CarMax 1999 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 1999 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MARKET RISK

The Company manages the private-label and bankcard revolving

loan portfolios of the Circuit City Group’s finance operation and

the installment loan portfolio of the CarMax Group’s finance

operation. Portions of these portfolios are securitized and, there-

fore, are not presented on the Company’s balance sheet. Interest

rate exposure relating to these receivables represents a market risk

exposure that the Company has managed with matched funding

and interest rate swaps.

Revolving Loans

Interest rates charged on the managed private-label and bankcard

portfolios are primarily indexed to the prime rate, adjustable on a

monthly basis, with the balance at a fixed annual percentage rate.

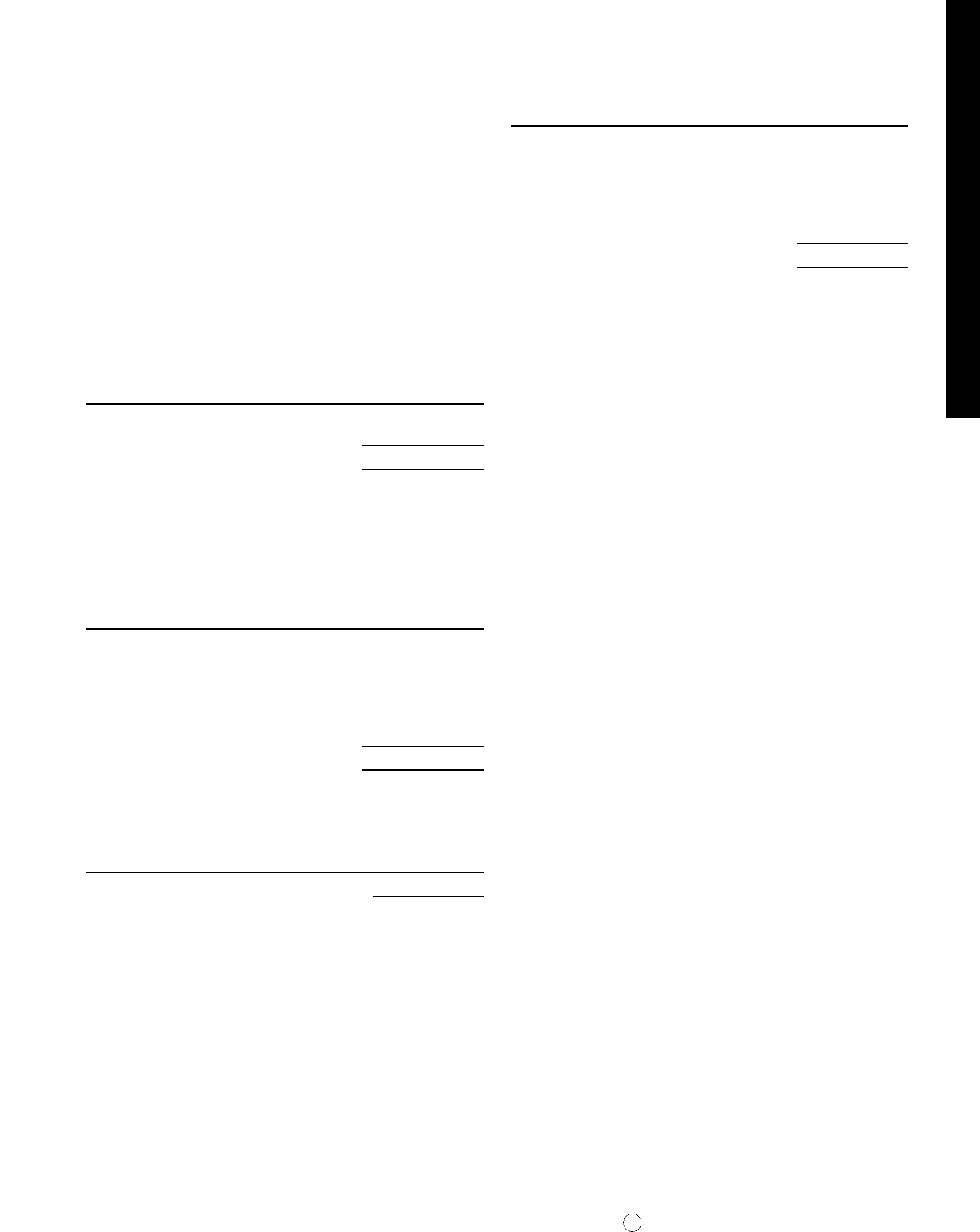

Total principal outstanding at February 28 had the following APR

structure:

