CarMax 1999 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 1999 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

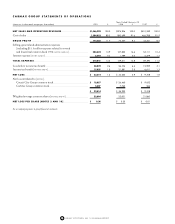

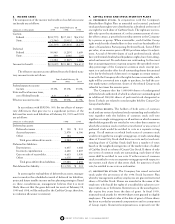

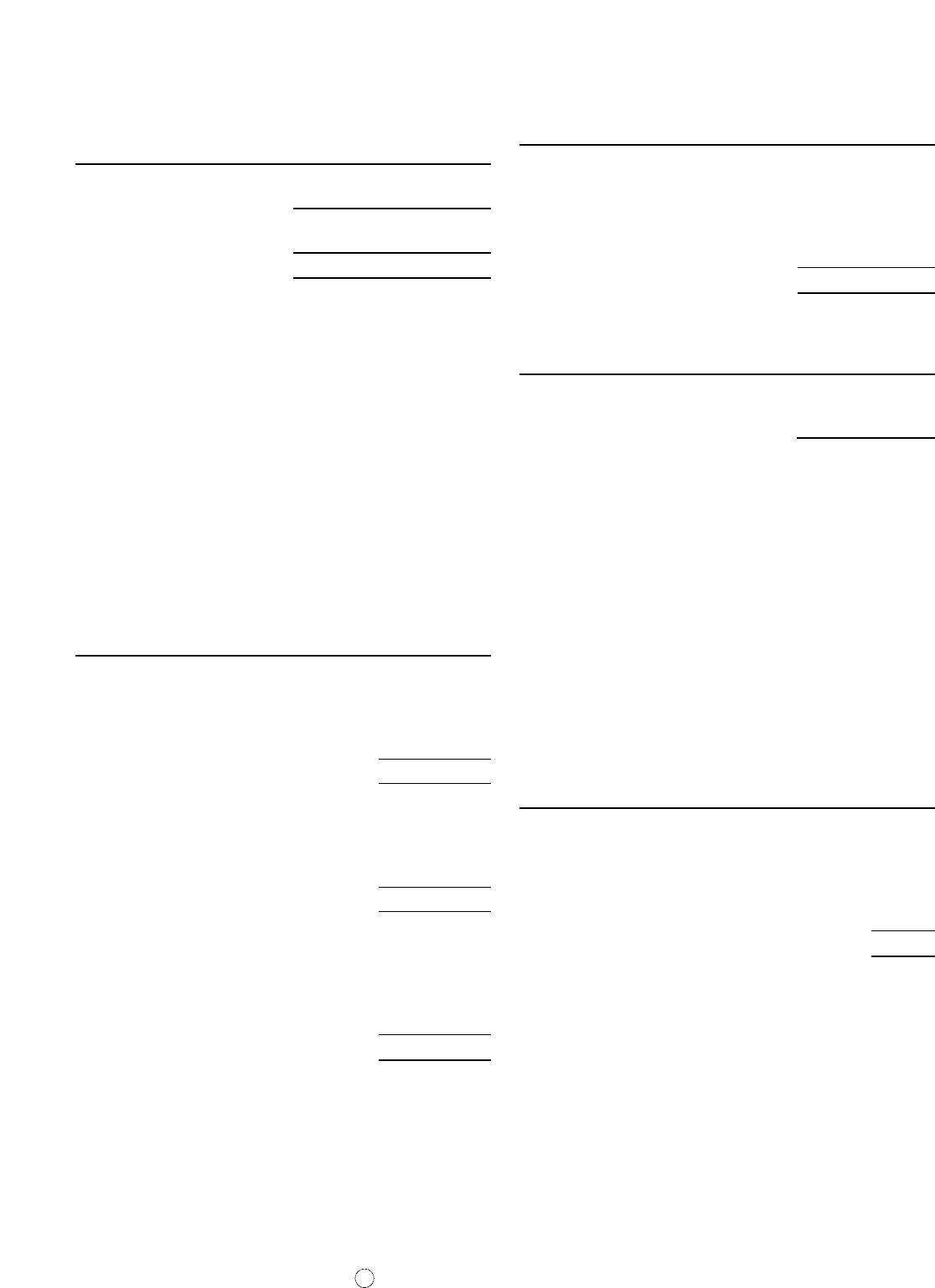

10. NET LOSS PER SHARE

The calculation of net loss per share is presented below:

(Amounts in thousands

Years Ended February 28

except per share data)

1999 1998 1997

Weighted average common

shares..................................... 22,604 22,001 21,860

Loss available to common

shareholders .......................... $ 5,457 $ 7,763 $ 266

Net loss per share........................ $ 0.24 $ 0.35 $ 0.01

The CarMax Group had no diluted net loss per share because

the Group had net losses for the periods presented.

