CVS 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

2014 Annual Report

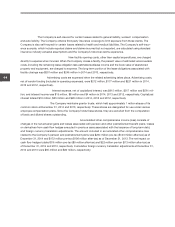

YEAR ENDED DECEMBER 31,

IN MILLIONS

2014 2013 2012

Cash flows from operating activities:

Cash receipts from customers

$ 132,406

$ 114,993 $ 113,205

Cash paid for inventory and prescriptions dispensed by

retail network pharmacies

(105,362)

(91,178) (90,032)

Cash paid to other suppliers and employees

(15,344)

(14,295) (13,643)

Interest received

15

8 4

Interest paid

(647)

(534) (581)

Income taxes paid

(2,931)

(3,211) (2,282)

Net cash provided by operating activities

8,137

5,783 6,671

Cash flows from investing activities:

Purchases of property and equipment

(2,136)

(1,984) (2,030)

Proceeds from sale-leaseback transactions

515

600 529

Proceeds from sale of property and equipment and other assets

11

54 23

Acquisitions (net of cash acquired) and other investments

(2,439)

(415) (378)

Purchase of available-for-sale investments

(157)

(226) —

Maturity of available-for-sale investments

161

136 —

Proceeds from sale of subsidiary — — 7

Net cash used in investing activities

(4,045)

(1,835) (1,849)

Cash flows from financing activities:

Increase (decrease) in short-term debt

685

(690) (60)

Proceeds from issuance of long-term debt

1,483

3,964 1,239

Repayments of long-term debt

(3,100)

— (1,718)

Purchase of noncontrolling interest in subsidiary

—

— (26)

Dividends paid

(1,288)

(1,097) (829)

Proceeds from exercise of stock options

421

500 836

Excess tax benefits from stock-based compensation

106

62 28

Repurchase of common stock

(4,001)

(3,976) (4,330)

Net cash used in financing activities

(5,694)

(1,237) (4,860)

Effect of exchange rate changes on cash and cash equivalents

(6)

3 —

Net increase (decrease) in cash and cash equivalents

(1,608)

2,714 (38)

Cash and cash equivalents at the beginning of the year

4,089

1,375 1,413

Cash and cash equivalents at the end of the year

$ 2,481

$ 4,089 $ 1,375

Reconciliation of net income to net cash provided by operating activities:

Net income

$ 4,644

$ 4,592 $ 3,862

Adjustments required to reconcile net income to net cash

provided by operating activities:

Depreciation and amortization

1,931

1,870 1,753

Stock-based compensation

165

141 132

Loss on early extinguishment of debt

521

— 348

Deferred income taxes and other noncash items

(58)

(86) (111)

Change in operating assets and liabilities, net of effects

from acquisitions:

Accounts receivable, net

(737)

(2,210) (387)

Inventories

(770)

12 (853)

Other current assets

(383)

105 3

Other assets

9

(135) (99)

Accounts payable and claims and discounts payable

1,742

1,024 1,147

Accrued expenses

1,060

471 766

Other long-term liabilities

13

(1) 110

Net cash provided by operating activities

$ 8,137

$ 5,783 $ 6,671

See accompanying notes to consolidated financial statements.

Consolidated Statements of Cash Flows