CarMax 1999 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 1999 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

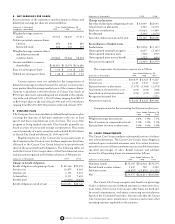

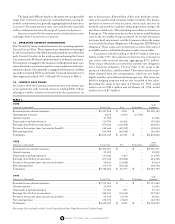

5. DEBT

Long-term debt of the Company at February 28 is summarized as

follows:

(Amounts in thousands)

1999 1998

Term loans.................................................... $405,000 $405,000

Industrial Development Revenue

Bonds due through 2006 at various

prime-based rates of interest ranging

from 5.0% to 7.0% .................................. 6,564 7,665

Obligations under capital leases [NOTE 10] ..... 12,728 12,928

Note payable................................................ 5,000 –

Total long-term debt .................................... 429,292 425,593

Less current installments .............................. 2,707 1,301

Long-term debt, excluding

current installments................................. $426,585 $424,292

Portion of long-term debt allocated

to the Circuit City Group........................ $288,322 $398,207

In July 1994, the Company entered into a seven-year,

$100,000,000, unsecured bank term loan. The loan was restruc-

tured in August 1996 as a $100,000,000, six-year unsecured bank

term loan. Principal is due in full at maturity with interest payable

periodically at LIBOR plus 0.40 percent. At February 28, 1999,

the interest rate on the term loan was 5.76 percent.

In May 1995, the Company entered into a five-year,

$175,000,000, unsecured bank term loan. Principal is due in full at

maturity with interest payable periodically at LIBOR plus 0.35

percent. At February 28, 1999, the interest rate on the term loan

was 5.67 percent.

In June 1996, the Company entered into a five-year,

$130,000,000, unsecured bank term loan. Principal is due in full at

maturity with interest payable periodically at LIBOR plus 0.35

percent. At February 28, 1999, the interest rate on the term loan

was 5.29 percent.

The Company maintains a multi-year, $150,000,000, unse-

cured revolving credit agreement with four banks. The agreement

calls for interest based on both committed rates and money mar-

ket rates and a commitment fee of 0.13 percent per annum. The

agreement was entered into as of August 31, 1996, and terminates

August 31, 2002. No amounts were outstanding under the revolv-

ing credit agreement at February 28, 1999 or 1998.

The Industrial Development Revenue Bonds are collateral-

ized by land, buildings and equipment with an aggregate carrying

value of approximately $10,740,000 at February 28, 1999, and

$10,879,000 at February 28, 1998.

Under certain of the debt agreements, the Company must

meet financial covenants relating to minimum tangible net worth,

current ratios and debt-to-capital ratios. The Company was in

compliance with all such covenants at February 28, 1999 and 1998.

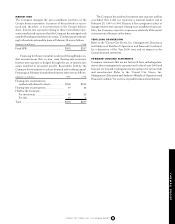

Short-term debt of the Company is funded through commit-

ted lines of credit and informal credit arrangements, as well as the

revolving credit agreement. Amounts outstanding and committed

lines of credit available are as follows:

Years Ended February 28

(Amounts in thousands)

1999 1998

Average short-term debt outstanding ........... $ 54,505 $ 48,254

Maximum short-term debt outstanding........ $463,000 $414,000

Aggregate committed lines of credit............. $370,000 $410,000

The weighted average interest rate on the outstanding short-

term debt was 5.1 percent during fiscal 1999, 5.7 percent during

fiscal 1998 and 5.4 percent during fiscal 1997.

Interest expense allocated by the Company to the Circuit

City Group, excluding interest capitalized, was $21,926,000 in

fiscal 1999, $25,072,000 in fiscal 1998 and $23,503,000 in fiscal

1997. The Circuit City Group capitalizes interest in connection

with the construction of certain facilities and software developed

or obtained for internal use. In fiscal 1999, interest capitalized

amounted to $2,749,000 ($4,759,000 in fiscal 1998 and

$6,072,000 in fiscal 1997).

6. INCOME TAXES

The components of the provision for income taxes on earnings

before income taxes and Inter-Group Interest in the CarMax

Group are as follows:

Years Ended February 28

(Amounts in thousands)

1999 1998 1997

Current:

Federal ....................................... $ 82,907 $63,576 $62,649

State........................................... 10,379 5,319 8,265

93,286 68,895 70,914

Deferred:

Federal ....................................... 9,068 14,060 18,150

State........................................... 280 2,859 1,157

9,348 16,919 19,307

Provision for income taxes .............. $102,634 $85,814 $90,221

The effective income tax rate differed from the Federal statu-

tory income tax rate as follows:

Years Ended February 28

1999 1998 1997

Federal statutory income

tax rate ....................................... 35.0% 35.0% 35.0%

State and local income taxes,

net of Federal benefit.................. 3.1%3.3%3.2%

Effective income tax rate................. 38.1% 38.3% 38.2%

CIRCUIT CITY GROUP

CIRCUIT CITY STORES, INC. 1999 ANNUAL REPORT 57