CVS 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS Health

68

Notes to Consolidated Financial Statements

The goodwill represents future economic benefits expected to arise from the Company’s expanded presence in the

specialty pharmaceuticals market, the assembled workforce acquired, and the expected synergies from combining

operations with Coram. The goodwill is nondeductible for income tax purposes.

Coram’s results of operations are included in the Company’s PSS beginning on January 16, 2014. Pro forma

information for this acquisition is not presented as Coram’s results are immaterial to the Company’s consolidated

financial statements. During the year ended December 31, 2014, acquisition costs of $15 million were expensed

as incurred within operating expenses.

3 | Goodwill and Other Intangibles

Goodwill and other indefinitely-lived assets are not amortized, but are subject to annual impairment reviews, or more

frequent reviews if events or circumstances indicate an impairment may exist.

When evaluating goodwill for potential impairment, the Company first compares the fair value of its two reporting

units, the PSS and RPS, to their respective carrying amounts. The Company estimates the fair value of its reporting

units using a combination of a future discounted cash flow valuation model and a comparable market transaction

model. If the estimated fair value of the reporting unit is less than its carrying amount, an impairment loss calculation

is prepared. The impairment loss calculation compares the implied fair value of a reporting unit’s goodwill with the

carrying amount of its goodwill. If the carrying amount of the goodwill exceeds the implied fair value, an impairment

loss is recognized in an amount equal to the excess. During the third quarter of 2014, the Company performed its

required annual goodwill impairment tests. The Company concluded there were no goodwill impairments as of the

testing date.

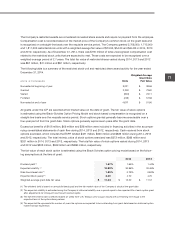

Below is a summary of the changes in the carrying amount of goodwill by segment for the years ended December 31,

2014 and 2013:

Pharmacy Retail

IN MILLIONS Services Pharmacy Total

Balance, December 31, 2012 $ 19,646 $ 6,749 $ 26,395

Acquisitions 13 160 173

Foreign currency translation adjustments — (25) (25)

Other (1) (1) — (1)

Balance, December 31, 2013 19,658 6,884 26,542

Acquisitions 1,578 38 1,616

Foreign currency translation adjustments — (14) (14)

Other (1) (2) — (2)

Balance, December 31, 2014

$ 21,234 $ 6,908 $ 28,142

(1) “Other” represents immaterial purchase accounting adjustments for acquisitions.

Indefinitely-lived intangible assets are tested for impairment by comparing the estimated fair value of the asset to its

carrying value. The Company estimates the fair value of its indefinitely-lived trademark using the relief from royalty

method under the income approach. If the carrying value of the asset exceeds its estimated fair value, an impair-

ment loss is recognized and the asset is written down to its estimated fair value. During the third quarter of 2014,

the Company performed its annual impairment test of the indefinitely-lived trademark and concluded there was

no impairment as of the testing date. The carrying amount of its indefinitely-lived trademark was $6.4 billion as of

December 31, 2014 and 2013.