CarMax 1999 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 1999 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

interest is held by the prominent Los Angeles law firm Ziffren,

Brittenham, Branca &Fischer. The Company’s investment in Divx

is allocated to the Circuit City Group. Through the end of the fiscal

year, the Company had invested $207 million in Divx, $120 mil-

lion of which was invested in fiscal 1999. The investment in Divx

impacts the Company’s and the Circuit City Group’s gross profit

margin and selling, general and administrative expense ratio.

Cost of Sales, Buying and Warehousing

The gross profit margin was 22.6 percent of sales in fiscal 1999 com-

pared with 23.0 percent in fiscal years 1998 and 1997. The fiscal

1999 gross profit margin reflects a lower gross profit margin for

the Circuit City Group and the higher percentage of sales from

the CarMax Group. The Circuit City Group’s gross profit margin

was reduced by the strength of the personal computer business,

which carries lower gross margins; the continued highly competi-

tive price environment; and costs associated with Divx. Better

inventory management and increased sales of new technologies

and more fully featured products partly offset these factors.

Because the CarMax business produces lower gross margins than

the Circuit City business, the increased sales contribution from

CarMax reduces the Company’s overall gross profit margin even

though the CarMax Group’s gross profit margin increased from

fiscal 1998 to fiscal 1999. The Company’s fiscal 1998 gross margin

reflects better inventory management and a stronger sales perfor-

mance in higher margin categories for the Circuit City Group,

offset by the higher sales contribution from the CarMax Group.

Selling, General and Administrative Expenses

Selling, general and administrative expenses were 20.2 percent of

sales in fiscal 1999 compared with 20.8 percent in fiscal 1998 and

19.7 percent in fiscal 1997. The fiscal 1999 decrease primarily

reflects the sales leverage gained from the Circuit City Group’s

comparable store sales increase, partly offset by the impact of sell-

ing, general and administrative expenses related to Divx.

CarMax’s lower expense structure reduces the Company’s overall

expense-to-sales ratio. The higher ratio in fiscal 1998 compared

with fiscal 1997, reflects the impact of lower comparable store

sales for the Circuit City Group, a decline in profits from the

Circuit City Group’s finance operation and the expenses related to

Divx. Operating profits generated by the Company’s finance

operations are recorded as a reduction to selling, general and

administrative expenses.

Interest Expense

Interest expense was 0.3 percent of sales in fiscal years 1999 and

1998 compared with 0.4 percent in fiscal 1997. Interest expense

was incurred on debt used to fund store expansion, working capi-

tal and the investment in Divx.

Net Earnings

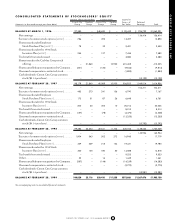

Net earnings for Circuit City Stores, Inc. increased 37 percent to

$142.9 million in fiscal 1999. The increase reflects the 48 percent

earnings increase achieved by the Circuit City business, partly

offset by the investment in Digital Video Express and the CarMax

Group losses. In fiscal 1998, net earnings were $104.3 million, a

decrease of 24 percent from $136.4 million in fiscal 1997. Net

earnings for all three fiscal years reflect the results of the Circuit

City business, the Company’s investment in Digital Video Express

and the losses incurred by the CarMax Group.

RECENT ACCOUNTING PRONOUNCEMENTS

In June 1998, the Financial Accounting Standards Board issued

Statement of Financial Accounting Standards No. 133, “Account-

ing for Derivative Instruments and Hedging Activities.” SFAS No.

133 is effective for fiscal years beginning after June 15, 1999. SFAS

No. 133 standardizes the accounting for derivative instruments,

including certain derivative instruments embedded in other con-

tracts, and requires that an entity recognize those items as either

assets or liabilities and measure them at fair value. The Company

does not expect SFAS No. 133 to have a material impact on its

financial position, results of operations or cash flows.

In April 1998, the AICPA issued SOP 98-5 “Reporting on the

Costs of Start-Up Activities.” SOP 98-5 is effective for fiscal years

beginning after December 15, 1998. It requires costs of start-up

activities, including organization and pre-opening costs, to be

expensed as incurred. The Company has determined that SOP

98-5 will not have a material impact on its financial position,

annual results of operations or cash flows.

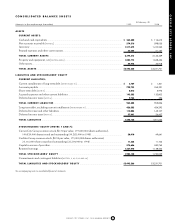

FINANCIAL CONDITION

Liquidity and Capital Resources

In fiscal 1999, net cash provided by operating activities was

$254.2 million compared with $194.6 million in fiscal 1998 and

$14.2 million in fiscal 1997. The fiscal 1999 increase primarily

reflects a decrease in net accounts receivable and higher earnings

for the Circuit City business, partly offset by increased inventory

for CarMax and the increased investment in Digital Video

Express. The fiscal 1998 increase primarily reflects a reduction in

inventory related to the Circuit City business, a smaller increase

in net accounts receivable and a slight earnings increase for the

Circuit City business, partly offset by the investment in Digital

Video Express, greater automotive inventory to support a larger

number of CarMax superstore openings and a higher loss from the

CarMax business.

Most financial activities, including the investment of surplus

cash and the issuance and repayment of short-term and long-term

debt, are managed by the Company on a centralized basis.

Interest-bearing loans, with terms determined by the board of

directors, are used to manage cash between the Groups. These

loans are reflected as inter-group receivables or payables on the

financial statements of each Group.

Capital expenditures have been funded through sale-leaseback

transactions, landlord reimbursements, proceeds from the

CarMax Group equity offering and short- and long-term debt.

Capital expenditures of $367.0 million in fiscal 1999 reflect

Circuit City and CarMax stores opened or remodeled during the

year and a portion of the stores opening in fiscal 2000. The sale-

leaseback and landlord reimbursement transactions completed in

fiscal 1999 totaled $273.6 million. Capital expenditures of $588.1

million in fiscal 1998 and $542.0 million in fiscal 1997 were

largely incurred in connection with the Company’s expansion

programs. Sale-leaseback and landlord reimbursement transac-

tions were $297.1 million in fiscal 1998 and $332.7 million in

fiscal 1997.

CIRCUIT CITY STORES, INC.

CIRCUIT CITY STORES, INC. 1999 ANNUAL REPORT 25