CVS 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

2014 Annual Report

Pursuant to various labor agreements, the Company also contributes to multiemployer health and welfare plans that

cover certain union-represented employees. The plans provide postretirement health care and life insurance benefits

to certain employees who meet eligibility requirements. Total Company contributions to multiemployer health and

welfare plans were $58 million, $55 million and $50 million in 2014, 2013 and 2012, respectively.

Pension Plans

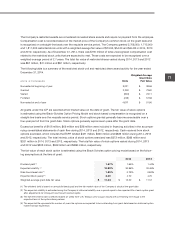

During the years ended December 31, 2014, 2013 and 2012, the Company sponsored nine defined benefit pension

plans. Four of the plans are tax-qualified plans that are funded based on actuarial calculations and applicable

federal laws and regulations. The other five plans are unfunded nonqualified supplemental retirement plans. Most

of the plans were frozen in prior periods.

As of December 31, 2014, the Company’s pension plans had a projected benefit obligation of $796 million and plan

assets of $635 million. As of December 31, 2013, the Company’s pension plans had a projected benefit obligation

of $694 million and plan assets of $568 million. Actual return on plan assets was $75 million and $49 million in 2014

and 2013, respectively. Net periodic pension costs related to these pension plans were $21 million, $19 million and

$31 million in 2014, 2013 and 2012, respectively. The net periodic pension costs for 2012 include a curtailment loss

of $2 million.

The discount rate is determined by examining the current yields observed on the measurement date of fixed-inter-

est, high quality investments expected to be available during the period to maturity of the related benefits on a plan

by plan basis. The discount rate for the plans was 4.0% in 2014 and 4.75% in 2013. The expected long-term rate of

return on plan assets is determined by using the plan’s target allocation and historical returns for each asset class

on a plan by plan basis. The expected long-term rate of return for the plans ranged from 5.75% to 7.25% in 2014

and was 7.25% for all plans in 2013 and 2012.

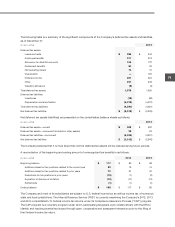

Historically, the Company used an investment strategy which emphasized equities in order to produce higher

expected returns, and in the long run, lower expected expense and cash contribution requirements. The qualified

pension plan asset allocation targets were 50% equity and 50% fixed income for 2012. Beginning in 2013, the

Company changed its investment strategy to be liability management driven. The qualified pension plan asset

allocation targets in 2014 and 2013 were revised to hold more fixed income investments based on the change in

the investment strategy. Investment allocations for the four qualified defined benefit plans range from 70% to 85%

in fixed income and 15% to 30% in equities as of December 31, 2014.

As of December 31, 2014, the Company’s qualified defined benefit pension plan assets consisted of 18% equity,

81% fixed income and 1% money market securities of which 14% were classified as Level 1 and 86% as Level 2

in the fair value hierarchy. The Company’s qualified defined benefit pension plan assets as of December 31, 2013

consisted of 23% equity, 76% fixed income and 1% money market securities of which 17% were classified as

Level 1 and 83% as Level 2 in the fair value hierarchy.

The Company contributed $42 million, $33 million and $36 million to the pension plans during 2014, 2013 and

2012, respectively. The Company plans to make approximately $36 million in contributions to the pension plans

during 2015.

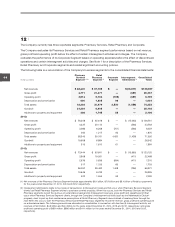

The Company also contributes to a number of multiemployer pension plans under the terms of collective-bargaining

agreements that cover its union-represented employees. The risks of participating in these multiemployer plans are

different from single-employer pension plans in the following aspects: (i) assets contributed to the multiemployer

plan by one employer may be used to provide benefits to employees of other participating employers, (ii) if a participat-

ing employer stops contributing to the plan, the unfunded obligations of the plan may be borne by the remaining

participating employers, and (iii) if the Company chooses to stop participating in some of its multiemployer plans, the

Company may be required to pay those plans an amount based on the underfunded status of the plan, referred to as

a withdrawal liability.