscal 2004, including a replacement store in Los Angeles. During the next three years, we plan to open stores at an annual rate of approximately 15%-20% of our used car superstore base, focusing primarily on new mid-sized markets and adding satellite stores in established... -

Page 17

..., following our own strategic priorities. CarMax has more than a 10-year development advantage over any challenger who attempts to copy our business. Building an organization, developing specialized processes and systems, refining execution...all take time. CarMax intends to stay ahead of any... -

Page 18

... store vehicle dollar growth (%) Total used unit growth (%) Total sales growth (%) 6 6 18 16 8 6 16 12 24 28 23 28 13 17 19 25 (8) 2 15 37 (5) (2) 71 69 6 6 79 68 7 23 62 73 12 12 252 250 19 43 335 356 Used car superstores at year-end Retail stores at year-end Associates at year-end... -

Page 19

... four core equities, including low, no-haggle prices; a broad selection; high quality; and customer-friendly service. We generate revenues, income, and cash flows by retailing used and new vehicles and associated items including vehicle financing, extended warranties, and vehicle repair service. In... -

Page 20

... the higher costs of being an independent company following the separation from Circuit City. New stores generally have higher SG&A ratios during the approximately four years it takes to reach mature levels of revenues. Net cash provided by operations increased to $148.5 million in fiscal 2004 from... -

Page 21

...2004 % Years Ended February 29 or 28 2003 % 2002 % Used vehicle sales New vehicle sales Total retail vehicle sales Wholesale vehicle sales Other sales and revenues: Extended warranty revenues Service department sales Third-party finance fees Appraisal purchase processing fees Total other sales... -

Page 22

...company's store base and increased consumer response to our vehicle appraisal offer. Other Sales and Revenues. Other sales and revenues include extended warranty revenues, service department sales, thirdparty finance fees, and, through the second quarter of fiscal 2004, appraisal purchase processing... -

Page 23

..., then changes in average retail prices will have only a short-term impact on our gross margin and thus profitability. Retail Stores. During fiscal 2004, we opened five standardsized used car superstores and four satellite superstores, including a replacement store in Los Angeles. In Los Angeles, we... -

Page 24

..., service sales and costs were adversely impacted by the rollout of the ERO system. Third-party warranty commissions and third-party finance fees both benefited from the growth in used car sales. CarMax Auto Finance Income CAF's lending business is limited to providing prime auto loans for our used... -

Page 25

...&A ratios than stores with mature sales levels, reflecting the sales ramp that occurs over time. Higher total pre-opening expenses and costs related to building our management team bench strength to support future store growth also contributed to the higher current year SG&A ratio. CARMAX 2004 23 -

Page 26

...) First Quarter 2004 2003 Second Quarter 2004 2003 Third Quarter 2004 2003 Fourth Quarter 2004 2003 Fiscal Year 2004 2003 Net sales and operating revenues Gross profit CarMax Auto Finance income Selling, general, and administrative expenses Separation costs Selling, general, and administrative... -

Page 27

... the fiscal 2004 increase is associated with the initial expenditures associated with our future corporate office site in Richmond, Va. Capital expenditures are funded through sale-leaseback transactions, short- and long-term debt, and internally generated funds. Net proceeds from sales of property... -

Page 28

... purchases associated with future year store openings; new corporate offices; and leasehold improvements to existing properties. We expect to open ten used car superstores during fiscal 2005, five of which will be satellite superstores. Financing Activities Off-Balance Sheet Arrangements Net cash... -

Page 29

... profitability for the company. â- â- â- â- â- The company operates in a highly competitive industry and new entrants to the industry could result in increased wholesale costs for used vehicles and lower-than-expected vehicle sales and margins. Any significant changes in retail prices... -

Page 30

...Cost of sales GROSS PROFIT CARMAX AUTO FINANCE INCOME (NOTES 3 AND 4) Selling, general, and administrative expenses (NOTE 2) Gain on franchise dispositions, net Interest expense (NOTE 9) Interest income Earnings before income taxes Provision for income taxes (NOTE 7) NET EARNINGS Weighted average... -

Page 31

... or 28 (In thousands except share data) 2004 2003 ASSETS CURRENT ASSETS: Cash and cash equivalents (NOTE 2) Accounts receivable, net Automobile loan receivables held for sale (NOTE 4) Retained interests in securitized receivables (NOTE 4) Inventory Prepaid expenses and other current assets TOTAL... -

Page 32

...) 41,621 (80,411) (41,417) 98,965 57,548 FINANCING ACTIVITIES: (Decrease) increase in short-term debt, net Issuance of long-term debt Payments on long-term debt Equity issuances, net Special dividend paid NET CASH (USED IN) PROVIDED BY FINANCING ACTIVITIES (51,605) - - 4,014 - (47,591) 27,028 34... -

Page 33

..., 2003 Net earnings Exercise of common stock options Shares purchased for employee stock purchase plan Shares issued under stock incentive plans Shares cancelled upon reacquisition by the company Tax benefit from stock issued Unearned compensation-restricted stock BALANCE AT FEBRUARY 29, 2004 $51... -

