CarMax 1999 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 1999 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

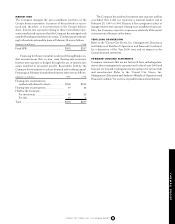

Operations Outlook

Late in fiscal 1999, management announced that it would delay

CarMax’s entry into the Los Angeles market until fiscal 2001 and

focus on improving profitability in existing markets. The single-

store Nashville, Tenn., market will likely be the Group’s only new

market in fiscal 2000. Instead, the company expects to add satel-

lite stores and new-car franchises into existing markets. CarMax

also continues to refine its marketing programs to increase con-

sumer awareness and build customer traffic for all locations, but

especially those in the underperforming markets. Management

believes the fiscal 2000 growth plan will allow CarMax to produce

a modest loss or reach break-even in fiscal 2000. In the following

year, CarMax expects to enter the Los Angeles market with a

combination of its current “A” format stores and satellite stores.

RECENT ACCOUNTING PRONOUNCEMENTS

Refer to the “Circuit City Stores, Inc. Management’s Discussion

and Analysis of Results of Operations and Financial Condition”

for a review of recent accounting pronouncements.

FINANCIAL CONDITION

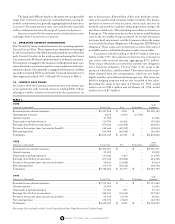

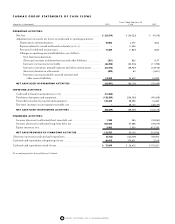

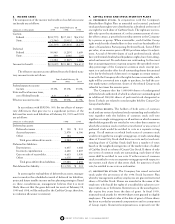

Net cash used in operating activities was $82.0 million in fiscal

1999, $86.1 million in fiscal 1998 and $25.4 million in fiscal 1997.

The net cash used in operations primarily reflects inventory to

support store openings and additional new-car franchises, net

losses for all periods and an increase in net accounts receivable,

partly offset by an increase in accounts payable.

Most financial activities, including the investment of surplus

cash and the issuance and repayment of short-term and long-term

debt, are managed by the Company on a centralized basis.

Investment of surplus cash from the equity offering has been allo-

cated to the CarMax Group. Allocated debt of the CarMax Group

consists of (1) Company debt, if any, that has been allocated in its

entirety to the CarMax Group and (2) a portion of the Company’s

debt that is allocated between the Circuit City Group and the

CarMax Group. This pooled debt bears interest at a rate based on

the average pooled debt balance. Expenses related to increases in

pooled debt are reflected in the weighted average interest rate of

the pooled debt.

In addition to the allocation of cash and debt, interest-bearing

loans, with terms determined by the board of directors, are used to

manage cash between the Groups. These loans are reflected as

inter-group receivables or payables on the financial statements of

each Group. During fiscal 1998, an inter-group note was issued by

the Circuit City Group on behalf of the CarMax Group as a tem-

porary financing vehicle for the CarMax inventory. At fiscal year-

end 1999 and 1998, the CarMax Group maintained no inter-group

notes, payables or receivables with the Circuit City Group. At

February 28, 1997, the CarMax Group had an inter-group receiv-

able totaling $48.1 million with the Circuit City Group.

The CarMax Group’s capital expenditures were $138.3 mil-

lion in fiscal 1999, $234.3 million in fiscal 1998 and $90.4 million

in fiscal 1997. CarMax’s capital expenditures through fiscal 1999

were related to store expansion. Capital expenditures have been

funded through sale-leaseback transactions, landlord reimburse-

ments, proceeds from the CarMax Group equity offering and allo-

cated short- and long-term debt. Sale-leaseback and landlord

reimbursement transactions totaled $139.3 million in fiscal 1999,

$98.1 million in fiscal 1998 and $16.5 million in fiscal 1997.

During fiscal 1999, the CarMax Group acquired the Toyota

franchise rights and the related assets of Laurel Automotive

Group, Inc.; the franchise rights and the related assets of Mauro

Auto Mall, Inc.; the franchise rights and the related assets of

Nissan of Greenville, Inc.; and the Mitsubishi franchise rights and

the related assets of Boomershine Automotive, Inc. for a total of

$49.6 million. The acquisitions were financed through cash pay-

ments totaling $41.6 million and the issuance of two promissory

notes totaling $8.0 million. Costs in excess of the acquired net

tangible assets, which are primarily inventory, have been recorded

as goodwill and covenants not to compete.

In fiscal 1996, Circuit City Stores, Inc. initiated an asset secu-

ritization program on behalf of the CarMax Group. At the end of

fiscal 1999, that program allowed the transfer of up to $575.0 mil-

lion in auto loan receivables. At February 28, 1999, securitized

receivables totaled $539.0 million. The receivables are sold to an

unaffiliated third party with the servicing retained. Management

expects that securitization programs that allow for the transfer of

receivables through both private placement and the public mar-

ket, can be used to fund increases in receivables resulting from

CarMax’s continued growth.

In fiscal 1999, CarMax entered into a $200.0 million one-

year, renewable inventory financing arrangement with an asset-

backed commercial paper conduit. The arrangement provides

funding for the acquisition of vehicle inventory through the use of

a non-affiliated special purpose company. As of February 28, 1999,

CarMax had not yet used the financing facility; however, manage-

ment expects the facility to be phased in during fiscal 2000 as vari-

ous state regulatory requirements are met.

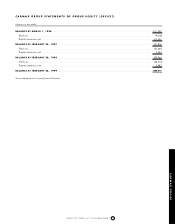

Late in fiscal 1997, Circuit City Stores, Inc. raised a net of

$412.3 million through the initial public offering of 21.86 million

shares of newly created CarMax Group Common Stock. In fiscal

1997, the Group used approximately $187 million of the net pro-

ceeds to repay its allocated portion of Circuit City Stores, Inc.

indebtedness. Management has used the remainder of the net pro-

ceeds to help finance the CarMax expansion.

Management believes that the proceeds from sales of prop-

erty and equipment and receivables, equity issuances, the use of

the renewable inventory financing facility, future increases in

Circuit City Stores, Inc. debt allocated to the CarMax Group and

cash generated by operations will be sufficient to fund the

CarMax Group’s capital expenditures and operations. In fiscal

2000, the Group anticipates capital expenditures of approxi-

mately $50.0 million.

66 CIRCUIT CITY STORES, INC. 1999 ANNUAL REPORT