CVS 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS Health

84

Notes to Consolidated Financial Statements

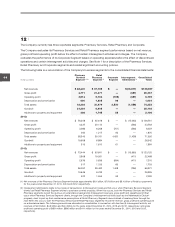

12 | Segment Reporting

The Company currently has three reportable segments: Pharmacy Services, Retail Pharmacy and Corporate.

The Company evaluates its Pharmacy Services and Retail Pharmacy segment performance based on net revenue,

gross profit and operating profit before the effect of certain intersegment activities and charges. The Company

evaluates the performance of its Corporate Segment based on operating expenses before the effect of discontinued

operations and certain intersegment activities and charges. See Note 1 for a description of the Pharmacy Services,

Retail Pharmacy and Corporate segments and related significant accounting policies.

The following table is a reconciliation of the Company’s business segments to the consolidated financial statements:

Pharmacy Retail

Services Pharmacy Corporate Intersegment Consolidated

IN MILLIONS Segment

(1) (2)

Segment

(2)

Segment Eliminations

(2)

Totals

2014:

Net revenues

$ 88,440 $ 67,798 $ — $ (16,871) $ 139,367

Gross profit

4,771 21,277 — (681) 25,367

Operating profit

3,514 6,762 (796) (681) 8,799

Depreciation and amortization

630 1,205 96 — 1,931

Total assets

42,302 30,979 2,530 (1,559) 74,252

Goodwill

21,234 6,908 — — 28,142

Additions to property and equipment

308 1,745 83 — 2,136

2013:

Net revenues $ 76,208 $ 65,618 $ — $ (15,065) $ 126,761

Gross profit 4,237 20,112 — (566) 23,783

Operating profit 3,086 6,268 (751) (566) 8,037

Depreciation and amortization 560 1,217 93 — 1,870

Total assets 38,343 30,191 4,420 (1,428) 71,526

Goodwill 19,658 6,884 — — 26,542

Additions to property and equipment 313 1,610 61 — 1,984

2012:

Net revenues $ 73,444 $ 63,641 $ — $ (13,965) $ 123,120

Gross profit 3,808 19,091 — (411) 22,488

Operating profit 2,679 5,636 (694) (411) 7,210

Depreciation and amortization 517 1,153 83 — 1,753

Total assets 36,057 29,492 1,408 (736) 66,221

Goodwill 19,646 6,749 — — 26,395

Additions to property and equipment 422 1,555 53 — 2,030

(1) Net revenues of the Pharmacy Services Segment include approximately $8.1 billion, $7.9 billion and $8.4 billion of Retail co-payments

for the years ended December 31, 2014, 2013 and 2012, respectively.

(2) Intersegment eliminations relate to two types of transactions: (i) Intersegment revenues that occur when Pharmacy Services Segment

clients use Retail Pharmacy Segment stores to purchase covered products. When this occurs, both the Pharmacy Services and Retail

Pharmacy segments record the revenue on a standalone basis and (ii) Intersegment revenues, gross profit and operating profit that

occur when Pharmacy Services Segment clients, through the Company’s intersegment activities (such as the Maintenance Choice®

program), elect to pick up their maintenance prescriptions at Retail Pharmacy Segment stores instead of receiving them through the

mail. When this occurs, both the Pharmacy Services and Retail Pharmacy segments record the revenue, gross profit and operating profit

on a standalone basis. The following amounts are eliminated in consolidation in connection with the item (ii) intersegment activity: net

revenues of $4.9 billion, $4.3 billion and $3.4 billion for the years ended December 31, 2014, 2013 and 2012, respectively; and gross

profit and operating profit of $681 million, $566 million and $411 million for the years ended December 31, 2014, 2013 and 2012,

respectively.