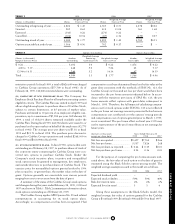

11. PENSION PLAN

The Company has a noncontributory defined benefit pension plan

covering the majority of full-time employees who are at least age

21 and have completed one year of service. The cost of the pro-

gram is being funded currently. Plan benefits generally are based

on years of service and average compensation. Plan assets consist

primarily of equity securities and included 80,000 shares of

Circuit City Stock at February 28, 1999 and 1998.

Eligible employees of the CarMax Group participate in the

Company’s plan. Pension costs for these employees have been

allocated to the CarMax Group based on its proportionate share

of the projected benefit obligation. The following tables set forth

the CarMax Group’s share of the Plan’s financial status and

amounts recognized in the balance sheets as of February 28:

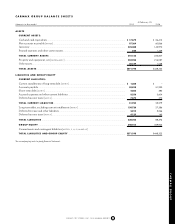

(Amounts in thousands)

1999 1998

Change in benefit obligation:

Benefit obligation at beginning of year............. $ 958 $ 521

Service cost ...................................................... 525 219

Interest cost...................................................... 67 39

Actuarial loss .................................................... 1,015 179

Benefit obligation at end of year....................... $ 2,565 $ 958

Change in plan assets:

Fair value of plan assets at beginning of year .... $ 1,242 $ 895

Actual return on plan assets.............................. 69 185

Employer contributions.................................... 242 162

Fair value of plan assets at end of year............... $ 1,553 $1,242

Reconciliation of funded status:

Funded status.................................................... $(1,012) $ 284

Unrecognized actuarial loss (gain)................... 1,063 (2)

Unrecognized transition asset.......................... (8) (11)

Unrecognized prior service benefit.................. (8) (9)

Net amount recognized.................................... $ 35 $ 262

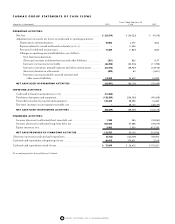

The components of net pension expense are as follows:

Years Ended February 28

(Amounts in thousands)

1999 1998 1997

Service cost................................................ $ 525 $219 $162

Interest cost................................................ 67 39 34

Expected return on plan assets ................... (119) (73) (55)

Amortization of prior service cost.............. (1) (1) (1)

Amortization of transitional asset .............. (3) (3) (3)

Recognized actuarial loss ........................... – 17 17

Net pension expense.................................. $ 469 $198 $154

Assumptions used in the accounting for the pension plan were:

Years Ended February 28

1999 1998 1997

Weighted average discount rate................. 6.8% 7.0% 7.5%

Rate of increase in compensation levels..... 5.0% 5.0% 5.5%

Expected rate of return on plan assets ........ 9.0% 9.0% 9.0%

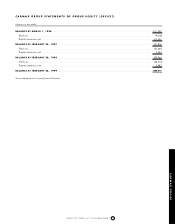

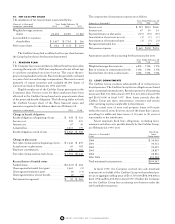

12. LEASE COMMITMENTS

The CarMax Group conducts substantially all of its business in

leased premises. The CarMax Group’s lease obligations are based

upon contractual minimum rates. Rental expenses for all operating

leases were $23,521,000 in fiscal 1999, $11,421,000 in fiscal 1998

and $6,019,000 in fiscal 1997. Most leases provide that the

CarMax Group pay taxes, maintenance, insurance and certain

other operating expenses applicable to the premises.

The initial term of most real property leases will expire

within the next 22 years; however, most of the leases have options

providing for additional lease terms of 10 years to 20 years at

terms similar to the initial terms.

Future minimum fixed lease obligations, excluding taxes,

insurance and other costs payable directly by the CarMax Group,

as of February 28, 1999, were:

Operating

(Amounts in thousands)

Lease

Fiscal Commitments

2000 ............................................................................. $ 30,965

2001 ............................................................................. 30,312

2002 ............................................................................. 29,059

2003 ............................................................................. 28,837

2004 ............................................................................. 28,836

After 2004 .................................................................... 451,538

Total minimum lease payments..................................... $599,547

In fiscal 1999, the Company entered into sale-leaseback

transactions on behalf of the CarMax Group with unrelated par-

ties at an aggregate selling price of $131,750,000 ($98,098,000 in

fiscal 1998 and $16,450,000 in fiscal 1997). Neither the Company

nor the CarMax Group has continuing involvement under the

sale-leaseback transactions.

78 CIRCUIT CITY STORES, INC. 1999 ANNUAL REPORT