CarMax 1999 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 1999 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

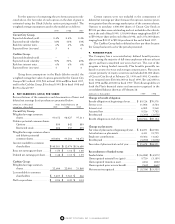

The APRs range from 6 percent to 12 percent fixed, with

default rates varying based on credit quality, but generally aggre-

gating 0.75 percent to 1.25 percent. Weighted average life of the

receivables is expected to be in the 18 month to 20 month range.

Interest cost depends on the time at which accounts were

originated, but is in the range of 5 percent to 7 percent.

13. INTEREST RATE SWAPS

In October 1994, the Company entered into five-year interest rate

swap agreements with notional amounts totaling $300 million

relating to a public issuance of securities by the master trust. As

part of this issuance, $344 million of five-year, fixed-rate certifi-

cates were issued to fund consumer credit receivables. The credit

card finance operation is servicer for the accounts, and as such,

receives its monthly cash portfolio yield after deducting interest,

charge-offs and other related costs. The underlying receivables are

based on a floating rate. The swaps were put in place to better

match funding costs to the receivables being securitized. As a

result, the master trust pays fixed-rate interest, and the Company

utilizes the swaps to convert the fixed-rate obligation to a floating-

rate, LIBOR-based obligation. These swaps were entered into as

part of the sales of receivables and are included in the gain on sales

of receivables.

Concurrent with the funding of the $175 million term loan

facility in May 1995, the Company entered into five-year interest

rate swaps with notional amounts aggregating $175 million.

These swaps effectively converted the variable-rate obligation

into a fixed-rate obligation. The fair value of the swaps is the

amount at which they could be settled. This value is based on esti-

mates obtained from the counterparties, which are two banks

highly rated by several financial rating agencies. The swaps are

held for hedging purposes and are not recorded at fair value.

Recording the swaps at fair value at February 28, 1999, would

result in a loss of $2.2 million and at February 28, 1998, would

result in a loss of $1.9 million.

The Company enters into amortizing swaps relating to the

auto loan receivable securitization to convert variable-rate financ-

ing costs to fixed-rate obligations to better match funding costs to

the receivables being securitized. In November 1995, the

Company entered into a 50-month amortizing swap with a

notional amount of $75 million and, in October 1996, entered

into a 40-month amortizing swap with a notional amount of $64

million. The Company entered into four 40-month amortizing

swaps with notional amounts totaling approximately $162 million

during fiscal 1998 and four 40-month amortizing swaps with

notional amounts totaling approximately $387 million in fiscal

1999. These swaps were entered into as part of sales of receivables

and are included in the gain on sales of receivables. The remaining

total notional amount of all swaps related to the auto loan receiv-

able securitization was approximately $499 million at February

28, 1999, $224 million at February 28, 1998, and $114 million at

February 28, 1997.

The market and credit risks associated with these interest rate

swaps are similar to those relating to other types of financial

instruments. Market risk is the exposure created by potential fluc-

tuations in interest rates and is directly related to the product

type, agreement terms and transaction volume. The Company

does not anticipate significant market risk from swaps, since their

use is to more closely match funding costs to the use of the fund-

ing. Credit risk is the exposure to nonperformance of another

party to an agreement. The Company mitigates credit risk by

dealing with highly rated counterparties.

14. COMMITMENTS AND CONTINGENT LIABILITIES

(A) INVESTMENT IN DIVX:

In May 1995, the Company agreed to

invest $30.0 million in Divx, a partnership that has developed and

is marketing a new home digital video system. That commitment

was increased to $130.0 million in September 1997. Although that

commitment was fulfilled during fiscal 1999, the Company contin-

ues to fund the operations of Divx as management continues to

explore various financing options. As of February 28, 1999, the

Company owned approximately 75 percent of the partnership.

The Company has been allocated 100 percent of the losses since

inception. The Company allocates its investment in Divx to the

Circuit City Group. As of February 28, 1999, the Company had

funded approximately $207 million for the operations of Divx.

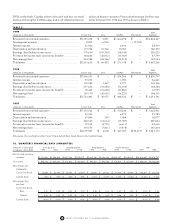

(B) LICENSING AGREEMENTS:

Divx has entered into licensing

agreements with motion picture distributors for use of their feature-

length films for the Divx system. The Company guarantees Divx’s

performance under these commitments. The licensing fees are based

on varying percentages of consumer viewing and wholesale receipts

and require minimum distributor compensation commencing from

the operational date of each agreement through the following one to

five years. As of February 28, 1999, the minimum compensation due

from Divx to the distributors is $101.0 million ($26.0 million in fiscal

2000, $32.0 million in fiscal 2001, $20.5 million in fiscal 2002, $14.5

million in fiscal 2003 and $8.0 million in fiscal 2004).

(C) LEGAL PROCEEDINGS:

In the normal course of business, the

Company is involved in various legal proceedings. Based upon the

Company’s evaluation of the information presently available,

management believes that the ultimate resolution of any such pro-

ceedings will not have a material adverse effect on the Company’s

financial position, liquidity or results of operations.

15. OPERATING SEGMENT INFORMATION

The Company conducts business in three operating segments:

Circuit City, Divx and CarMax. These segments are identified and

managed by the Company based on the different products and

services offered by each. Circuit City refers to the retail opera-

tions bearing the Circuit City name and to all related operations

such as its finance operation. This segment is engaged in the

business of selling brand-name consumer electronics, personal

computers, major appliances and entertainment software. Divx

primarily is engaged in the business of selling specially encrypted

CIRCUIT CITY STORES, INC.

CIRCUIT CITY STORES, INC. 1999 ANNUAL REPORT 43