CarMax 1999 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 1999 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

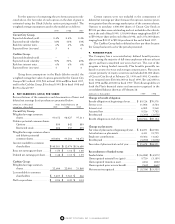

1. BASIS OF PRESENTATION

On January 24, 1997, shareholders of Circuit City Stores, Inc. and

its subsidiaries approved the creation of two common stock series.

The Company’s existing common stock was subsequently redesig-

nated as Circuit City Stores, Inc.–Circuit City Group Common

Stock. In an initial public offering, which was completed February

7, 1997, the Company sold 21.86 million shares of Circuit City

Stores, Inc.–CarMax Group Common Stock.

The Circuit City Group Common Stock is intended to track

the performance of the Circuit City store-related operations, the

Company’s investment in Digital Video Express and the Group’s

retained interest in the CarMax Group. The CarMax Group

Common Stock is intended to track the performance of the

CarMax operations. The Circuit City Group held a 76.6 percent

interest in the CarMax Group at February 28, 1999, a 77.3 percent

interest at February 28, 1998, and a 77.5 percent interest at

February 28, 1997.

Notwithstanding the attribution of the Company’s assets and

liabilities (including contingent liabilities) and stockholders’

equity between the Circuit City Group and the CarMax Group

for the purposes of preparing their respective financial statements,

holders of Circuit City Stock and holders of CarMax Stock are

shareholders of the Company and continue to be subject to all of

the risks associated with an investment in the Company and all of

its businesses, assets and liabilities. Such attribution and the

change in the equity structure of the Company does not affect

title to the assets or responsibility for the liabilities of the

Company or any of its subsidiaries. The results of operations or

financial condition of one Group could affect the results of opera-

tions or financial condition of the other Group. Accordingly, the

Company’s consolidated financial statements included herein

should be read in conjunction with the financial statements of

each Group.

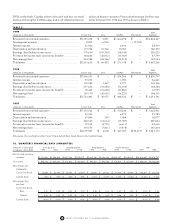

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(A) PRINCIPLES OF CONSOLIDATION:

The consolidated finan-

cial statements include the accounts of the Circuit City Group,

including Divx, and the CarMax Group, which combined com-

prise all accounts of the Company. All significant intercompany

balances and transactions have been eliminated in consolidation.

(B) CASH AND CASH EQUIVALENTS:

Cash equivalents of

$216,129,000 at February 28, 1999, and $71,750,000 at February

28, 1998, consist of highly liquid debt securities with original

maturities of three months or less.

(C) TRANSFERS AND SERVICING OF FINANCIAL ASSETS:

The

Company adopted Statement of Financial Accounting Standards

No. 125, “Accounting for Transfers and Servicing of Financial

Assets and Extinguishments of Liabilities,” effective January 1,

1997. For transfers that qualify as sales, the Company recognizes

gains or losses as a component of the Company’s finance opera-

tions. For transfers of financial assets to qualify for sale accounting,

control over the assets must be surrendered at the time of sale.

Multiple estimates are used to calculate the gain or loss on sales of

receivables under SFAS No. 125. Finance charge income, default

rates and payment rates are estimated using projections developed

from the prior 12 months of operating history. These estimates are

adjusted for any industry or portfolio trends that have been

observed. The resulting cash flow projections are present valued at

a discount rate appropriate for the type of asset and risk. Retained

interests (such as residual interests in a securitization trust, cash

reserve accounts and rights to future interest from serviced assets

that exceed contractually specified servicing fees) are included in

net accounts receivable and are carried at fair value with changes in

fair value reflected in earnings. Loan receivables held for sale are

carried at the lower of cost or market, whereas loan receivables

held for investment are carried at cost less an allowance for losses.

At February 28, 1999 and 1998, cost approximates fair value.

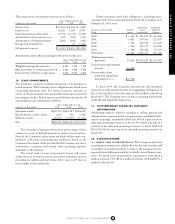

(D) FAIR VALUE OF FINANCIAL INSTRUMENTS:

The carrying

value of the Company’s financial instruments, excluding interest rate

swaps held for hedging purposes, approximates fair value. Credit risk

is the exposure created by the potential nonperformance of another

material party to an agreement due to changes in economic, industry

or geographic factors. The Company mitigates credit risk by dealing

only with counterparties that are highly rated by several financial rat-

ing agencies. Accordingly, the Company does not anticipate material

loss for nonperformance. The Company broadly diversifies all finan-

cial instruments along industry, product and geographic areas.

(E) INVENTORY:

Inventory is stated at the lower of cost or mar-

ket. Cost is determined by the average cost method for the Circuit

City Group’s inventory and by specific identification for the

CarMax Group’s vehicle inventory. Parts and labor used to recon-

dition vehicles, as well as transportation and other incremental

expenses associated with acquiring vehicles, are included in the

CarMax Group’s inventory.

(F) PREPAID ROYALTIES AND EXECUTION FEES:

Prepaid royal-

ties represent fixed minimum advance payments made to licensors

for digital video disc distribution rights. Divx retains a licensor’s

share of distribution revenues until the share equals the advance

paid to the licensor. Thereafter, any excess distribution revenue is

paid to the licensor. Prepaid royalties are charged to operations as

revenues are earned. Execution fees are one-time payments made

to licensors at the time the related licensing agreements are exe-

cuted and are amortized over the shorter of the initial terms of the

licensing agreements or five years. Both the prepaid royalties and

execution fees are stated at the lower of amortized cost or esti-

mated net realizable value on a license-agreement basis.

(G) PROPERTY AND EQUIPMENT:

Property and equipment is

stated at cost less accumulated depreciation and amortization.

Depreciation and amortization are calculated using the straight-

line method over the assets’ estimated useful lives.

Property held under capital lease is stated at the lower of the

present value of the minimum lease payments at the inception of

the lease or market value and is amortized on a straight-line basis

over the lease term or the estimated useful life of the asset,

whichever is shorter.

34 CIRCUIT CITY STORES, INC. 1999 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS