CarMax 1999 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 1999 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1999, the consumer electronics industry remains highly competi-

tive. Circuit City’s primary competitors are large specialty, dis-

count or warehouse retailers with generally lower levels of service.

Because of Circuit City’s long history of providing exceptional

customer service, management believes that the Circuit City loca-

tions can continue to maintain share in existing markets and build

comparable shares in new markets.

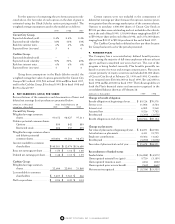

SALES BY MERCHANDISE CATEGORIES

Fiscal 1999 1998 1997 1996 1995

TV............................... 18% 18% 18% 17% 19%

VCR/Camcorders........ 13% 13% 14% 13% 14%

Audio........................... 16% 17% 18% 19% 22%

Home Office ............... 27% 25% 24% 26% 20%

Appliance .................... 15% 15% 15% 14% 15%

Other .......................... 11% 12% 11% 11% 10%

Total ............................ 100% 100% 100% 100% 100%

The Group sells two extended warranty programs on behalf of

unrelated third parties that issue these plans for merchandise sold

by the Group and other retailers. These third-party programs are

sold in most major markets. In states where third-party warranty

sales are not permitted, the Group sells a Circuit City extended

warranty. Gross dollar sales from all extended warranty programs

were 5.4 percent of the Group’s total sales in fiscal year 1999, com-

pared with 5.5 percent in fiscal 1998 and 6.0 percent in fiscal 1997.

The lower percentages in fiscal years 1999 and 1998 reflect the

impact of lower average retail prices on consumer demand for the

related warranties in many categories and increased sales of some

products that carry lower warranty penetration rates. Total

extended warranty revenue, which is reported in the Group’s total

sales, was 4.6 percent of sales in fiscal years 1999 and 1998 and 5.1

percent of sales in fiscal year 1997. The gross profit margins on

products sold with extended warranties are higher than the gross

profit margins on products sold without extended warranties.

Third-party extended warranty revenue was 4.1 percent of the

Group’s total sales in fiscal year 1999 and 3.6 percent of the Group’s

total sales in fiscal years 1998 and 1997. The fiscal 1999 increase in

third-party extended warranty revenue reflects the conversion of

stores in 10 states to third-party warranty sales in June 1998.

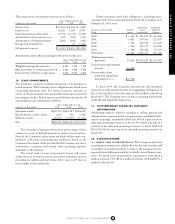

SUPERSTORE SALES PER TOTAL SQUARE FOOT

Fiscal

1999 ..................................................................................... $514

1998 ..................................................................................... $478

1997 ..................................................................................... $499

1996 ..................................................................................... $577

1995 ..................................................................................... $584

SUPERSTORE SALES PER TOTAL SQUARE FOOT.

Over the last

five years, the Group has significantly increased the percentage of

store square footage devoted to selling space. In fiscal 1995, the

Group introduced the larger format “D” stores in some markets.

These stores are intended to generate high sales volumes in spe-

cific trade areas but lower sales per total square foot than smaller

Superstores. These stores and the declines in comparable store

sales produced lower Superstore sales per total square foot in the

period from fiscal 1996 through fiscal 1998. The fiscal 1999 sales

per square foot increase primarily reflects the comparable store

sales increase.

IMPACT OF INFLATION.

Inflation has not been a significant con-

tributor to the Group’s results. In fact, during the past two years,

the average retail price has declined in virtually all of the Group’s

product categories. Although new product introductions could

help reverse this trend in selected areas, management expects no

significant short-term change overall. Because the Group pur-

chases substantially all products in U.S. dollars, prices are not

directly impacted by the value of the dollar in relation to other

foreign currencies, including the Japanese yen.

Digital Video Express

Digital Video Express has developed and is marketing a new digi-

tal video system for watching movies at home. Circuit City

Stores, Inc. holds the majority interest in the business. The

remaining interest is held by the prominent Los Angeles law firm

Ziffren, Brittenham, Branca &Fischer. The Company’s investment

in Divx is allocated to the Circuit City Group. Through the end of

fiscal 1999, the Company had invested $207 million in Divx,

$120 million of which was invested in fiscal 1999. The investment

in Divx impacts the Circuit City Group’s gross profit margin and

selling, general and administrative expense ratio.

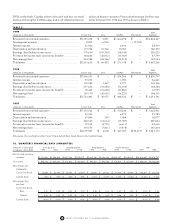

Cost of Sales, Buying and Warehousing

The gross profit margin was 24.3 percent of sales in fiscal 1999,

24.6 percent in fiscal 1998 and 24.0 percent in fiscal 1997. The

lower gross margin in fiscal 1999 reflects the strength of the per-

sonal computer business, which carries lower gross margins; the

continued highly competitive price environment for the Circuit

City business; and costs associated with Divx. Better inventory

management and increased sales of new technologies and more

fully featured products partly offset these factors. The Group

gradually has reduced its assortment in a variety of product cate-

gories to more closely match consumer demand and has carefully

managed product transitions, especially in the personal computer

business. As a result, mark-downs have decreased, reducing their

impact on the gross margin. Excluding Divx, the gross margin for

the Circuit City business was 24.4 percent of sales in fiscal 1999.

Because Divx was not selling any product in fiscal 1998 and fiscal

1997, it had no impact on gross margins in those periods.

Selling, General and Administrative Expenses

Selling, general and administrative expenses were 21.2 percent of

sales in fiscal 1999 compared with 21.5 percent in fiscal 1998 and

20.4 percent in fiscal 1997. The improved ratio in fiscal 1999 pri-

marily reflects the expense leverage gained from the comparable

store sales increase, partly offset by selling, general and adminis-

trative expenses related to Divx. Operating profits generated

by the Group’s finance operation are recorded as a reduction to

the selling, general and administrative expenses. Excluding Divx,

the expense ratio for the Circuit City business was 20.1 percent

in fiscal 1999, 21.1 percent in fiscal 1998 and 20.2 percent in

fiscal 1997.

Interest Expense

Interest expense was 0.2 percent of sales in fiscal 1999 and 0.3 per-

cent of sales in fiscal 1998 and 1997. Interest expense was incurred

CIRCUIT CITY GROUP

CIRCUIT CITY STORES, INC. 1999 ANNUAL REPORT 47