CVS 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

36

CVS Health

Net cash used in investing activities

increased by $2.2 billion in 2014 and remained relatively flat from 2012 to

2013. The increase in 2014 was primarily due to the $2.1 billion in cash consideration paid for the acquisition of

Coram in January 2014 and an increase in capital expenditures.

In 2014, gross capital expenditures totaled approximately $2.1 billion, an increase of $152 million compared to the

prior year. During 2014, approximately 42% of our total capital expenditures were for new store construction, 21%

were for store, fulfillment and support facilities expansion and improvements and 37% were for technology and

other corporate initiatives. Gross capital expenditures totaled approximately $2.0 billion during 2013 and 2012.

During 2013, approximately 45% of our total capital expenditures were for new store construction, 25% were for

store, fulfillment and support facilities expansion and improvements and 30% were for technology and other

corporate initiatives.

Proceeds from sale-leaseback transactions totaled $515 million in 2014. This compares to $600 million in 2013

and $529 million in 2012. Under the sale-leaseback transactions, the properties are generally sold at net book value,

which generally approximates fair value, and the resulting leases generally qualify and are accounted for as operat-

ing leases. The specific timing and amount of future sale-leaseback transactions will vary depending on future

market conditions and other factors.

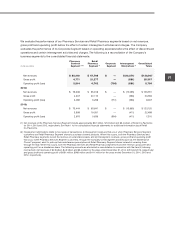

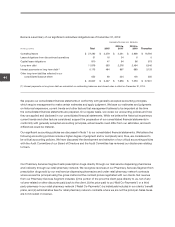

Below is a summary of our store development activity for the respective years:

2014 (2) 2013 (2) 2012 (2)

Total stores (beginning of year)

7,702

7,508 7,388

New and acquired stores (1)

187

213 150

Closed stores (1)

(23)

(19) (30)

Total stores (end of year)

7,866

7,702 7,508

Relocated stores

60

78 90

(1) Relocated stores are not included in new or closed store totals.

(2) Includes retail drugstores, onsite pharmacy stores and specialty pharmacy stores.

Net cash used in financing activities

increased by $4.5 billion in 2014 and decreased by $3.6 billion in 2013. The

increase in 2014 was primarily due to the repayments of long-term debt and lower borrowings than in 2013. The

decrease in 2013 was primarily due to greater net borrowings than in 2012.

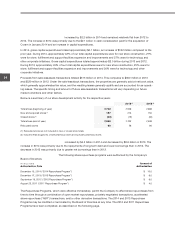

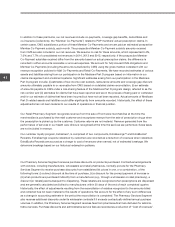

Share repurchase programs —

The following share repurchase programs were authorized by the Company’s

Board of Directors:

IN BILLIONS Amount of

Authorization Date Authorization

December 15, 2014 (“2014 Repurchase Program”) $ 10.0

December 17, 2013 (“2013 Repurchase Program”) $ 6.0

September 19, 2012 (“2012 Repurchase Program”) $ 6.0

August 23, 2011 (“2011 Repurchase Program”) $ 4.0

The Repurchase Programs, which were effective immediately, permit the Company to effect share repurchases from

time to time through a combination of open market repurchases, privately negotiated transactions, accelerated

share repurchase (“ASR”) transactions, and/or other derivative transactions. The 2014 and 2013 Repurchase

Programs may be modified or terminated by the Board of Directors at any time. The 2012 and 2011 Repurchase

Programs have been completed, as described on the following page.