CarMax 1999 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 1999 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Property held under capital lease is stated at the lower of the

present value of the minimum lease payments at the inception of

the lease or market value and is amortized on a straight-line basis

over the lease term or the estimated useful life of the asset,

whichever is shorter.

(G) COMPUTER SOFTWARE COSTS:

Effective March 1, 1998, the

Company adopted the American Institute of Certified Public

Accountants Statement of Position 98-1, “Accounting for the

Costs of Computer Software Developed or Obtained for Internal

Use.” Once the capitalization criteria of the SOP have been met,

external direct costs of materials and services used in the develop-

ment of internal-use software and payroll and payroll-related

costs for employees directly involved in the development of inter-

nal-use software are capitalized. Amounts capitalized are amor-

tized on a straight-line basis over a period of three to five years.

(H) PRE-OPENING EXPENSES:

Expenses associated with the open-

ing of new stores are deferred and amortized ratably over the period

from the date of the store opening to the end of the fiscal year.

(I) INCOME TAXES:

Income taxes are accounted for in accordance

with SFAS No. 109, “Accounting for Income Taxes.” Deferred

income taxes reflect the impact of temporary differences between

the amounts of assets and liabilities recognized for financial

reporting purposes and the amounts recognized for income tax

purposes, measured by applying currently enacted tax laws. A

deferred tax asset is recognized if it is more likely than not that a

benefit will be realized.

(J) DEFERRED REVENUE:

The Circuit City Group sells its own

extended warranty contracts and extended warranty contracts on

behalf of unrelated third parties. The contracts extend beyond the

normal manufacturer’s warranty period, usually with terms

(including the manufacturer’s warranty period) between 12 and 60

months. All revenue from the sale of the Circuit City Group’s own

extended warranty contracts is deferred and amortized on a

straight-line basis over the life of the contracts. Incremental direct

costs related to the sale of contracts are deferred and charged to

expense in proportion to the revenue recognized. Commission

revenue for the unrelated third-party extended warranty plans is

recognized at the time of sale.

(K) INTER-GROUP INTEREST:

Prior to the offering, the Circuit

City Group held a 100 percent Inter-Group Interest in the

CarMax Group. The Circuit City Group held a 76.6 percent

Inter-Group Interest in the CarMax Group at February 28, 1999, a

77.3 percent Inter-Group Interest at February 28, 1998, and a 77.5

percent Inter-Group Interest at February 28, 1997. For purposes of

these group financial statements, the Circuit City Group accounts

for the Inter-Group Interest in a manner similar to the equity

method of accounting. Accordingly, the Circuit City Group’s

Inter-Group Interest in the Company’s equity value that is

attributed to the CarMax Group is reflected as “Inter-Group

Interest in the CarMax Group” on the Circuit City Group balance

sheets. Similarly, the net losses of the CarMax Group attributed to

the Circuit City Group’s Inter-Group Interest are reflected as “Net

loss related to Inter-Group Interest in the CarMax Group” on the

Circuit City Group statements of earnings. All amounts corre-

sponding to the Circuit City Group’s Inter-Group Interest in the

CarMax Group in these group financial statements represent the

Circuit City Group’s proportional interest in the businesses, assets

and liabilities and income and expenses of the CarMax Group.

The carrying value of the Circuit City Group’s Inter-Group

Interest in the CarMax Group has been decreased proportionally

for the net loss of the CarMax Group. In addition, in the event of

any dividend or other distribution on CarMax Stock, an amount

that is proportionate to the aggregate amount paid in respect to

shares of CarMax Stock would be transferred to the Circuit City

Group from the CarMax Group with respect to its Inter-Group

Interest and would reduce the related book value.

(L) SELLING, GENERAL AND ADMINISTRATIVE EXPENSES:

Oper-

ating profits generated by the finance operation are recorded as a

reduction to selling, general and administrative expenses.

(M) ADVERTISING EXPENSES:

All advertising costs are expensed

as incurred.

(N) NET EARNINGS PER SHARE:

On December 15, 1997, the

Company adopted SFAS No. 128, “Earnings per Share.” All

prior period earnings per share data presented has been restated to

conform with the provisions of SFAS No. 128.

Basic net earnings per share is computed by dividing net

earnings attributed to Circuit City Stock, including the Circuit

City Group’s 100 percent interest in the losses of the CarMax

Group for periods prior to the offering and the Circuit City

Group’s retained interest in the CarMax Group subsequent to the

offering, by the weighted average number of common shares out-

standing. Diluted net earnings per share is computed by dividing

net earnings attributed to Circuit City Stock, which includes the

Circuit City Group’s retained interest in CarMax, by the weighted

average number of common shares outstanding and dilutive

potential common shares.

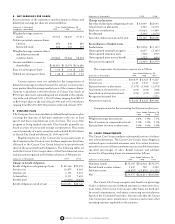

(O) STOCK-BASED COMPENSATION:

On March 1, 1996, the

Company adopted SFAS No. 123, “Accounting for Stock-Based

Compensation.” The Company has elected to continue applying

the provisions of the Accounting Principles Board Opinion No.

25, “Accounting for Stock Issued to Employees,” and to provide

the pro forma disclosures of SFAS No. 123.

(P) DERIVATIVE FINANCIAL INSTRUMENTS:

The Company enters

into interest rate swap agreements to manage exposure to interest

rates and to more closely match funding costs to the use of fund-

ing. Interest rate swaps relating to long-term debt are classified as

held for purposes other than trading and are accounted for on a

settlement basis. To qualify for this accounting treatment, the

swap must synthetically alter the nature of a designated underly-

ing financial instrument. Under this method, payments or receipts

due or owed under the swap agreement are accrued through each

settlement date and recorded as a component of interest expense.

If a swap designated as a synthetic alteration were to be termi-

nated, any gain or loss on the termination would be deferred and

recognized over the shorter of the original contractual life of the

swap or the related life of the designated long-term debt.

The Company also enters into interest rate swap agreements

as part of its asset securitization programs. Swaps entered into by

a seller as part of a sale of financial assets are considered proceeds

at fair value in the determination of the gain or loss on the sale. If

CIRCUIT CITY GROUP

CIRCUIT CITY STORES, INC. 1999 ANNUAL REPORT 55