CVS 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

32

CVS Health

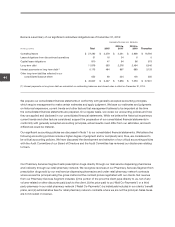

Retail Pharmacy Segment

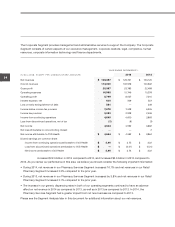

The following table summarizes our Retail Pharmacy Segment’s performance for the respective periods:

YEAR ENDED DECEMBER 31,

IN MILLIONS

2014 2013 2012

Net revenues

$ 67,798

$ 65,618 $ 63,641

Gross profit

$ 21,277

$ 20,112 $ 19,091

Gross profit % of net revenues

31.4 %

30.6 % 30.0 %

Operating expenses

$ 14,515

$ 13,844 $ 13,455

Operating expenses % of net revenues

21.4 %

21.1 % 21.1 %

Operating profit

$ 6,762

$ 6,268 $ 5,636

Operating profit % of net revenues

10.0 %

9.6 % 8.9 %

Retail prescriptions filled (90 Day = 3 prescriptions) (1)

935.9

890.1 845.8

Net revenue increase (decrease):

Total

3.3 %

3.1 % 6.8 %

Pharmacy

5.1 %

4.1 % 7.6 %

Front Store

(2.5) %

1.0 % 5.1 %

Total prescription volume (90 Day = 3 prescriptions) (1)

5.2 %

5.2 % 11.0 %

Same store sales increase (decrease):

Total

2.1 %

1.7 % 5.6 %

Pharmacy

4.8 %

2.6 % 6.6 %

Front Store

(4.0) %

(0.5) % 3.4 %

Prescription volume (90 Day = 3 prescriptions) (1)

4.1 %

4.4 % 10.0 %

Generic dispensing rates

83.1 %

81.4 % 79.2 %

Pharmacy % of net revenues

70.7 %

69.5 % 68.8 %

Third party % of pharmacy revenue

98.6 %

97.9 % 97.5 %

(1) Includes the adjustment to convert 90-day, non-specialty prescriptions to the equivalent of three 30-day prescriptions. This adjustment

reflects the fact that these prescriptions include approximately three times the amount of product days supplied compared to a normal

prescription.

Net revenues

increased approximately $2.2 billion, or 3.3%, to $67.8 billion for the year ended December 31, 2014,

as compared to the prior year. This increase was primarily driven by a same store sales increase of 2.1% and net

revenues from new and acquired stores, which accounted for approximately 110 basis points of our total net

revenue percentage increase during the year. Net revenues increased $2.0 billion, or 3.1% to $65.6 billion for the

year ended December 31, 2013, as compared to the prior year. This increase was primarily driven by a same store

sales increase of 1.7% and net revenues from new stores, which accounted for approximately 130 basis points of

our total net revenue percentage increase during the year. Additionally, in 2014, 2013 and 2012 we continued to see

a positive impact on our net revenues due to the growth of our Maintenance Choice program.

As you review our Retail Pharmacy Segment’s performance in this area, we believe you should consider the follow-

ing important information:

• Front store same store sales declined 4.0% in the year ended December 31, 2014, as compared to the prior year.

The decrease is primarily due to the Company’s decision to stop selling tobacco products, softer customer traffic

and a less severe flu season than the prior year and extreme weather conditions across much of the United States

during the first quarter of 2014. The decrease was partially offset by an increase in basket size. Front store same