CarMax 1999 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 1999 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

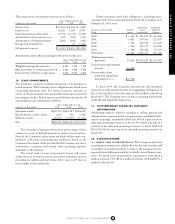

On January 24, 1997, shareholders of Circuit City Stores, Inc.

approved the creation of two common stock series. The

Company’s existing common stock was subsequently redesignated

as Circuit City Stores, Inc.–Circuit City Group Common Stock.

In an initial public offering, which was completed February 7,

1997, the Company sold 21.86 million shares of Circuit City

Stores, Inc.–CarMax Group Common Stock.

The Circuit City Group Common Stock is intended to track

the performance of the Circuit City store-related operations, the

Company’s investment in Digital Video Express and the Group’s

retained interest in the CarMax Group. The effects of this

retained interest on the Circuit City Group’s financial statements

are identified by the term “Inter-Group.”

The CarMax Group Common Stock is intended to track the

performance of the CarMax operations. The Inter-Group Interest

is not considered outstanding CarMax Group stock. Therefore,

any net earnings or loss attributed to the Inter-Group Interest is

not included in the CarMax Group’s per share calculations.

The following discussion and analysis relates to the Circuit City

Group. Reported earnings reflect the Circuit City Group’s 100

percent interest in the losses of the CarMax Group prior to the

consummation of the offering on February 7, 1997, and the lower

Inter-Group Interest since that time. For additional information,

refer to the “Management’s Discussion and Analysis of Results of

Operations and Financial Condition” for Circuit City Stores, Inc.

and for the CarMax Group.

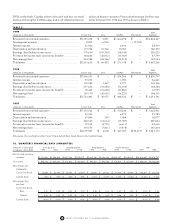

RESULTS OF OPERATIONS

Sales Growth

Total sales for the Circuit City Group increased 17 percent in fiscal

1999 to $9.34 billion. In fiscal 1998, total sales were $8.00 billion,

a 12 percent increase from $7.15 billion in fiscal 1997.

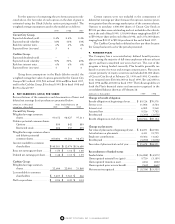

PERCENTAGE SALES CHANGE FROM PRIOR YEAR

Circuit City Group

Fiscal Total Comparable Industry*

1999............................................ 17% 8)% 5)%

1998............................................ 12% (1)% (3)%

1997............................................ 6% (8)% (8)%

1996............................................ 23% 5)% 6)%

1995............................................ 34% 15)% 11)%

* The industry sales rates are derived from Electronic Industries Alliance, Recording

Industry Association of America and Company estimates of audio, video, home

office, telecommunications, appliance and music software sales.

The fiscal 1999 total sales increase reflects an 8 percent com-

parable store sales increase, which was in part caused by an accel-

eration in industry growth, and the continued geographic

expansion of the Group’s Circuit City Superstores. In fiscal 1999,

the Group opened 37 Superstores. The Group entered a number

of one- and two-store markets; added stores to existing markets,

including the New York metropolitan market that was entered in

fiscal 1998; replaced three Superstores; and closed two consumer

electronics-only stores. In addition, the Group remodeled 30

stores to reflect its most recent merchandising initiatives.

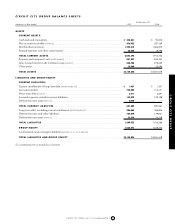

The Group operates four Circuit City Superstore formats

with square footage and merchandise assortments tailored to vol-

ume expectations for specific trade areas. The “D” format serves

the most populous trade areas. At the end of fiscal 1999, selling

space for the “D” format stores averaged about 23,000 square feet

and total square footage for all “D” stores averaged 43,042. The

“C” format constitutes the largest percentage of the store base. At

the end of fiscal 1999, selling space in the “C” format stores aver-

aged about 15,000 square feet with total square footage for all “C”

stores averaging 34,036. The “B” format often is located in smaller

markets or in smaller trade areas within larger metropolitan mar-

kets. At the end of fiscal 1999, selling space in these stores aver-

aged approximately 12,500 square feet with an average total

square footage of 26,651. The “B” stores offer a broad merchandise

assortment that maximizes return on investment in lower volume

areas. The “A” format serves the least populated trade areas.

Selling space for all “A” stores averaged approximately 9,500

square feet at the end of fiscal 1999, and total square footage aver-

aged 19,558. These stores feature a layout, staffing level and mer-

chandise assortment that creates high productivity in the smallest

markets.

The Group also operates 48 mall-based Circuit City Express

stores. These stores are located in regional malls and are approxi-

mately 2,000 to 3,000 square feet in size.

STORE MIX

Retail Units at Year-End

Fiscal 1999 1998 1997 1996 1995

Superstore

“D” Superstore............. 118 114 95 61 12

“C” Superstore............. 294 289 278 259 257

“B” Superstore............. 82 72 54 46 37

“A” Superstore............. 43 25 16 12 6

Electronics-Only.............. 2 4 5 5 5

Circuit City Express ......... 48 52 45 36 35

Total................................. 587 556 493 419 352

Industry sales in Circuit City’s retail segments have varied

significantly over the past five years, resulting in wide variations in

the Group’s sales growth. Geographic expansion and the addition

of product categories such as personal computers were the pri-

mary contributors to the Circuit City Group’s total sales growth

early in the period. From mid-fiscal 1996 through fiscal 1998, a

lack of significant product introductions resulted in lower average

retails and weak sales throughout the industry. In fiscal 1999, the

industry began to emerge from this period of declining sales. For

Circuit City, the fiscal 1999 sales reflected strong sales across all

major categories with especially strong sales in personal comput-

ers and in new high technology areas such as DIRECTV; wireless

communications; DVD players, especially players with the Divx

feature; and digital camcorders. The continued Superstore addi-

tions also contributed to the total sales growth.

The industry weakness in fiscal 1997 and 1998 resulted in a

highly competitive climate, and a significant number of regional

competitors closed stores. Despite the improvement in fiscal

46 CIRCUIT CITY STORES, INC. 1999 ANNUAL REPORT

CIRCUIT CITY GROUP MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION