CarMax 1999 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 1999 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

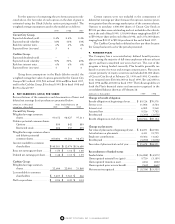

on allocated debt used to fund store expansion, working capital

and the investment in Divx.

Income Taxes

The Group’s effective income tax rate was 38.1 percent in fiscal

year 1999, 38.3 percent in fiscal year 1998 and 38.2 percent in fiscal

1997. The shifts in the tax rate reflect the state tax impact of varia-

tions in taxable income produced by the Group’s separate legal oper-

ating entities.

Earnings before the Inter-Group Interest in the

CarMax Group

Earnings before the Inter-Group Interest in the CarMax Group

increased 20 percent to $166.4 million in fiscal 1999. In fiscal 1998,

earnings before the Inter-Group Interest in the CarMax Group were

$138.5 million, a 5 percent decrease from $145.7 million in fiscal

1997. The results for all three years include the Company’s invest-

ment in Digital Video Express. Excluding the Company’s invest-

ment in Divx, earnings for the Circuit City Group before the

Inter-Group Interest in the CarMax Group increased 48 percent to

$235.0 million in fiscal 1999 compared with $159.2 million in fiscal

1998 and $153.6 million in fiscal 1997.

Net Loss Related to the Inter-Group Interest in the

CarMax Group

The CarMax Group has incurred losses since its startup in fiscal

1994. The net loss attributed to the Circuit City Group’s Inter-

Group Interest in the CarMax Group was $18.1 million in fiscal

1999, $26.5 million in fiscal 1998 and $9.1 million in fiscal 1997.

Net Earnings

Net earnings for the Circuit City Group were $148.4 million in fiscal

1999, $112.1 million in fiscal 1998 and $136.7 million in fiscal 1997.

Net earnings per share were $1.48 in fiscal 1999, $1.13 in fiscal 1998

and $1.39 in fiscal 1997. The improved results in fiscal 1999 primar-

ily reflect the renewed strength in the Company’s Circuit City busi-

ness, which was partly offset by the increased investment in Divx

and the losses incurred by the CarMax Group. The lower earnings in

fiscal year 1998 compared with fiscal year 1997 reflect the challeng-

ing industry environment faced by the Circuit City business at that

time, the Company’s higher investment in Digital Video Express and

increased losses incurred by the CarMax Group.

Operations Outlook

Management expects that industry growth will be the primary

contributor to sales and earnings growth for the Circuit City busi-

ness during the coming decade. Management anticipates that

growth in the household penetration of products such as

DIRECTV, wireless communications, digital camcorders, DVD

players and personal computers will be the major contributors to

this growth. Management also believes that the introductions of

digital and high-definition televisions and multi-functional set top

boxes will help drive industry sales to new levels. Management

expects to focus its attention on maximizing store volumes in the

existing Circuit City Superstores. These efforts will include the

remodeling of approximately 50 Superstores in fiscal 2000 to

include the Group’s new merchandising initiatives.

Circuit City has established its presence in virtually all of the

nation’s top 100 markets and will continue adding to the existing

store base as attractive market opportunities arise. Management

believes that the Group has the opportunity to operate approxi-

mately 800 Superstores within the United States. In fiscal 2000,

the Group will continue to expand its Superstore concept into

new trade areas, adding approximately 35 stores that are either

new-market entries or fill-in locations in existing Circuit City

markets, including approximately seven additional stores in the

New York metropolitan area. Management anticipates that the

industry’s growth, ongoing expansion and continued strong oper-

ating controls will enable the Circuit City business to generate

earnings growth of 20 percent to 25 percent in fiscal 2000.

Management continues to be encouraged by the long-term

profit potential of the Company’s investment in Digital Video

Express. The early sales results exceeded management’s expecta-

tions, as DVD players with the Divx feature captured a 20 percent

to 25 percent share of DVD player sales during the last quarter

of the fiscal year. Titles are available from major studios. Divx

expects eight player brands to be available in calendar 1999. At

February 28, 1999, approximately 370 titles were available on

Divx discs and Divx plans to add 30 to 40 titles each month in

fiscal 2000. Management remains in active discussions with

potential financing and distribution partners for Divx and is opti-

mistic that the Company will complete one or more transactions

in fiscal 2000. However, in the event that additional financing is

not obtained, management does not expect the costs associated

with Divx in fiscal 2000 to exceed those incurred in fiscal 1999.

Management expects that CarMax’s financial performance

will improve to a modest loss or to break-even in fiscal 2000. The

CarMax results will be partly reflected in the Circuit City Group’s

Inter-Group Interest.

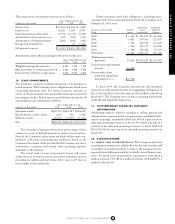

RECENT ACCOUNTING PRONOUNCEMENTS

Refer to the “Circuit City Stores, Inc. Management’s Discussion

and Analysis of Results of Operations and Financial Condition”

for a review of recent accounting pronouncements.

FINANCIAL CONDITION

In fiscal 1999, net cash provided by operating activities was

$336.2 million compared with $280.7 million provided by operat-

ing activities in fiscal 1998 and $39.7 million provided by oper-

ating activities in fiscal 1997. The fiscal 1999 increase primarily

reflects a decrease in net accounts receivable and the improve-

ment in net earnings for the Circuit City business, partly offset

by the higher investment in Digital Video Express. The fiscal

1998 increase reflects a reduction in inventory, a smaller increase

in net accounts receivable and a slight earnings increase for the

Circuit City business, partly offset by the investment in Digital

Video Express.

Most financial activities, including the investment of surplus

cash and the issuance and repayment of short-term and long-term

debt, are managed by the Company on a centralized basis.

Allocated debt of the Circuit City Group consists of (1) Company

debt, if any, that has been allocated in its entirety to the Circuit

City Group and (2) a portion of the Company’s debt that is allo-

cated between the Groups. This pooled debt bears interest at a

rate based on the average pooled debt balance. Expenses related

to increases in pooled debt are reflected in the weighted average

interest rate of the pooled debt.

48 CIRCUIT CITY STORES, INC. 1999 ANNUAL REPORT