CarMax 1999 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 1999 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. 1999 ANNUAL REPORT 63

CIRCUIT CITY GROUP

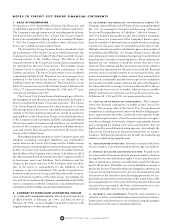

The market and credit risks associated with these interest rate

swaps are similar to those relating to other types of financial

instruments. Market risk is the exposure created by potential fluc-

tuations in interest rates and is directly related to the product

type, agreement terms and transaction volume. The Company

does not anticipate significant market risk from swaps, since their

use is to more closely match funding costs to the use of the fund-

ing. Credit risk is the exposure to nonperformance of another

party to an agreement. Credit risk is mitigated by dealing with

highly rated counterparties.

15. COMMITMENTS AND CONTINGENT LIABILITIES

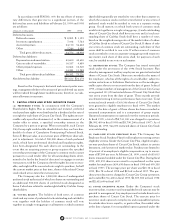

(A) INVESTMENT IN DIVX:

In May 1995, the Company agreed to

invest $30.0 million in Divx, a partnership that has developed and

is marketing a new home digital video system. That commitment

was increased to $130.0 million in September 1997. Although that

commitment was fulfilled during fiscal 1999, the Company contin-

ues to fund the operations of Divx as management continues to

explore various financing options. As of February 28, 1999, the

Company owned approximately 75 percent of the partnership.

The Company has been allocated 100 percent of the losses since

inception. The Company allocates its investment in Divx to the

Circuit City Group. As of February 28, 1999, the Company had

funded approximately $207 million for the operations of Divx.

(B) LICENSING AGREEMENTS:

Divx has entered into licensing

agreements with motion picture distributors for use of their feature-

length films for the Divx system. The Company guarantees Divx’s

performance under these commitments. The licensing fees are based

on varying percentages of consumer viewing and wholesale receipts

and require minimum distributor compensation commencing from

the operational date of each agreement through the following one to

five years. As of February 28, 1999, the minimum compensation due

from Divx to the distributors is $101.0 million ($26.0 million in fiscal

2000, $32.0 million in fiscal 2001, $20.5 million in fiscal 2002, $14.5

million in fiscal 2003 and $8.0 million in fiscal 2004).

(C) LEGAL PROCEEDINGS:

In the normal course of business, the

Company is involved in various legal proceedings. Based upon the

Circuit City Group’s evaluation of the information presently available,

management believes that the ultimate resolution of any such pro-

ceedings will not have a material adverse effect on the Circuit City

Group’s financial position, liquidity or results of operations.

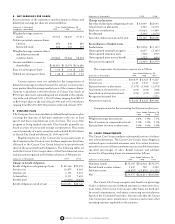

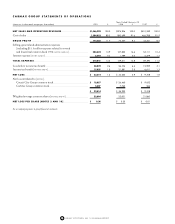

16. QUARTERLY FINANCIAL DATA (UNAUDITED)

(Amounts in thousands

First Quarter Second Quarter Third Quarter Fourth Quarter Year

except per share data)

1999 1998 1999 1998 1999 1998 1999 1998 1999 1998

Net sales and operating

revenues ....................... $1,924,727 $1,679,350 $2,117,123 $1,814,139 $2,266,956 $1,917,133 $3,029,343 $2,585,969 $9,338,149 $7,996,591

Gross profit......................... $ 464,618 $ 401,649 $ 525,470 $ 453,559 $ 552,345 $ 466,396 $ 730,320 $ 648,553 $2,272,753 $1,970,157

Earnings before Inter-Group

Interest in the CarMax

Group........................... $ 15,748 $ 13,697 $ 34,427 $ 29,226 $ 21,575 $ 21,078 $ 94,688 $ 74,533 $ 166,438 $ 138,534

Net earnings ....................... $ 13,269 $ 12,749 $ 32,147 $ 27,879 $ 15,945 $ 14,012 $ 87,020 $ 57,434 $ 148,381 $ 112,074

Net earnings per share:

Basic ............................. $ 0.13 $ 0.13 $ 0.32 $ 0.28 $ 0.16 $ 0.14 $ 0.87 $ 0.58 $ 1.50 $ 1.14

Diluted......................... $ 0.13 $ 0.13 $ 0.32 $ 0.28 $ 0.16 $ 0.14 $ 0.86 $ 0.58 $ 1.48 $ 1.13

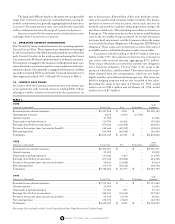

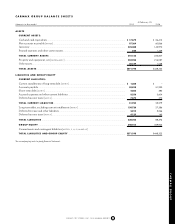

INDEPENDENT AUDITORS’ REPORT

The Board of Directors and Stockholders

of Circuit City Stores, Inc.:

We have audited the accompanying balance sheets of the Circuit

City Group (as defined in Note 1) as of February 28, 1999 and 1998

and the related statements of earnings, group equity and cash flows

for each of the fiscal years in the three-year period ended February

28, 1999. These financial statements are the responsibility of Circuit

City Stores, Inc.’s management. Our responsibility is to express an

opinion on these financial statements based on our audits.

We conducted our audits in accordance with generally

accepted auditing standards. Those standards require that we plan

and perform the audit to obtain reasonable assurance about

whether the financial statements are free of material misstatement.

An audit includes examining, on a test basis, evidence supporting

the amounts and disclosures in the financial statements. An audit

also includes assessing the accounting principles used and signifi-

cant estimates made by management, as well as evaluating the

overall financial statement presentation. We believe that our

audits provide a reasonable basis for our opinion.

As more fully discussed in Note 1, the financial statements of

the Circuit City Group should be read in conjunction with the

consolidated financial statements of Circuit City Stores, Inc. and

subsidiaries and the financial statements of the CarMax Group.

The Circuit City Group has accounted for its interest in the

CarMax Group in a manner similar to the equity method of

accounting. Generally accepted accounting principles require that

the CarMax Group be consolidated with the Circuit City Group.

In our opinion, except for the effects of not consolidating the

Circuit City Group and the CarMax Group as discussed in the

preceding paragraph, the financial statements referred to above

present fairly, in all material respects, the financial position of the

Circuit City Group as of February 28, 1999 and 1998 and the

results of its operations and its cash flows for each of the fiscal

years in the three-year period ended February 28, 1999 in confor-

mity with generally accepted accounting principles.

Richmond, Virginia

April 2, 1999