(Amounts in millions)

1999 1998

Indexed to prime rate.................................... $2,714 $2,523

Fixed APR..................................................... 243 227

Total ............................................................. $2,957 $2,750

Financing for the securitization programs is achieved primar-

ily through the issuance of public market debt, which is issued

either at floating rates based on LIBOR or at fixed rates. Certain of

the fixed-rate issuances have been swapped to LIBOR. Receivables

held by the Company for investment or sale are financed with

working capital. At February 28, financings were as follows:

(Amounts in millions)

1999 1998

Floating-rate (including synthetic

alteration) securitizations........................ $2,568 $2,211

Fixed-rate securitizations.............................. 187 290

Held by the Company:

For investment......................................... 162 204

For sale .................................................... 40 45

Total ............................................................. $2,957 $2,750

Automobile Installment Loans

Total principal outstanding for fixed-rate automobile loans at

February 28 was as follows:

(Amounts in millions)

1999 1998

Fixed APR........................................................ $592 $297

Financing for these receivables is achieved through bank con-

duit securitizations that, in turn, issue floating-rate securities.

Interest rate exposure is hedged through the use of interest rate

swaps matched to projected payoffs. Receivables held by the

Company for investment or sale are financed with working capital.

Financings at February 28 and related interest rates were as follows:

(Amounts in millions)

1999 1998

Floating-rate securitizations

synthetically altered to fixed ...................... $500 $224

Floating-rate securitizations ............................ 39 44

Held by the Company:

For investment............................................ 38 23

For sale ....................................................... 15 6

Total ................................................................ $592 $297

The Company has analyzed its interest rate exposure and has

concluded that it did not represent a material market risk at

February 28, 1999 or 1998. Because programs are in place to man-

age interest rate exposure relating to the consumer loan portfo-

lios, the Company expects to experience relatively little impact as

interest rates fluctuate in the future. The Company also has the

ability to adjust fixed-APR revolving cards and the index on float-

ing-rate cards, subject to cardholder ratification, but does not cur-

rently anticipate the need to do so.

YEAR 2000 CONVERSION

The following disclosure is a Year 2000 readiness disclosure state-

ment pursuant to the Year 2000 Readiness Disclosure Act. The

Year 2000 issue arises because many computer programs use two

digits rather than four to define the applicable year. Using two

digits to define dates after January 1, 2000, could result in a system

failure or miscalculations that cause disruption of operations

including, among other things, a temporary inability to process

transactions, process invoices or engage in similar normal business

activities. In addition to computer systems, any equipment with

embedded systems that involve date-sensitive functions are at risk

if two digits have been used rather than four. Embedded systems

are specialized microchips used to control, monitor or assist the

operation of electrical equipment.

In fiscal 1997, the Company began a Year 2000 date conver-

sion project to address necessary code changes, testing and imple-

mentation for its systems. This project includes internally

developed information technology systems, purchased and leased

software and hardware, embedded systems and electronic data

interchange transaction processing. The Company has employed

both internal and external resources to reprogram or replace and

test the software for Year 2000 modifications. The Company has

completed its remediation, forward-date testing and production

implementation efforts for its internally developed and externally

purchased systems. Replacement work and enterprise-level testing

is scheduled to be completed by approximately July 1999.

With regard to embedded systems, the Company has identi-

fied approximately 200 distinct makes and models used for envi-

ronmental controls, fire detection and monitoring, burglar

detection and monitoring, elevators, office equipment and unin-

terruptible power supplies. As of February 28, 1999, approxi-

mately 98 percent of these embedded systems are believed to be

Year 2000 compliant. The remaining 2 percent are expected to be

compliant by June 1999, except for certain low-impact embedded

systems that will be left untested because the cost of compliance

testing is believed to far exceed the risk or cost of an outage.

CIRCUIT CITY STORES, INC.

CIRCUIT CITY STORES, INC. 1999 ANNUAL REPORT 27