CarMax 1999 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 1999 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

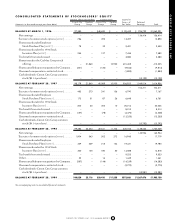

On January 24, 1997, shareholders of Circuit City Stores, Inc.

approved the creation of two common stock series. The

Company’s existing common stock was subsequently redesignated

as Circuit City Stores, Inc.–Circuit City Group Common Stock.

In an initial public offering, which was completed February 7,

1997, the Company sold 21.86 million shares of Circuit City

Stores, Inc.–CarMax Group Common Stock.

The Circuit City Group Common Stock is intended to track

the performance of the Circuit City store-related operations, the

Company’s investment in Digital Video Express and the Group’s

retained interest in the CarMax Group. The effects of this

retained interest on the Circuit City Group’s financial statements

are identified by the term “Inter-Group.”

The CarMax Group Common Stock is intended to track the

performance of the CarMax operations. The Inter-Group Interest

is not considered outstanding CarMax Group stock. Therefore,

any net earnings or loss attributed to the Inter-Group Interest is

not included in the CarMax Group’s per share calculations.

The following discussion and analysis refers to Circuit City

Stores, Inc., which includes the operations related to both the

Circuit City Group and the CarMax Group. All financial state-

ments reflect consummation of the CarMax Group stock offering

on February 7, 1997. For additional information, refer to the

“Management’s Discussion and Analysis of Results of Operations

and Financial Condition” for the Circuit City Group and for the

CarMax Group.

RESULTS OF OPERATIONS

Sales Growth

Total sales for Circuit City Stores, Inc. increased 22 percent in fiscal

1999 to $10.80 billion. In fiscal 1998, total sales were $8.87 bil-

lion, a 16 percent increase from $7.66 billion in fiscal 1997.

PERCENTAGE SALES CHANGE FROM PRIOR YEAR

Circuit City Circuit City CarMax

Stores, Inc. Group Group

Fiscal Total Total Comparable Total Comparable

1999 ............ 22% 17% 8)% 68% (2)%

1998 ............ 16% 12% (1)% 71% 6)%

1997 ............ 9% 6% (8)% 85% 23)%

1996 ............ 26% 23% 5)% 258% 12)%

1995 ............ 35% 34% 15)% 376% 43)%

THE CIRCUIT CITY GROUP.

Industry sales in Circuit City’s retail

segments have varied significantly over the past five years, result-

ing in wide variations in the Group’s sales growth. Geographic

expansion and the addition of product categories such as personal

computers were the primary contributors to the Circuit City

Group’s total sales growth early in the period. From mid-fiscal

1996 through fiscal 1998, a lack of significant product introduc-

tions resulted in lower average retails and weak sales throughout

the industry. In fiscal 1999, the industry began to emerge from this

period of declining sales. For Circuit City, the fiscal 1999 sales

reflected strong sales across all major categories with especially

strong sales in personal computers and new high technology areas

such as DIRECTV; wireless communications; DVD players, espe-

cially players with the Divx feature; and digital camcorders. The

addition of 37 Superstores also contributed to the total sales

growth.

The industry weakness in fiscal 1997 and 1998 resulted in a

highly competitive climate, and a significant number of regional

competitors closed stores. Despite the improvement in fiscal

1999, the consumer electronics industry remains highly competi-

tive. Circuit City’s primary competitors are large specialty, dis-

count or warehouse retailers with generally lower levels of service.

Because of Circuit City’s long history of providing exceptional

customer service, management believes that the Circuit City loca-

tions can continue to maintain share in existing markets and build

comparable shares in new markets.

CIRCUIT CITY STORES, INC.

CIRCUIT CITY STORES, INC. 1999 ANNUAL REPORT 23

CIRCUIT CITY STORES, INC. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION

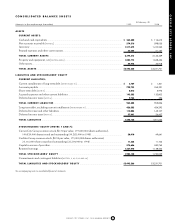

REPORTED HISTORICAL INFORMATION

(Amounts in thousands except per share data)

1999 1998 1997 1996 1995

Net sales and operating revenues..................................................

$10,804,447

$8,870,797 $7,663,811 $7,029,123 $5,582,947

Net earnings.................................................................................

$ 142,924

$ 104,311 $ 136,414 $ 179,375 $ 167,875

Net earnings (loss) per share:

Circuit City Group:

Basic ...................................................................................

$ 1.50

$ 1.14 $ 1.40 $ 1.86 $ 1.75

Diluted...............................................................................

$ 1.48

$ 1.13 $ 1.39 $ 1.84 $ 1.74

CarMax Group........................................................................

$ (0.24)

$ (0.35) $ (0.01) $ – $ –

Total assets ...................................................................................

$ 3,445,266

$3,231,701 $3,081,173 $2,526,022 $2,004,055

Long-term debt, excluding current installments...........................

$ 426,585

$ 424,292 $ 430,290 $ 399,161 $ 178,605

Deferred revenue and other liabilities ..........................................

$ 112,085

$ 145,107 $ 166,295 $ 214,001 $ 241,866

Cash dividends per share paid on

Circuit City Group common stock..........................................

$ 0.14

$ 0.14 $ 0.14 $ 0.12 $ 0.10

See notes to consolidated financial statements.