CarMax 1999 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 1999 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The bank card APRs are based on the prime rate and generally

range from 7 percent to 22 percent, with default rates varying by

portfolio composition, but generally aggregating from 8 percent to

12 percent. Principal payment rates vary widely both seasonally

and by credit terms but are in the range of 5 percent to 8 percent.

Interest cost paid by the master trusts varies between series

and ranges from 5.0 percent to 6.3 percent.

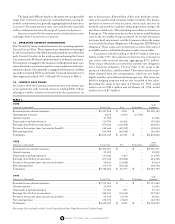

13. OPERATING SEGMENT INFORMATION

The Circuit City Group conducts business in two operating segments:

Circuit City and Divx. These segments are identified and managed

by the Group based on the different products and services offered by

each. Circuit City refers to the retail operations bearing the Circuit

City name and to all related operations such as its finance operation.

This segment is engaged in the business of selling brand-name con-

sumer electronics, personal computers, major appliances and enter-

tainment software. Divx primarily is engaged in the business of selling

specially encrypted DVD at wholesale. Financial information for

these segments for fiscal 1999, 1998 and 1997 is shown in Table 3.

14. INTEREST RATE SWAPS

In October 1994, the Company entered into five-year interest rate

swap agreements with notional amounts totaling $300 million

relating to a public issuance of securities by the master trust. As

part of this issuance, $344 million of five-year, fixed-rate certifi-

cates were issued to fund consumer credit receivables. The finance

operation is servicer for the accounts, and as such, receives its

monthly cash portfolio yield after deducting interest, charge-offs

and other related costs. The underlying receivables are based on a

floating rate. The swaps were put in place to better match funding

costs to the receivables being securitized. As a result, the master

trust pays fixed-rate interest, and the Company utilizes the swaps

to convert the fixed-rate obligation to a floating-rate, LIBOR-based

obligation. These swaps were entered into as part of the sales of

receivables and are included in the gain on sales of receivables.

Concurrent with the funding of the $175 million term loan

facility in May 1995, the Company entered into five-year interest

rate swaps with notional amounts aggregating $175 million.

These swaps effectively converted the variable-rate obligation

into a fixed-rate obligation. The fair value of the swaps is the

amount at which they could be settled. This value is based on esti-

mates obtained from the counterparties, which are two banks

highly rated by several financial rating agencies. The swaps are

held for hedging purposes and are not recorded at fair value.

Recording the swaps at fair value at February 28, 1999, would

result in a loss of $2.2 million and at February 28, 1998, would

result in a loss of $1.9 million.

62 CIRCUIT CITY STORES, INC. 1999 ANNUAL REPORT

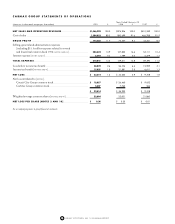

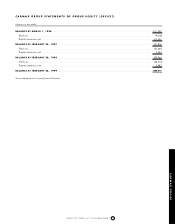

TABLE 3

1999 Total

(Amounts in thousands)

Circuit City Divx Elimination Segments

Revenues from external customers...................................................................... $9,335,298 $ 2,851 $ – $9,338,149

Intersegment revenues ........................................................................................ 8,872 6,830 (15,702) –

Interest expense .................................................................................................. 21,926 – – 21,926

Depreciation and amortization........................................................................... 119,724 10,566 – 130,290

Earnings (loss) before income taxes .................................................................... 379,630 (110,558) – 269,072

Provision for income taxes (income tax benefit) ................................................. 144,646 (42,012) – 102,634

Net earnings (loss) .............................................................................................. 234,984 (68,546) – 166,438

Total assets.......................................................................................................... $2,813,635 $ 60,433 $ – $2,874,068

1998 Total

(Amounts in thousands)

Circuit City Divx Elimination Segments

Revenues from external customers...................................................................... $7,996,591 $ – $ – $7,996,591

Interest expense .................................................................................................. 25,072 – – 25,072

Depreciation and amortization........................................................................... 110,282 1,467 – 111,749

Earnings (loss) before income taxes .................................................................... 257,632 (33,284) – 224,348

Provision for income taxes (income tax benefit) ................................................. 98,462 (12,648) – 85,814

Net earnings (loss).............................................................................................. 159,170 (20,636) – 138,534

Total assets.......................................................................................................... $2,752,402 $ 30,977 $ – $2,783,379

1997 Total

(Amounts in thousands)

Circuit City Divx Elimination Segments

Revenues from external customers...................................................................... $7,153,562 $ – $ – $7,153,562

Interest expense .................................................................................................. 23,503 – – 23,503

Depreciation and amortization........................................................................... 97,006 307 – 97,313

Earnings (loss) before income taxes .................................................................... 248,567 (12,614) – 235,953

Provision for income taxes (income tax benefit) ................................................. 95,014 (4,793) – 90,221

Net earnings (loss).............................................................................................. 153,553 (7,821) – 145,732

Total assets.......................................................................................................... $2,699,907 $ 4,692 $ – $2,704,599

Net earnings (loss) and total assets for Circuit City exclude the Inter-Group Interest in the CarMax Group.