CarMax 1999 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1999 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During fiscal 1999, the CarMax Group acquired the Toyota

franchise rights and the related assets of Laurel Automotive

Group, Inc.; the franchise rights and the related assets of Mauro

Auto Mall, Inc.; the franchise rights and the related assets of

Nissan of Greenville, Inc.; and the Mitsubishi franchise rights and

the related assets of Boomershine Automotive, Inc. for a total of

$49.6 million. The acquisitions were financed through cash pay-

ments totaling $41.6 million and the issuance of two promissory

notes totaling $8.0 million. Costs in excess of the acquired net

tangible assets, which are primarily inventory, have been recorded

as goodwill and covenants not to compete.

Receivables generated by the consumer finance operations

are funded through securitization transactions that allow the

operations to sell their receivables while retaining a small interest

in them. The Circuit City Group’s finance operation has a master

trust securitization facility for its private-label credit card that

allows the transfer of up to $1.38 billion in receivables through

both private placement and the public market. A second master

trust securitization program allows for the transfer of up to $1.75

billion in receivables related to the operation’s bankcard pro-

grams. Receivables securitized under the master trust facilities

totaled $2.76 billion at February 28, 1999. In fiscal 1996, Circuit

City Stores, Inc. initiated an asset securitization program on

behalf of the CarMax Group. At the end of fiscal 1999, that pro-

gram allowed for the transfer of up to $575.0 million in auto loan

receivables. At February 28, 1999, securitized receivables totaled

$539.0 million. Under the securitization programs, receivables are

sold to an unaffiliated third party with the servicing retained.

Management expects that these securitization programs can be

expanded to accommodate future receivables growth.

In fiscal 1999, CarMax entered into a $200.0 million one-

year, renewable inventory financing arrangement with an asset-

backed commercial paper conduit. The arrangement provides

funding for the acquisition of vehicle inventory through the use of

a non-affiliated special purpose company. As of February 28, 1999,

CarMax had not yet used the financing facility; however, manage-

ment expects the facility to be phased in during fiscal 2000 as vari-

ous state regulatory requirements are met.

Capital Structure

Total assets at February 28, 1999, were $3.45 billion, up $213.6

million or 7 percent, since February 28, 1998. A $107.1 million

increase in inventory contributed to the rise in total assets.

Over the past three years, expansion for the Groups has been

funded with internally generated cash, sale-leaseback transac-

tions, proceeds from the CarMax equity offering, operating leases

and long-term debt. Consumer receivables have been funded

through securitization transactions. Late in fiscal 1997, Circuit

City Stores, Inc. raised a net of $412.3 million through the initial

public offering of 21.86 million shares of newly created CarMax

Group Common Stock. In fiscal 1997, the CarMax Group used

approximately $187 million of the net proceeds to repay its allo-

cated portion of Circuit City Stores, Inc. indebtedness.

Management has used the remainder of the net proceeds to help

finance the CarMax expansion. In fiscal 1997, the Company also

entered into a five-year, $130 million unsecured bank term loan

agreement.

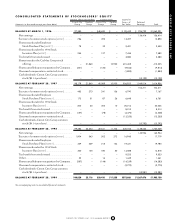

During the period from fiscal 1995 to fiscal 1999, stockhold-

ers’ equity grew substantially. From fiscal 1998 to fiscal 1999,

stockholders’ equity increased 10 percent to $1.91 billion.

Capitalization for the past five years is illustrated in the

“Capitalization” table below. Higher earnings for the Circuit City

business, partly offset by the investment in Digital Video Express

and losses from the CarMax Group, produced a return on equity

of 7.9 percent in fiscal 1999 compared with 6.2 percent in fiscal

1998. The returns are below the Company’s long-term objective

but reflect the investments in the development and launch of the

Divx system and the expansion of CarMax in fiscal years 1999 and

1998. In fiscal 1998, the challenging environment for Circuit City

also contributed to the below-objective return.

Management believes that proceeds from sales of property

and equipment and receivables, operating leases, equity issuances,

CarMax’s use of the renewable inventory financing facility and

cash generated by operations will be sufficient to fund the capital

expenditures of the Company. In fiscal 2000, management antici-

pates capital expenditures of approximately $315 million. At the

end of fiscal 1999, the Company maintained a multi-year $150.0

million unsecured revolving credit agreement and $370.0 million

in seasonal lines that are renewed annually with various banks.

Management remains in discussions with potential financing

partners for Divx, but has not obtained any acceptable commitments

to date. The Company has provided guarantees relating to licensing

agreements with motion picture distributors for use of their films by

the Divx system. The licensing fees are based on varying percent-

ages of consumer viewing and wholesale receipts and require mini-

mum distributor compensation commencing from the operational

date of each agreement through the following one to five years.

The Groups rely on the external debt or equity of Circuit

City Stores, Inc. to provide working capital needed to fund net

assets not otherwise financed through operating income, sale-

leasebacks or the securitization of receivables. All significant

financial activities of each Group are managed by the Company

on a centralized basis and are dependent on the financial condi-

tion of the Company. These financial activities include the invest-

ment of surplus cash, issuance and repayment of debt,

securitization of receivables and sale-leasebacks of real estate.

26 CIRCUIT CITY STORES, INC. 1999 ANNUAL REPORT

CAPITALIZATION

Fiscal 1999 1998 1997 1996 1995

(Dollar amounts in millions)

$ % $ % $ % $ % $ %

Long-term debt, excluding

current installments........................ 426.6 17 424.3 18 430.3 19 399.2 23 178.6 14

Other long-term liabilities .................. 149.7 6 171.5 7 199.4 9 231.8 14 241.9 19

Total stockholders’ equity.................... 1,905.1 77 1,730.0 75 1,614.8 72 1,063.9 63 877.4 67

Total capitalization.............................. 2,481.4 100 2,325.8 100 2,244.5 100 1,694.9 100 1,297.9 100