Page 34

...quality used vehicles at low, "no-haggle" prices using a customer-friendly sales process in an attractive, modern sales facility. CarMax also sells new vehicles under various franchise agreements. CarMax provides its customers with a full range of related services, including the financing of vehicle... -

Page 35

... earnings process is complete, generally either at the time of sale to a customer or upon delivery to a customer. As part of its customer service strategy, the company guarantees the vehicles it sells with a 5-day or 250-mile, money-back guarantee. If a customer returns the vehicle purchased within... -

Page 36

... as a component of CarMax Auto Finance income. (S) Risks and Uncer tainties Years Ended February 29 or 28 2004 2003 2002 Net earnings, as reported Total additional stock-based compensation expenses determined under the fair-value-based method for all awards, net of related tax effects Pro forma... -

Page 37

... cash flows are calculated taking into account expected prepayment and default rates. CarMax Auto Finance income was as follows: (In millions) Years Ended February 29 or 28 2004 2003 2002 Gains on sales of loans Other income: Servicing fee income Interest income Total other income Direct expenses... -

Page 38

...the future cash flows using management's assumptions of key factors, such as finance charge income, default rates, prepayment rates, and discount rates appropriate for the type of asset and risk. The value of interest-only strip receivables may be affected by external factors, such as changes in the... -

Page 39

..., the company must meet financial covenants relating to minimum tangible net worth, maximum total liabilities to tangible net worth ratio, minimum tangible net worth to managed assets ratio, minimum current ratio, minimum cash balance or borrowing capacity, and minimum fixed charge coverage ratio... -

Page 40

... 28, 2003. The fair value of swaps included in accounts payable totaled a net liability of $2.0 million at February 29, 2004, and $2.6 million at February 28, 2003. The market and credit risks associated with interest rate swaps are similar to those relating to other types of financial instruments... -

Page 41

... of the company's pension plan assets were as follows: Years Ended February 29 or 28 Pension Plan 2004 2003 (In thousands) Change in plan assets: Fair value of plan assets at beginning of year Actual return on plan assets Adjustment for separation Employer contributions Benefits paid Fair value of... -

Page 42

... The components of net pension expense were as follows: Pension Plan (In thousands) Years Ended February 29 or 28 Restoration Plan 2002 2004 2003 2002 2004 Total 2003 2002 2004 2003 Service cost Interest cost Expected return on plan assets Amortization of prior year service cost Amortization of... -

Page 43

... into a right to purchase, for half the current market price at that time, shares of CarMax, Inc. common stock valued at two times the exercise price. The company also has an additional 19,880,000 shares of undesignated preferred stock authorized of which no shares are outstanding. CARMAX 2004 41 -

Page 44

... information about stock options outstanding as of February 29, 2004. (D) Employee Stock Purchase Plan Under the company's stock incentive plans, nonqualified stock options may be granted to management, key employees, and outside directors to purchase shares of common stock. The exercise price... -

Page 45

...operates 23 of its sales locations pursuant to various leases under which its former parent Circuit City was the original tenant and primary obligor. Circuit City had originally entered into these leases so that CarMax could take advantage of the favorable economic terms In fiscal 2004, the company... -

Page 46

...its customer service strategy, the company guarantees the vehicles it sells with a 30-day limited warranty. A vehicle in need of repair within 30 days of the customer's purchase will be repaired free of charge. As a result of this guarantee, each vehicle sold has an implied liability associated with... -

Page 47

... per share data) (UNAUDITED) Fourth Quarter 2004 2003 Fiscal Year 2004 2003 First Quarter 2004 2003 Second Quarter 2004 2003 Third Quarter 2004 2003 Net sales and operating revenues Gross profit CarMax Auto Finance income Selling, general, and administrative expenses (Gain)/loss on franchise... -

Page 48

... February 28, 2003, and the related consolidated statements of earnings, shareholders' equity and cash flows for each of the fiscal years in the three-year period ended February 29, 2004. These financial statements are the responsibility of the Company's management. Our responsibility is to express... -

Page 49

...Deputy General Counsel JOHN DAVIS Assistant Vice President Management Information Systems JACK HIGHTOWER Region Vice President Ser vice Operations Atlanta Region RICHARD SMITH Region Vice President Ser vice Development DAVE BANKS Region Vice President Ser vice Operations Florida Region JASON DAY... -

Page 50

...RICHARD L. SHARP AUSTIN LIGON Chairman of the Board CarMax, Inc. Private Investor Retired Chairman and Chief Executive Officer Circuit City Stores, Inc. (a consumer electronics specialty retailer) Richmond, Virginia KEITH BROWNING President Chief Executive Officer CarMax, Inc. MAJOR GENERAL HUGH... -

Page 51

..., June 29, 2004, at 10:00 a.m. The Richmond Marriott West Hotel 4240 Dominion Boulevard Glen Allen, Virginia 23060 S TO C K I N F O R M AT I O N CarMax, Inc. common stock is traded on the New York Stock Exchange under the symbol "KMX." Prior to the separation from Circuit City Stores, Inc. on... -

Page 52

CARMAX, INC. 4 9 0 0 C OX RO A D G L E N A L L E N V I R G I N I A 2 3 0 6 0 - 6 2 9 5 804.747.0422 W W W. C A R M A X . C O M