CarMax 1999 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 1999 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(G) INTANGIBLE ASSETS:

Amounts paid for acquired businesses in

excess of the fair value of the net tangible assets acquired are

recorded as goodwill, which is amortized on a straight-line basis

over 15 years, and covenants not to compete, which are amortized

on a straight-line basis over the life of the covenant not to exceed

five years. Both goodwill and covenants not to compete are

included in other assets on the accompanying CarMax Group bal-

ance sheets. The carrying value of intangible assets is periodically

reviewed by the Company and impairments are recognized when

the expected future undiscounted operating cash flows derived

from such intangible assets are less than the carrying value.

(H) PRE-OPENING EXPENSES:

Expenses associated with the open-

ing of new stores are deferred and amortized ratably over the period

from the date of the store opening to the end of the fiscal year.

(I) INCOME TAXES:

Income taxes are accounted for in accordance

with SFAS No. 109, “Accounting for Income Taxes.” Deferred

income taxes reflect the impact of temporary differences between

the amounts of assets and liabilities recognized for financial

reporting purposes and the amounts recognized for income tax

purposes, measured by applying currently enacted tax laws. A

deferred tax asset is recognized if it is more likely than not that a

benefit will be realized.

(J) DEFERRED REVENUE:

The CarMax Group sells service con-

tracts on behalf of unrelated third parties and, prior to July 1997,

sold its own contracts at one location where third-party warranty

sales were not permitted. Contracts usually have terms of coverage

between 12 and 72 months. All revenue from the sale of the

CarMax Group’s own service contracts is deferred and amortized

over the life of the contracts consistent with the pattern of repair

experience of the industry. Incremental direct costs related to the

sale of contracts are deferred and charged to expense in proportion

to the revenue recognized. Commission revenue for the unrelated

third-party service contracts is recognized at the time of sale.

(K) SELLING, GENERAL AND ADMINISTRATIVE EXPENSES:

Oper-

ating profits generated by the finance operation are recorded as a

reduction to selling, general and administrative expenses.

(L) ADVERTISING EXPENSES:

All advertising costs are expensed

as incurred.

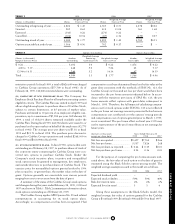

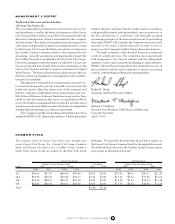

(M) NET LOSS PER SHARE:

On December 15, 1997, the Company

adopted SFAS No. 128, “Earnings per Share.” All prior period loss

per share data presented has been restated to conform with the

provisions of SFAS No. 128.

Net loss per share is computed by dividing the net loss

attributed to CarMax Stock by the weighted average number of

common shares outstanding. Diluted net loss per share is not cal-

culated since CarMax has a net loss for the periods presented.

(N) STOCK-BASED COMPENSATION:

On March 1, 1996, the

Company adopted SFAS No. 123, “Accounting for Stock-Based

Compensation.” The Company has elected to continue applying

the provisions of the Accounting Principles Board Opinion No.

25, “Accounting For Stock Issued to Employees,” and to provide

the pro forma disclosures of SFAS No. 123.

(O) DERIVATIVE FINANCIAL INSTRUMENTS:

The Company

enters into interest rate swap agreements to manage exposure to

interest rates and to more closely match funding costs to the use

of funding. Interest rate swaps relating to long-term debt are clas-

sified as held for purposes other than trading and are accounted

for on a settlement basis. To qualify for this accounting treatment,

the swap must synthetically alter the nature of a designated under-

lying financial instrument. Under this method, payments or

receipts due or owed under the swap agreement are accrued

through each settlement date and recorded as a component of

interest expense. If a swap designated as a synthetic alteration

were to be terminated, any gain or loss on the termination would

be deferred and recognized over the shorter of the original con-

tractual life of the swap or the related life of the designated long-

term debt.

The Company also enters into interest rate swap agreements

as part of its asset securitization programs. Swaps entered into by

a seller as part of a sale of financial assets are considered proceeds

at fair value in the determination of the gain or loss on the sale. If

such a swap were terminated, the impact on the fair value of the

financial asset created by the sale of the related receivables would

be estimated and included in earnings.

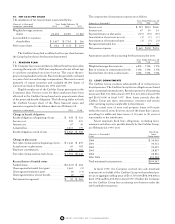

(P) RISKS AND UNCERTAINTIES:

The CarMax Group is a used-

and new-car retail business. The diversity of the CarMax Group’s

customers and suppliers reduces the risk that a severe impact will

occur in the near term as a result of changes in its customer base or

sources of supply. However, due to the CarMax Group’s limited

overall size, management cannot assure that unanticipated events

will not have a negative impact on the Group.

The preparation of financial statements in conformity with

generally accepted accounting principles requires management to

make estimates and assumptions that affect the reported amounts

of assets, liabilities, revenues and expenses and the disclosure of

contingent assets and liabilities. Actual results could differ from

those estimates.

(Q) RECLASSIFICATIONS:

Certain amounts in prior years have

been reclassified to conform to classifications adopted in fiscal 1999.

3. CORPORATE ACTIVITIES

The CarMax Group’s financial statements reflect the application

of the management and allocation policies adopted by the board

of directors to various corporate activities, as described below:

(A) FINANCIAL ACTIVITIES:

Most financial activities are man-

aged by the Company on a centralized basis. Such financial activi-

ties include the investment of surplus cash and the issuance and

repayment of short-term and long-term debt. Allocated invested

surplus cash of the CarMax Group consists of (i) Company

cash equivalents, if any, that have been allocated in their entirety

to the CarMax Group and (ii) a portion of the Company’s cash

equivalents that are allocated between the Groups. Investment of

surplus cash from the offering has been allocated to the CarMax

Group. Allocated debt of the CarMax Group consists of (i)

Company debt, if any, that has been allocated in its entirety to the

CarMax Group and (ii) a portion of the Company’s pooled debt,

which is debt allocated between the Groups. The pooled debt

bears interest at a rate based on the average pooled debt balance.

CARMAX GROUP

CIRCUIT CITY STORES, INC. 1999 ANNUAL REPORT 73